Sinch (OM:SINCH): Losses Accelerate 46% Per Year, Valuation Discount Highlights Profit Turnaround Hopes

Reviewed by Simply Wall St

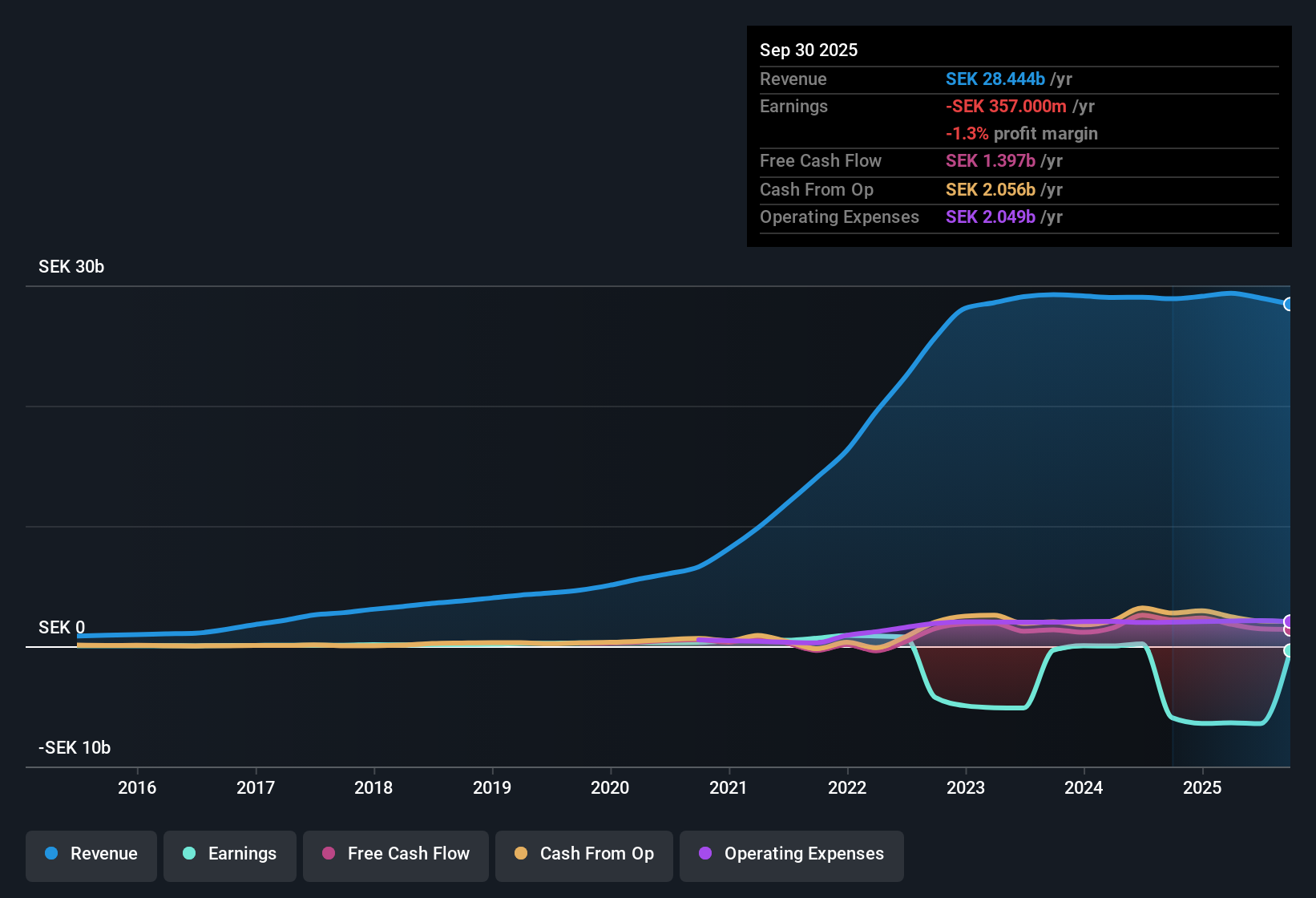

Sinch (OM:SINCH) continues to face unprofitability, with losses increasing at an annual rate of 46% over the past five years and no improvement in margins. Yet, the company stands out for its upside potential, as consensus forecasts call for earnings to grow at 70.11% per year, with profitability anticipated within three years. This pace is seen as well above market averages. Investors are weighing these rapid projected profit gains against Sinch’s current discounted share price, which trades below both its estimated fair value and peer multiples.

See our full analysis for Sinch.Now comes the deeper dive. Let’s see how the latest results stack up versus the dominant narratives in the market and where those stories might get ruffled.

See what the community is saying about Sinch

AI Platform Drives New Revenue Streams

- Sinch's strategic push into advanced AI and machine learning is poised to unlock new product revenue streams, as highlighted by the integration of AI-enabled conversational solutions and recent partnerships with major platforms like Salesforce and Microsoft.

- Analysts' consensus view points to two contrasting forces:

- Expanding demand for real-time, omnichannel messaging is set to broaden Sinch’s addressable market, supporting higher recurring revenues and customer stickiness.

- However, overall sales growth is expected to lag the wider Swedish market at 2.5% per year versus 3.7%. Sinch’s innovation momentum must convert quickly to justify the growth narrative.

- Momentum in self-serve channels and cross-selling across email, messaging, and voice is improving Sinch’s profit mix, with ongoing gross margin expansion and EBITDA margin gains reported recently. This progression heavily supports the bullish expectations for sustainable margin growth, even as the company’s current net margin remains negative at -22.2%.

- Bulls argue that continued improvements in product mix and platform innovation will accelerate the journey to profitability and position Sinch for long-term margin expansion.

- However, future margin improvement depends on realized efficiency rather than pure revenue growth, which heightens the importance of execution as competitors increase pricing pressure.

Profit Mix Shift Offsets Low Sales Growth

- Organic net sales are advancing just 2% year-on-year, falling short of the company’s 7 to 9% mid-term target and well below its addressable market, but recent improvements in gross profit mix and higher net margins are cushioning the blow.

- Analysts' consensus view highlights a complex tension for Sinch:

- While omnichannel business messaging growth and digital transformation create substantial upside, slow top-line momentum and headwinds in core messaging segments threaten the pace of improvement, particularly given the company’s exposure to maturing or commoditized markets.

- Success in driving higher EBITDA margins and strong free cash flow supports the optimistic scenario for earnings durability, although this is at risk if volume growth continues to underperform or new technology adoption does not accelerate rapidly.

Discounted Share Price Versus Fair Value

- Sinch currently trades at SEK27.56 per share, with a DCF fair value of SEK54.23 and a consensus analyst price target of SEK35.71, creating a material discount that reflects both optimism about profit inflection and persistent skepticism about execution and risk.

- Analysts' consensus view draws a sharp line:

- To reach the valuation implied by the SEK35.71 target, Sinch must achieve SEK1.1 billion in earnings by 2028 while improving margins from -22.2% to 3.7%. This is subject to significant analyst disagreement, with the bullish camp expecting up to SEK1.4 billion in earnings, while the bearish see as little as SEK769.2 million.

- Despite the upside potential, ongoing restructuring costs, competitive pressure in the U.S. messaging market, and delayed gains from next-gen messaging (RCS) temper the case, leaving the market discount in place until execution delivers clearer results.

- See what’s driving debate on Sinch’s future. Analysts remain split on how quickly the gap between share price, profit growth, and valuation can close. 📊 Read the full Sinch Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sinch on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the figures? Craft your perspective and shape the conversation in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sinch.

See What Else Is Out There

Sinch’s slow top-line growth and continued struggles with profitability make its turnaround highly dependent on execution and uncertain margin gains.

If you’d prefer companies with steadier earnings and reliable momentum, check out stable growth stocks screener (2081 results) which is designed to spotlight businesses that consistently deliver growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SINCH

Sinch

Provides cloud communications services and solutions for enterprises and mobile operators.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives