- Sweden

- /

- Capital Markets

- /

- OM:K33

Investors Still Aren't Entirely Convinced By K33 AB (publ)'s (STO:K33) Revenues Despite 116% Price Jump

K33 AB (publ) (STO:K33) shares have continued their recent momentum with a 116% gain in the last month alone. The annual gain comes to 252% following the latest surge, making investors sit up and take notice.

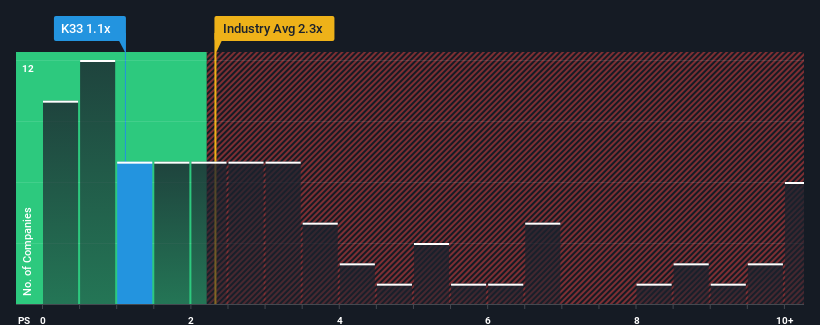

Even after such a large jump in price, K33's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a buy right now compared to the Software industry in Sweden, where around half of the companies have P/S ratios above 2.3x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for K33

How Has K33 Performed Recently?

K33 certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on K33 will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

K33's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Pleasingly, revenue has also lifted 248% in aggregate from three years ago, thanks to the last 12 months of explosive growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 18% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that K33's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does K33's P/S Mean For Investors?

K33's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see K33 currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You need to take note of risks, for example - K33 has 4 warning signs (and 3 which are significant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if K33 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:K33

K33

Through its subsidiaries, invests in digital assets in Sweden and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives