Knowit (OM:KNOW) Net Margin Falls to 1.3%, Testing Bullish Profit Growth Narratives

Reviewed by Simply Wall St

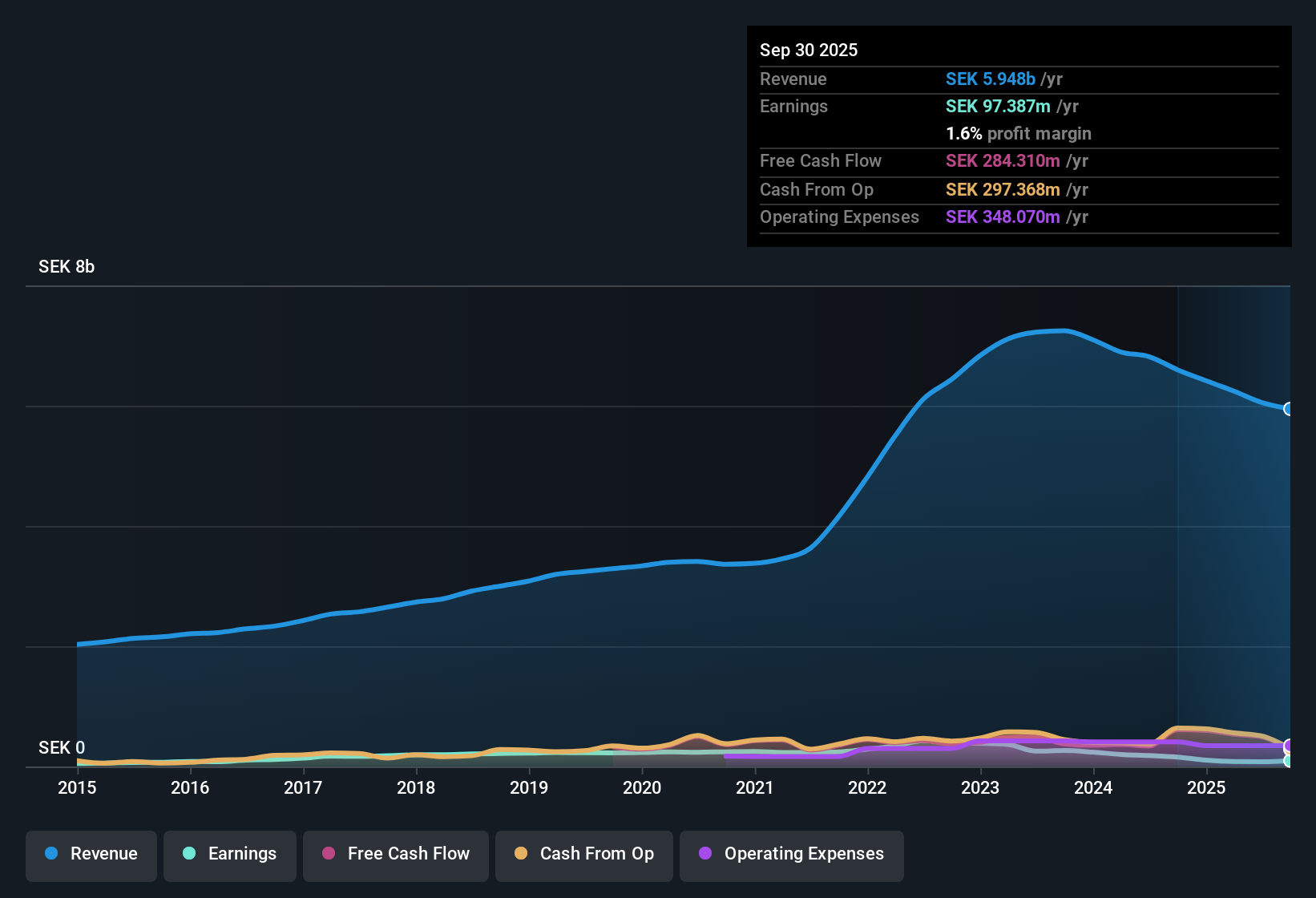

Knowit (OM:KNOW) has seen its earnings decline at an average rate of 14.8% per year for the past five years, with net profit margin slipping to 1.3% from 2.7% a year ago. Despite this downward trend in profitability, analysts are forecasting a major turn and project annual earnings growth of 31.2% for the next several years, well ahead of the Swedish market average of 12.6%. Revenue is also set for moderate growth, with expectations of a 4% annual increase just above the market rate. This sets up a fresh narrative for investors to consider.

See our full analysis for Knowit.Now, let’s pit these headline numbers against the prevailing community narratives to see which perspectives are confirmed and where the surprises might be.

See what the community is saying about Knowit

PE Ratio Nearly Double Peers

- Knowit is trading at a Price-to-Earnings ratio of 40.7x, almost twice the average for both European IT industry peers (19x) and its closest sector competitors (20.3x).

- According to the analysts' consensus view, this steep premium hinges on expectations for profit margins to grow from 1.3% today to 4.6% in three years and for annual revenue growth to outpace the Swedish market. The company would need to reach earnings of SEK 326.2 million and a lower PE of 16.8x by 2028 to justify the current stock price.

- This creates tension with the consensus price target of SEK 142.0, which is only moderately above the current share price of SEK 120.8 and far below the DCF fair value of SEK 398.71.

- The rapid decline needed in the PE ratio could pressure future returns unless earnings growth materializes as forecast.

- For a balanced take on whether Knowit's high multiple is sustainable, see what the community is debating in the full consensus story. 📊 Read the full Knowit Consensus Narrative.

Net Profit Margin Remains Under Pressure

- Net profit margin sits at 1.3%, down from 2.7% last year, which continues a multi-year trend of declining profitability.

- The analysts’ consensus narrative flags margin pressure as a persistently high operational risk. The ability to offset salary inflation with disciplined pricing could support future net margin expansion, but underutilization of staff and restructuring costs are likely to limit near-term improvement.

- Consensus expects a gradual margin recovery to 4.6% in three years, but this is only possible if internal efficiency efforts take hold and salary pressures ease.

- Recent initiatives to cut costs and focus on higher-value contracts are seen as catalysts, but execution risk remains if market conditions do not stabilize soon.

Dividend Sustainability in Question

- Concerns are rising around the sustainability of Knowit's dividend, with recent dividend-related risks explicitly highlighted by analysts despite expectations for earnings growth.

- From a consensus narrative perspective, reliance on cyclical client sectors and headwinds from automation may create instability in cash flows, making generous or consistently growing dividends more difficult to maintain as structural shifts in demand play out.

- Critics highlight that recurring income streams, such as from SaaS or platform services, remain underdeveloped compared to traditional consulting, leaving dividends more vulnerable to business cycles.

- While optimism about margin recovery exists, sustained payout growth may be limited until recurring revenues become a larger part of the business.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Knowit on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpret the data from a fresh angle. Take just a few moments to craft and share your perspective on where Knowit is heading. Do it your way

A great starting point for your Knowit research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Knowit faces headwinds from shrinking net margins, premium valuation, and concerns about the sustainability of its dividend in an uncertain market environment.

For more reliable income, check out these 1987 dividend stocks with yields > 3% that have a proven record of stable and sustainable shareholder payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knowit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KNOW

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives