Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:600366

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious Federal Reserve, small-cap stocks have faced heightened volatility, with large-cap equities generally faring better in this environment. In such conditions, high-growth tech stocks can stand out by demonstrating resilience through strong innovation and adaptability to evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

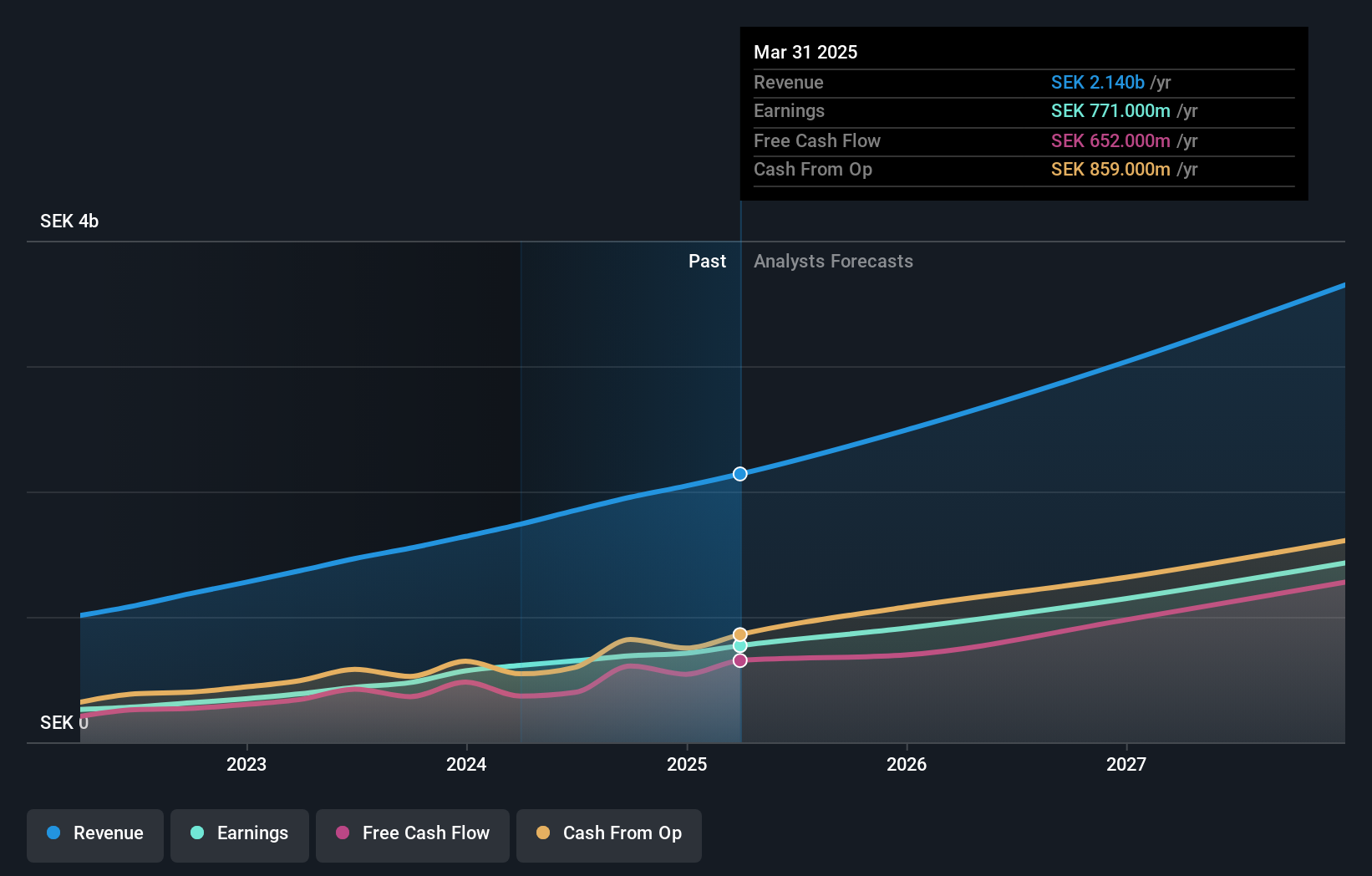

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers a range of financial and administrative software solutions tailored for small and medium-sized businesses, accounting firms, and organizations, with a market cap of approximately SEK40.93 billion.

Operations: Fortnox AB (publ) generates revenue through various segments, including Core Products (SEK768 million), Businesses (SEK397 million), and Marketplaces (SEK173 million). The company also serves accounting firms with services amounting to SEK376 million and offers financial services generating SEK267 million.

Fortnox, a player in the tech sector, has demonstrated robust growth with its recent earnings report showing a 45% increase over the past year, outpacing the software industry's average of 20.3%. This performance is supported by significant investment in R&D which aligns with their revenue growth of 18.5% per year, surpassing Sweden's market average significantly. With an anticipated earnings growth rate of 22.9%, Fortnox is positioned above many peers in its market segment. The company's strategic focus on innovation through R&D spending is evident as it continues to exceed market expectations in both revenue and earnings growth. Fortnox has successfully leveraged its technological advancements to secure a high Return on Equity forecast at 32.4%, indicative of efficient management and promising future prospects within the competitive landscape of high-growth tech sectors.

- Click here and access our complete health analysis report to understand the dynamics of Fortnox.

Evaluate Fortnox's historical performance by accessing our past performance report.

Ningbo Yunsheng (SHSE:600366)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China, with a market capitalization of CN¥7.39 billion.

Operations: The company generates revenue primarily through the production and sale of rare earth permanent magnet materials. It focuses on leveraging its expertise in research and development to enhance its product offerings.

Ningbo Yunsheng has pivoted from a significant net loss to reporting a net income of CNY 69.14 million in the past nine months, marking a drastic improvement in profitability. This turnaround is underscored by an aggressive R&D investment strategy, aligning with their revenue growth of 23.5% annually, significantly outpacing the Chinese market average of 13.9%. Moreover, their strategic share repurchases, totaling 13.8 million shares for CNY 75.86 million this year, reflect a confident outlook by management in the company's value proposition and future prospects amidst competitive pressures in the tech sector.

- Unlock comprehensive insights into our analysis of Ningbo Yunsheng stock in this health report.

Review our historical performance report to gain insights into Ningbo Yunsheng's's past performance.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. focuses on the research, development, design, production, and sale of time-frequency and satellite application products both in China and globally, with a market cap of CN¥7.16 billion.

Operations: Spaceon Electronics generates revenue primarily from the computer, communications, and other electronic equipment manufacturing segment, amounting to CN¥1.04 billion. The company's operations span both domestic and international markets, focusing on time-frequency and satellite application products.

Despite a challenging fiscal period where Chengdu Spaceon Electronics saw revenues dip to CNY 576.91 million from CNY 642.45 million, the firm remains poised for recovery with projected revenue growth at an impressive 27.7% annually, outstripping the broader Chinese market's average of 13.9%. This optimism is further bolstered by expected earnings growth of 37% per year, signaling robust future prospects despite current setbacks. The company's commitment to innovation is evident in its R&D investments, crucial for maintaining competitive edge in the swiftly evolving tech landscape. With strategic adjustments and a focus on high-growth sectors, Chengdu Spaceon Electronics is navigating through temporary fluctuations while setting the stage for sustained long-term growth.

Next Steps

- Dive into all 1281 of the High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yunsheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600366

Ningbo Yunsheng

Engages in the research and development, manufacture, and sale of rare earth permanent magnet materials in China.