- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

Top Swedish Dividend Stocks To Consider In August 2024

Reviewed by Simply Wall St

As the European economy experiences a boost from the Paris Olympics and Sweden's Riksbank reduces borrowing costs, investors are increasingly looking toward stable dividend stocks as a reliable source of income. In this context, identifying high-quality Swedish dividend stocks can be particularly advantageous, offering not only potential for steady returns but also resilience amid fluctuating market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.28% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.67% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.65% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.92% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.49% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.14% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.98% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.40% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.77% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.82% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top Swedish Dividend Stocks screener.

We'll examine a selection from our screener results.

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Avanza Bank Holding AB (publ) and its subsidiaries provide a variety of savings, pension, and mortgage products in Sweden with a market cap of SEK37.89 billion.

Operations: Avanza Bank Holding AB (publ) generates SEK3.96 billion in revenue from its commercial operations.

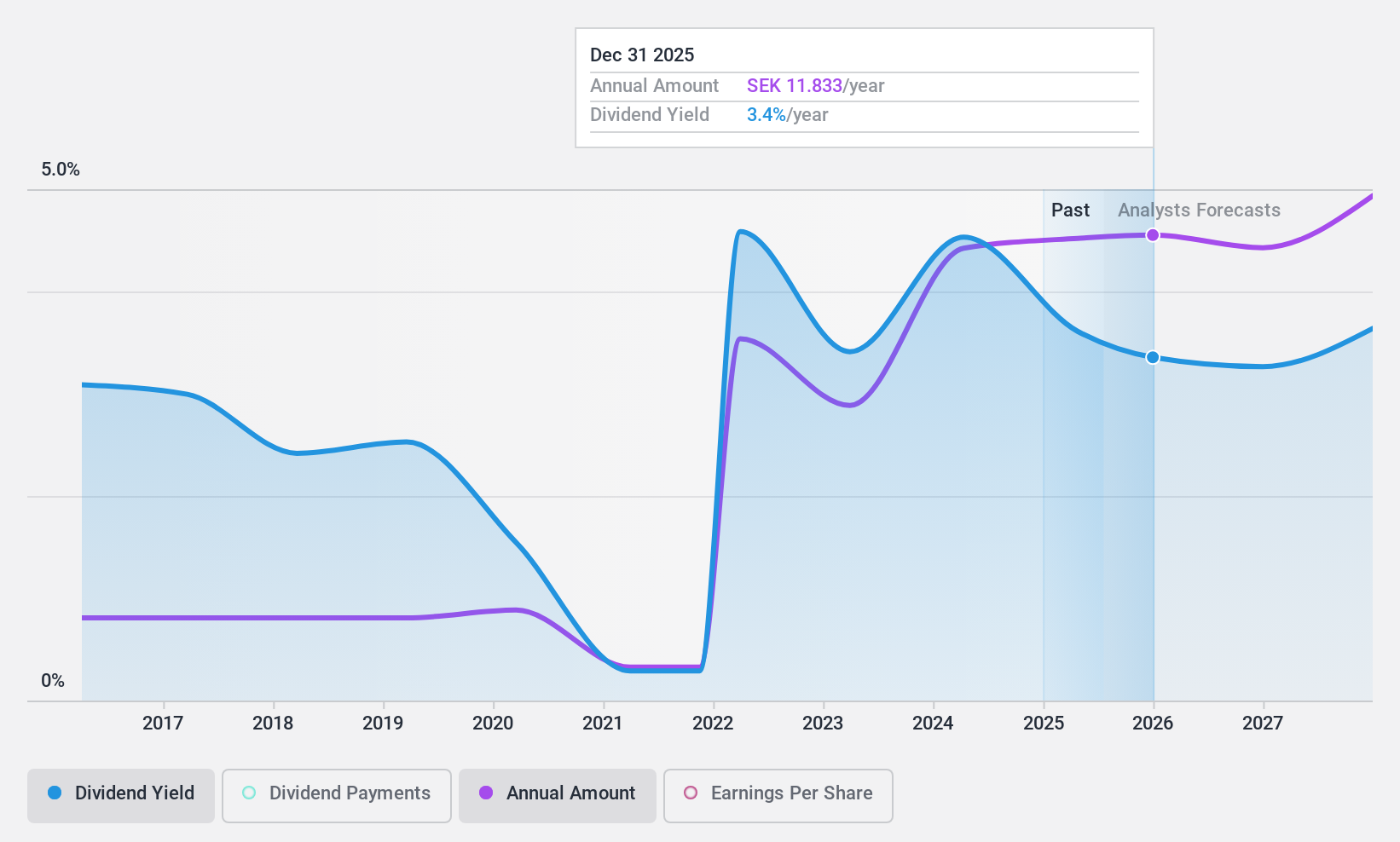

Dividend Yield: 4.8%

Avanza Bank Holding's dividend payments have increased over the past decade, though they have been volatile. The current payout ratio of 87.3% indicates dividends are covered by earnings, and a cash payout ratio of 55.8% suggests coverage by cash flows is reasonable. Trading at 9% below its estimated fair value, Avanza's dividend yield of 4.77% is in the top quartile in Sweden. Recent collaborations and customer growth underscore its robust operational performance.

- Dive into the specifics of Avanza Bank Holding here with our thorough dividend report.

- The valuation report we've compiled suggests that Avanza Bank Holding's current price could be inflated.

Knowit (OM:KNOW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company that develops digital solutions and has a market cap of SEK4.40 billion.

Operations: Knowit AB (publ) generates revenue from various segments, including Insight (SEK898.95 million), Solutions (SEK3.90 billion), Experience (SEK1.44 billion), and Connectivity (SEK1.02 billion).

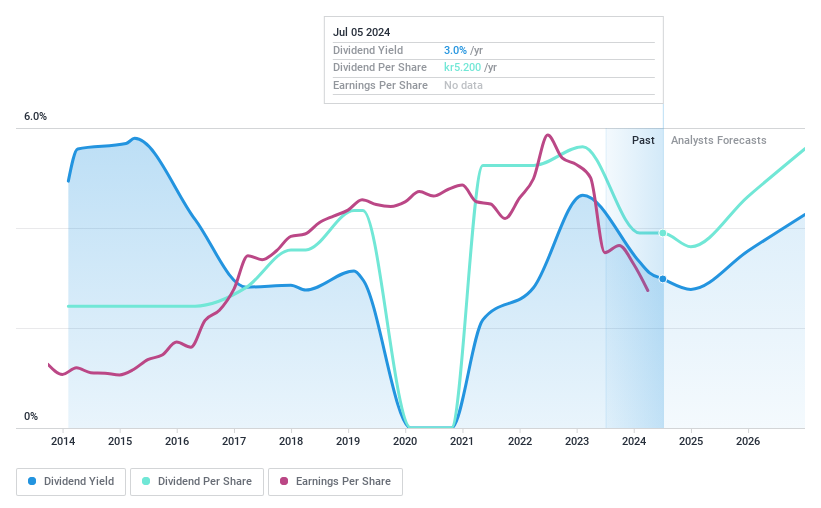

Dividend Yield: 3.2%

Knowit AB's recent earnings report showed a decline in revenue and net income, impacting its dividend reliability. The company's dividend yield of 3.23% is below the top quartile in Sweden, and its dividends have been volatile over the past decade. However, with a cash payout ratio of 41.6%, dividends are well covered by cash flows, and a payout ratio of 77.3% indicates earnings coverage is adequate despite an unstable track record.

- Click to explore a detailed breakdown of our findings in Knowit's dividend report.

- Upon reviewing our latest valuation report, Knowit's share price might be too pessimistic.

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK2.62 billion.

Operations: Zinzino AB (publ) generates revenue primarily from its Zinzino (including VMA Life) segment, which accounts for SEK1.74 billion, and the Faun segment, contributing SEK161.20 million.

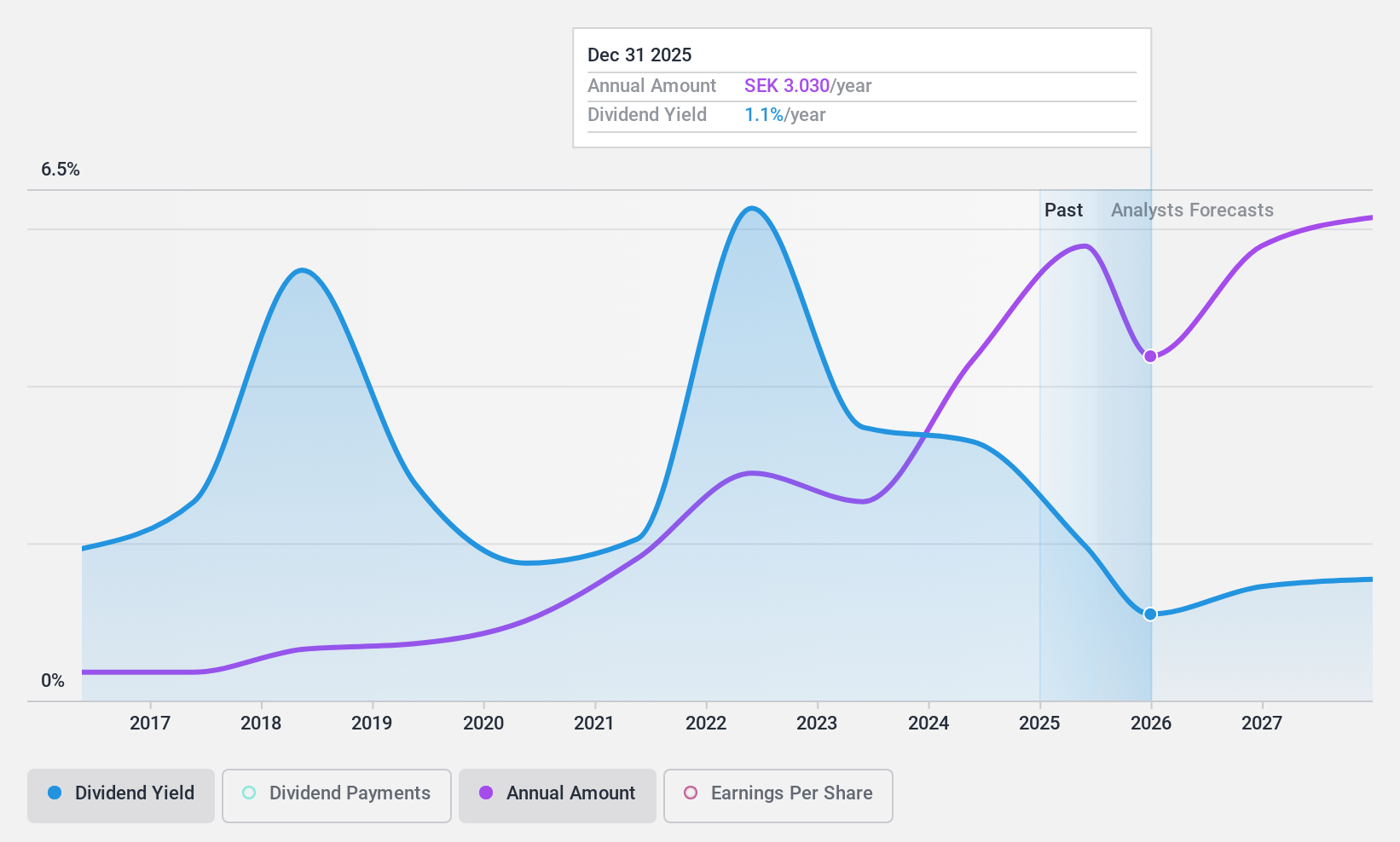

Dividend Yield: 3.9%

Zinzino AB's dividend payments are well-covered by both earnings (payout ratio: 59.9%) and cash flows (cash payout ratio: 59.3%). The company has consistently paid stable dividends over the past decade, with a current yield of 3.92%, slightly below Sweden's top quartile payers. Recent sales growth, including a 13% revenue increase in July to SEK 169.9 million, supports its sustainable dividend strategy amidst ongoing expansion efforts in Serbia and acquisition plans in the US and Asia.

- Click here and access our complete dividend analysis report to understand the dynamics of Zinzino.

- The analysis detailed in our Zinzino valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Explore the 19 names from our Top Swedish Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.