As global markets experience fluctuations, with European indices showing modest gains amid hopes for economic stimulus and interest rate adjustments, the Swedish market remains a focal point for investors seeking stability and income through dividend stocks. In this environment, identifying robust Swedish dividend stocks involves evaluating companies with strong fundamentals and consistent payout histories that can weather economic uncertainties while providing reliable returns.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.69% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 3.85% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.25% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.46% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.89% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.07% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.96% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.06% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.80% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

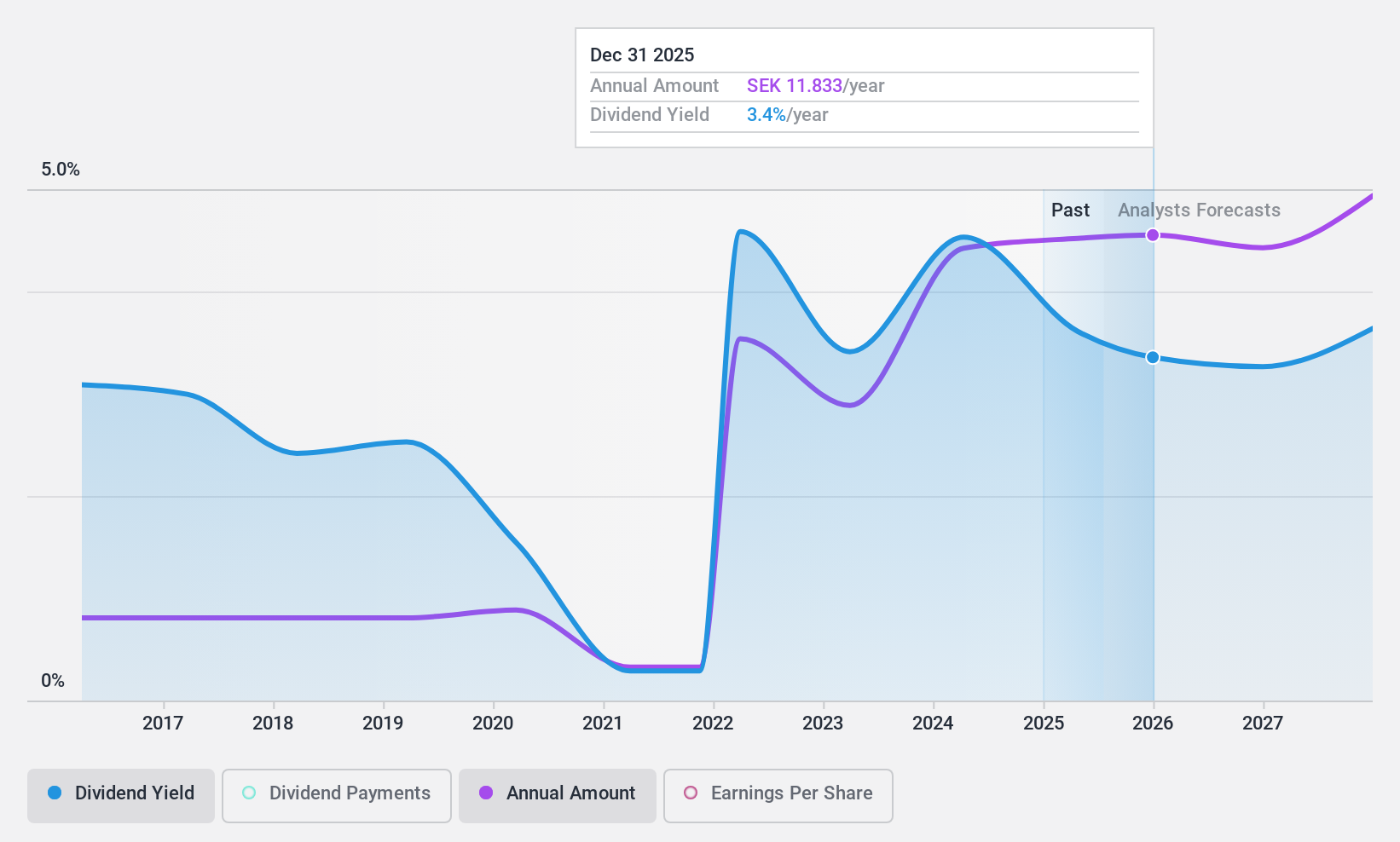

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Avanza Bank Holding AB (publ) operates in Sweden, providing savings, pension, and mortgage products, with a market capitalization of approximately SEK35.65 billion.

Operations: Avanza Bank Holding AB generates revenue primarily from its commercial operations, amounting to SEK3.96 billion.

Dividend Yield: 5.1%

Avanza Bank Holding's dividend yield of 5.07% is in the top quartile among Swedish dividend stocks, yet its payments have been historically volatile and unreliable over the past decade. Despite recent earnings growth of 22.5% annually over five years, a high payout ratio of 87.3% raises sustainability concerns. However, dividends are covered by cash flows with a cash payout ratio of 55.8%. Recent leadership changes may impact future strategic directions but have not affected current operations significantly.

- Click to explore a detailed breakdown of our findings in Avanza Bank Holding's dividend report.

- Upon reviewing our latest valuation report, Avanza Bank Holding's share price might be too optimistic.

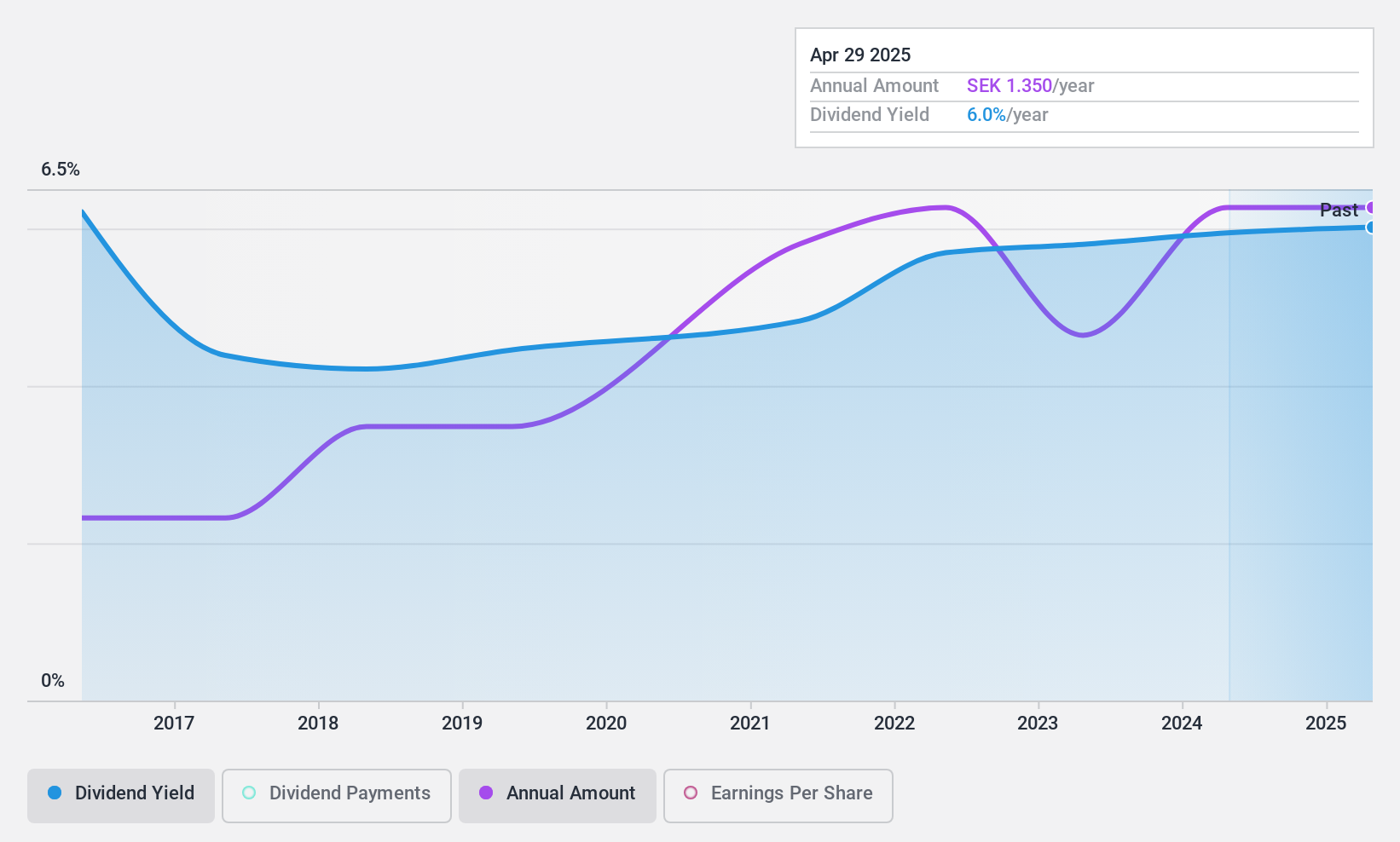

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) offers IT and management services mainly in Sweden, with a market cap of SEK1.21 billion.

Operations: Softronic AB (publ) generates revenue from its Computer Services segment, amounting to SEK838.92 million.

Dividend Yield: 5.9%

Softronic's dividend yield of 5.9% places it among the top 25% of Swedish dividend payers, but sustainability is a concern due to a high cash payout ratio of 94.5%, indicating dividends are not well covered by free cash flows. Although earnings cover the current payout ratio of 85.5%, past volatility and unreliability in payments over the last decade raise caution for investors seeking stable income sources despite recent earnings growth of 34%.

- Take a closer look at Softronic's potential here in our dividend report.

- Our expertly prepared valuation report Softronic implies its share price may be too high.

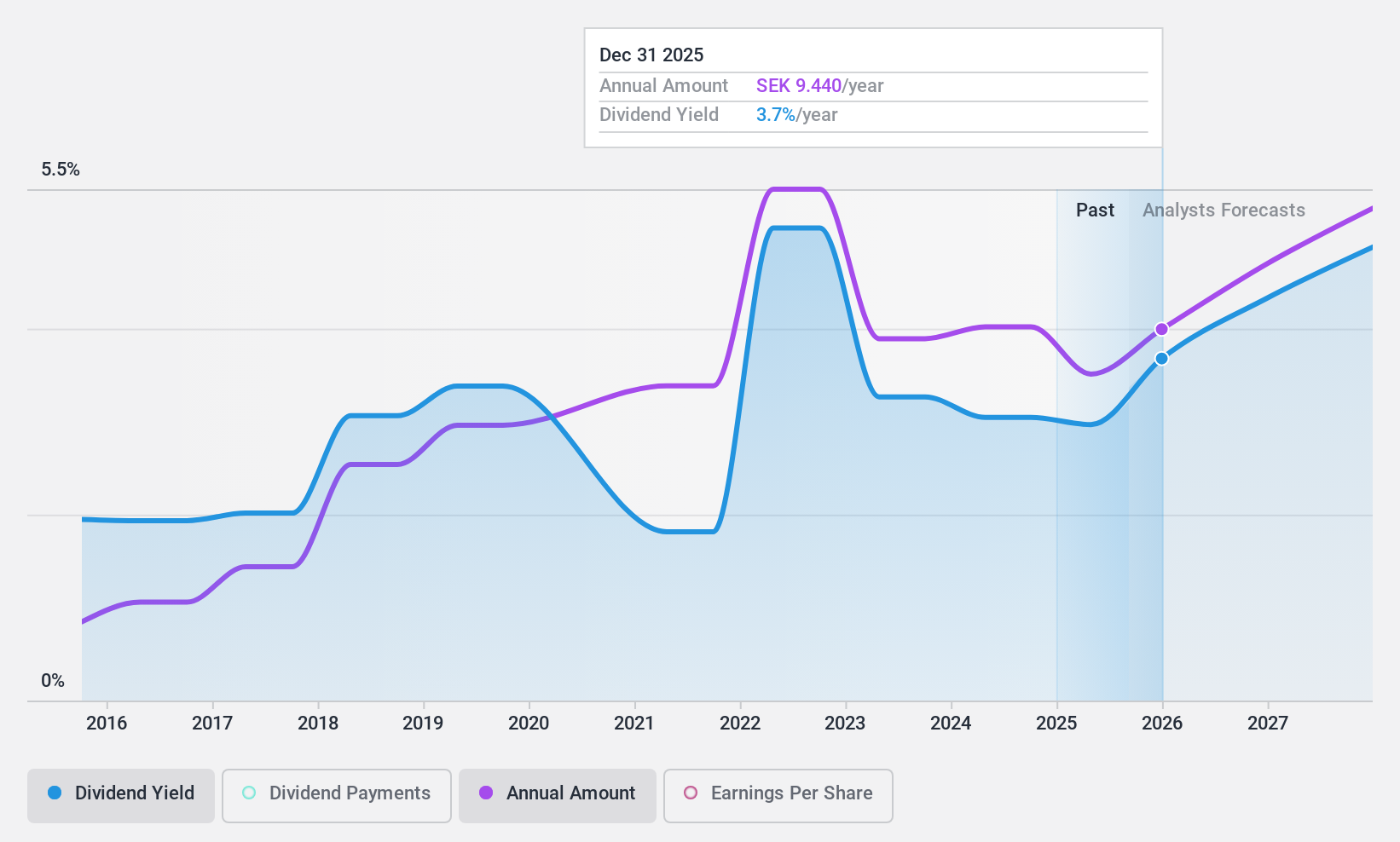

Thule Group (OM:THULE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thule Group AB (publ) is a sports and outdoor company operating in Sweden and internationally, with a market cap of SEK31.97 billion.

Operations: Thule Group AB (publ) generates revenue primarily from its Outdoor & Bags segment, amounting to SEK9.40 billion.

Dividend Yield: 3.1%

Thule Group's dividend yield of 3.14% is below the top quartile in Sweden, reflecting limited appeal for income-focused investors. Despite a reasonable cash payout ratio of 56.1%, dividends are volatile and have experienced significant cuts over the past decade, raising sustainability concerns. However, earnings grew by 22.4% last year and cover the current payout ratio of 87.8%, suggesting some level of dividend coverage despite historical unreliability in payments.

- Unlock comprehensive insights into our analysis of Thule Group stock in this dividend report.

- According our valuation report, there's an indication that Thule Group's share price might be on the expensive side.

Seize The Opportunity

- Get an in-depth perspective on all 22 Top Swedish Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOF B

Outstanding track record with flawless balance sheet and pays a dividend.