June 2025's European Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As European markets navigate a landscape shaped by trade negotiations and slowing inflation, the pan-European STOXX Europe 600 Index has shown resilience, ending 0.65% higher recently. With these economic dynamics in mind, growth companies with high insider ownership can offer unique insights into market confidence and potential stability amidst uncertainty.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Yubico (OM:YUBICO) | 36.2% | 30.4% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| Lokotech Group (OB:LOKO) | 14.8% | 58.1% |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| Elliptic Laboratories (OB:ELABS) | 22.9% | 79% |

Let's dive into some prime choices out of the screener.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

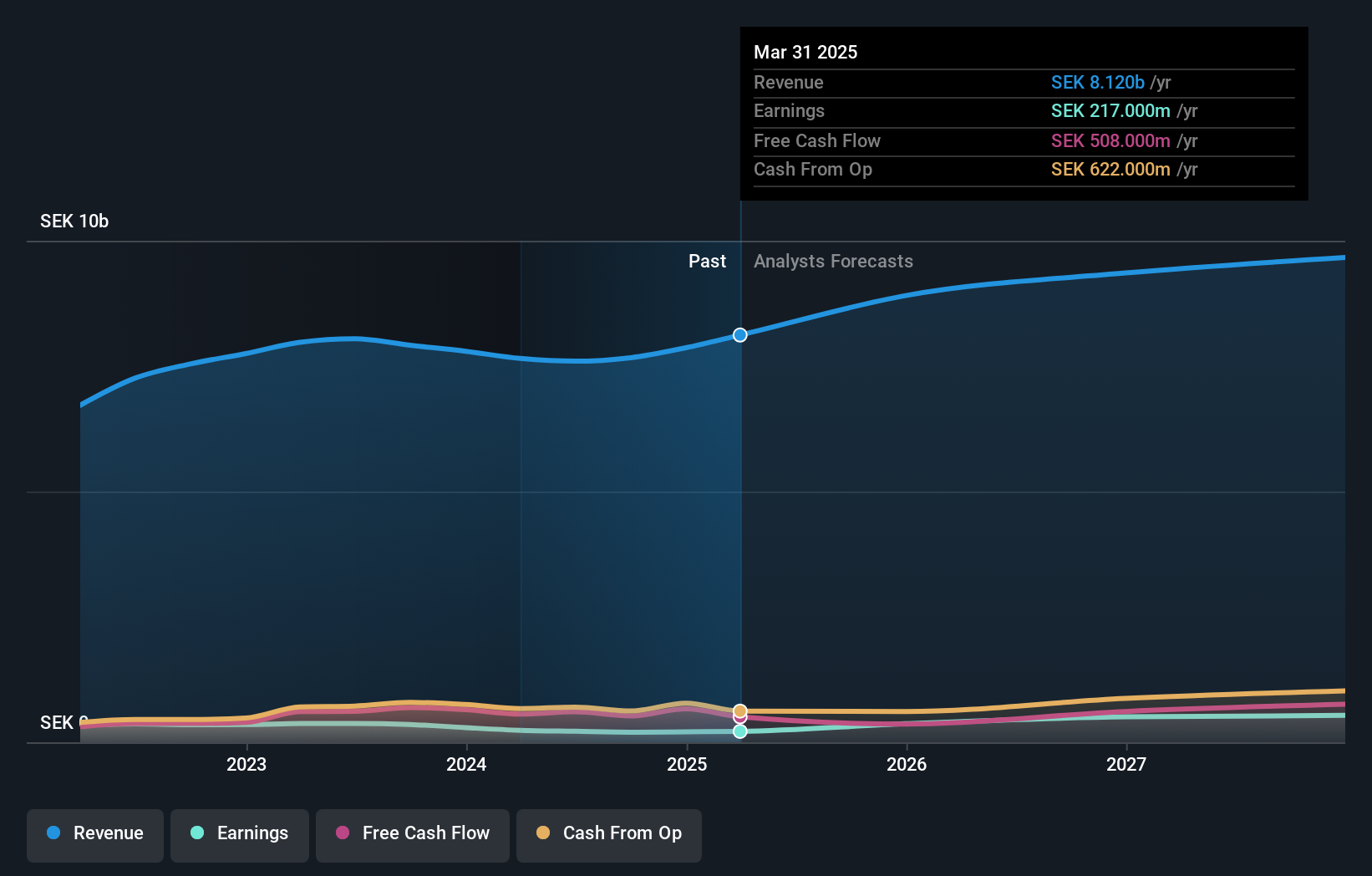

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of SEK5.41 billion.

Operations: The company's revenue is primarily derived from selling and implementing CRM software systems, amounting to SEK706.44 million.

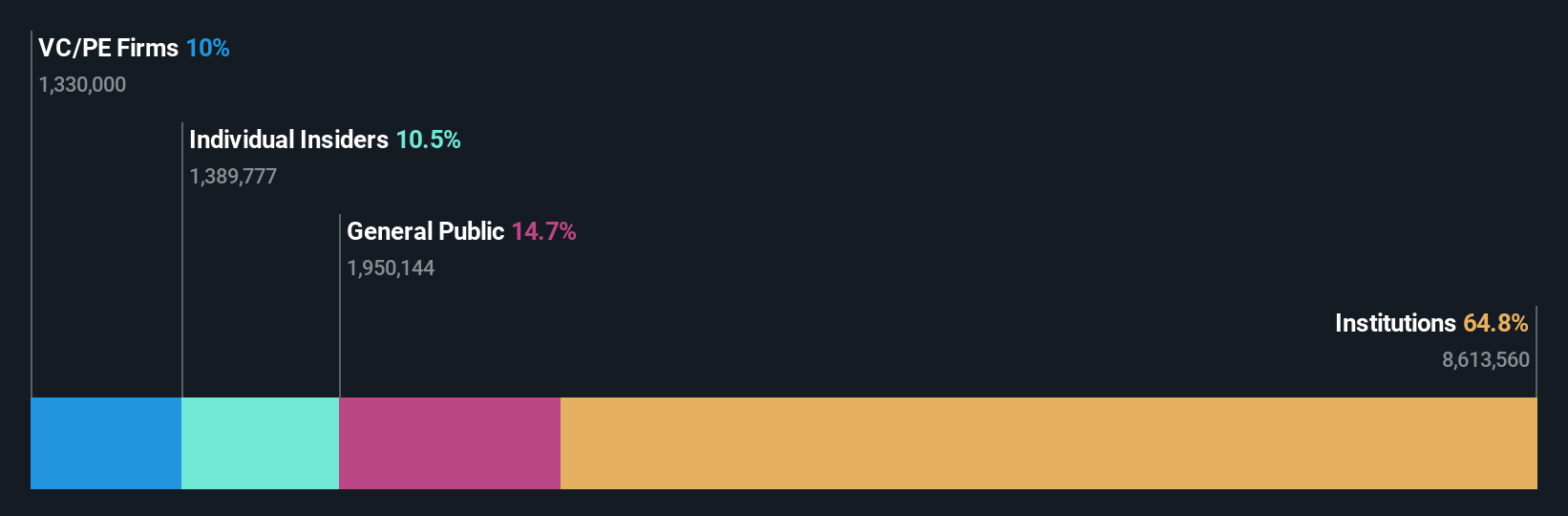

Insider Ownership: 10.5%

Earnings Growth Forecast: 21.9% p.a.

Lime Technologies demonstrates strong growth potential, with earnings forecasted to grow significantly at 21.9% annually, outpacing the Swedish market's 15.9%. The company's revenue is expected to rise by 12% per year, surpassing the national average of 4.2%. Recent board changes include Anna Jennehov's election as a director, enhancing governance expertise. First-quarter results showed increased sales and net income compared to last year, reflecting robust performance amidst strategic shifts.

- Navigate through the intricacies of Lime Technologies with our comprehensive analyst estimates report here.

- Our valuation report here indicates Lime Technologies may be overvalued.

Volati (OM:VOLO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Volati AB (publ) is a private equity firm that focuses on growth capital, buyouts, and add-on acquisitions in mature and middle-market companies, with a market cap of SEK9.75 billion.

Operations: The company's revenue segments include Salix Group at SEK3.79 billion, Ettiketto Group at SEK1.01 billion, and the Industry segment (excluding Ettiketto) at SEK3.33 billion.

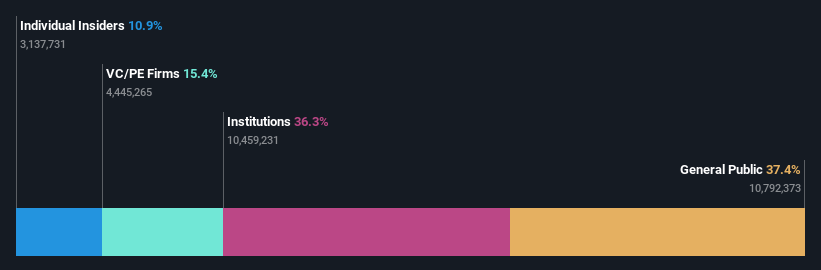

Insider Ownership: 28.9%

Earnings Growth Forecast: 31.9% p.a.

Volati exhibits strong growth potential, with earnings expected to grow significantly at 31.9% annually, outpacing the Swedish market's 15.9%. Revenue is forecasted to increase by 6.6% per year, above the national average of 4.2%. Despite trading well below fair value and having a high return on equity forecast, it carries substantial debt. Recent executive changes include CFO Martin Aronsson's departure announcement while first-quarter results showed increased sales and net income compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of Volati.

- Insights from our recent valuation report point to the potential undervaluation of Volati shares in the market.

Landis+Gyr Group (SWX:LAND)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Landis+Gyr Group AG, with a market cap of CHF1.50 billion, offers integrated energy management solutions to the utility sector across the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Operations: The company's revenue segments include $967.49 million from the Americas, $158.68 million from Asia Pacific, and $639.04 million from Europe, the Middle East, and Africa (EMEA).

Insider Ownership: 10.8%

Earnings Growth Forecast: 101% p.a.

Landis+Gyr Group is positioned for growth, with revenue expected to rise by 6.8% annually, surpassing the Swiss market's average. Despite a recent net loss of US$150.46 million and declining sales, strategic initiatives like advanced metering infrastructure upgrades and partnerships for grid-edge solutions enhance its technological edge. The company forecasts a return to profitability within three years, driven by innovative product offerings and operational improvements under new CFO Davinder Athwal's leadership.

- Unlock comprehensive insights into our analysis of Landis+Gyr Group stock in this growth report.

- Our expertly prepared valuation report Landis+Gyr Group implies its share price may be lower than expected.

Make It Happen

- Click here to access our complete index of 210 Fast Growing European Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives