- Switzerland

- /

- Biotech

- /

- SWX:KURN

European Growth Stocks Insiders Are Eager To Own

Reviewed by Simply Wall St

As European markets reach record highs, driven by a rally in technology stocks and optimism around potential U.S. rate cuts, investors are increasingly focusing on growth opportunities within the region. In this favorable environment, companies with high insider ownership often stand out as promising candidates, signaling confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

We're going to check out a few of the best picks from our screener tool.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers software as a service (SaaS) customer relationship management (CRM) solutions in the Nordic region and has a market cap of SEK4.26 billion.

Operations: The company generates revenue of SEK714.91 million from selling and implementing CRM software systems in the Nordic region.

Insider Ownership: 10.4%

Revenue Growth Forecast: 11.5% p.a.

Lime Technologies shows promising growth potential with earnings forecasted to grow significantly at 21.2% annually, outpacing the Swedish market. Recent earnings reports reveal steady revenue and profit increases, with a net income of SEK 54.25 million for the first half of 2025. Insider activity indicates more buying than selling in recent months, suggesting confidence in future prospects. The company is actively seeking acquisitions to bolster its CRM and Sportadmin segments, enhancing its growth trajectory further.

- Click to explore a detailed breakdown of our findings in Lime Technologies' earnings growth report.

- The valuation report we've compiled suggests that Lime Technologies' current price could be quite moderate.

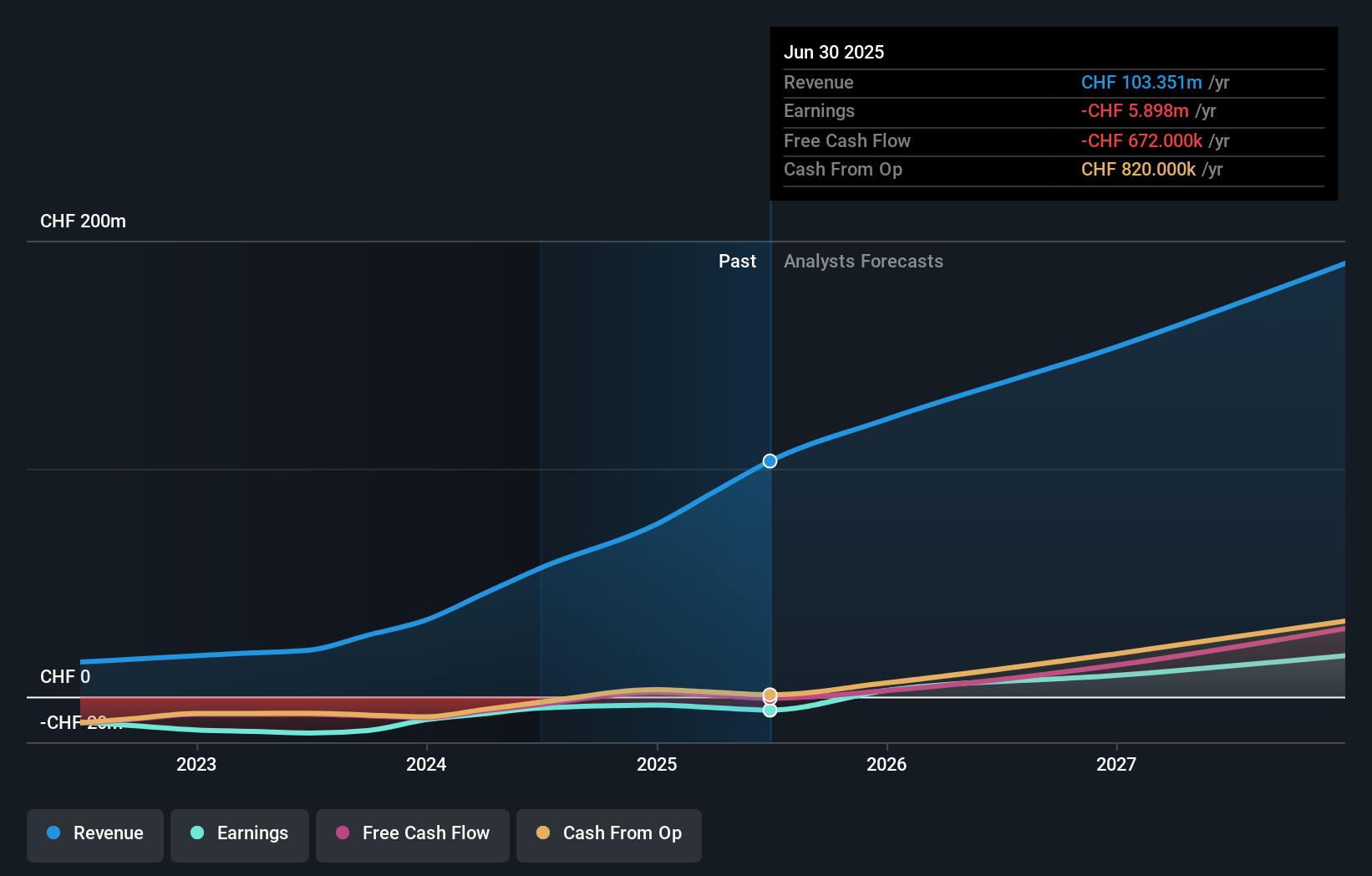

Kuros Biosciences (SWX:KURN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuros Biosciences AG focuses on the commercialization and development of biologic technologies for musculoskeletal care across the USA, EU, and internationally, with a market cap of CHF1.11 billion.

Operations: The company's revenue is primarily derived from its Medical Devices segment, totaling CHF103.35 million.

Insider Ownership: 24.2%

Revenue Growth Forecast: 21.5% p.a.

Kuros Biosciences is positioned for substantial growth, with revenue projected to increase by 21.5% annually, surpassing the Swiss market's growth rate. The company anticipates robust sales of US$220-250 million by 2027, driven by innovation and market expansion. Despite a recent net loss of CHF 2.01 million for the first half of 2025, Kuros' new MagnetOs MIS Delivery System has gained FDA clearance and expanded into South America, supporting its long-term strategic goals amidst high insider ownership stability.

- Click here to discover the nuances of Kuros Biosciences with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Kuros Biosciences' current price could be inflated.

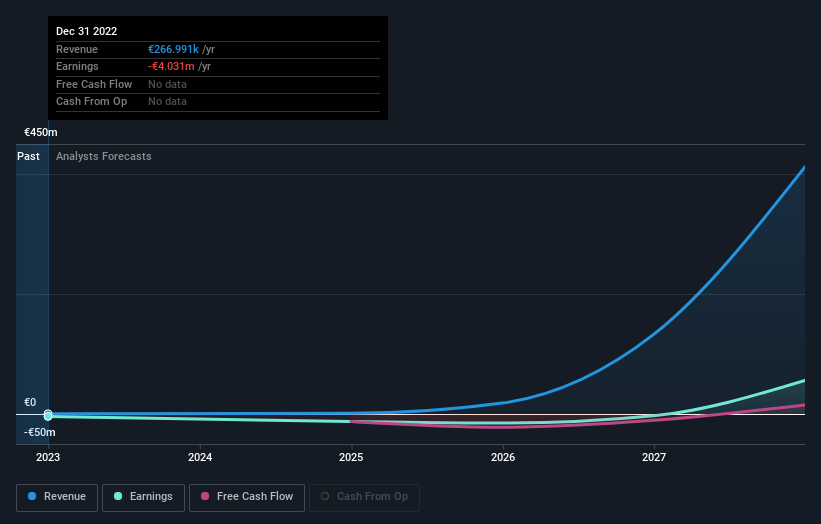

Circus (XTRA:CA1)

Simply Wall St Growth Rating: ★★★★★★

Overview: Circus SE is a technology company that develops and delivers autonomous solutions for the food service market, with a market cap of €373.47 million.

Operations: The company generates revenue from its Industrial Automation & Controls segment, amounting to €979 million.

Insider Ownership: 24.5%

Revenue Growth Forecast: 49.4% p.a.

Circus SE is advancing in the AI-robotics sector, leveraging high insider ownership to drive innovation and strategic partnerships. Recent collaborations with Meta and Secura highlight its focus on deploying autonomous solutions across defense and service sectors. Despite a volatile share price, Circus is trading significantly below its estimated fair value. With expected revenue growth of 49.4% annually, surpassing the German market rate, Circus' CA-1 technology positions it as a key player in Europe's AI-driven industries.

- Unlock comprehensive insights into our analysis of Circus stock in this growth report.

- Our expertly prepared valuation report Circus implies its share price may be too high.

Key Takeaways

- Unlock our comprehensive list of 179 Fast Growing European Companies With High Insider Ownership by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuros Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KURN

Kuros Biosciences

Engages in the commercialization and development of biologic technologies for musculoskeletal care in the United States of America, the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives