- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

European Growth Companies With High Insider Ownership June 2025

Reviewed by Simply Wall St

As the European markets show resilience with a rise in major stock indexes and a slowdown in inflation, investors are increasingly interested in growth companies with high insider ownership. Such companies often signal confidence from those who know the business best, making them appealing options for those looking to navigate current economic conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| VusionGroup (ENXTPA:VU) | 13.4% | 52.7% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Guard Therapeutics International (OM:GUARD) | 24.5% | 68.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's review some notable picks from our screened stocks.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers smart technical products, packages, services, and integrations for financial and administrative applications targeting small and medium-sized businesses, accounting firms, and organizations in Sweden with a market cap of SEK54.76 billion.

Operations: Fortnox generates revenue through the provision of innovative technical solutions, including products, packages, services, and integrations tailored for financial and administrative needs of small to medium-sized enterprises, accounting firms, and organizations in Sweden.

Insider Ownership: 39.8%

Fortnox demonstrates strong growth potential with earnings forecast to grow significantly at 20.1% annually, outpacing the Swedish market's 16%. Despite its high insider ownership, recent months have seen minimal insider buying activity. The company's recent Q1 results show robust performance with revenue and net income increases compared to the previous year. An acquisition proposal by First Kraft and EQT AB highlights Fortnox's strategic value, offering a substantial premium over its March closing price.

- Delve into the full analysis future growth report here for a deeper understanding of Fortnox.

- In light of our recent valuation report, it seems possible that Fortnox is trading beyond its estimated value.

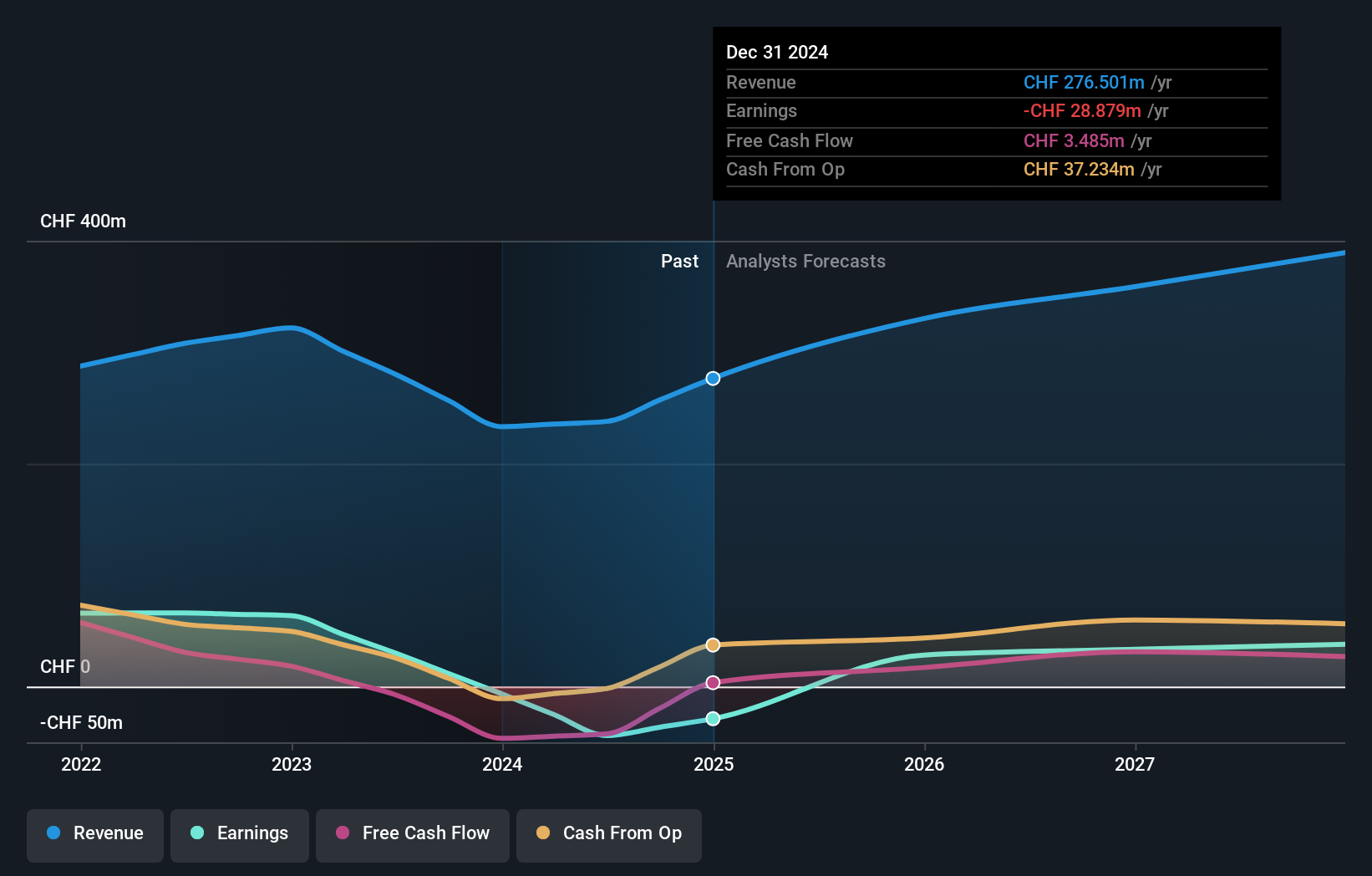

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG develops, produces, sells, and services sensor systems, modules, and components across various regions including Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF1.21 billion.

Operations: Sensirion Holding's revenue primarily comes from its sensor systems, modules, and components segment, which generated CHF276.50 million.

Insider Ownership: 19.9%

Sensirion Holding is poised for growth with expected earnings increasing by 70.66% annually, surpassing the Swiss market's forecast. Despite recent share price volatility, no substantial insider trading has occurred in the past three months. The company recently partnered with Sintropy.ai to enhance AI-driven automation solutions using Sensirion’s sensors, highlighting its innovation and quality. Additionally, Mirjana Blume's appointment as Audit Committee chair reflects strong governance amid these strategic advancements.

- Navigate through the intricacies of Sensirion Holding with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Sensirion Holding's share price might be on the expensive side.

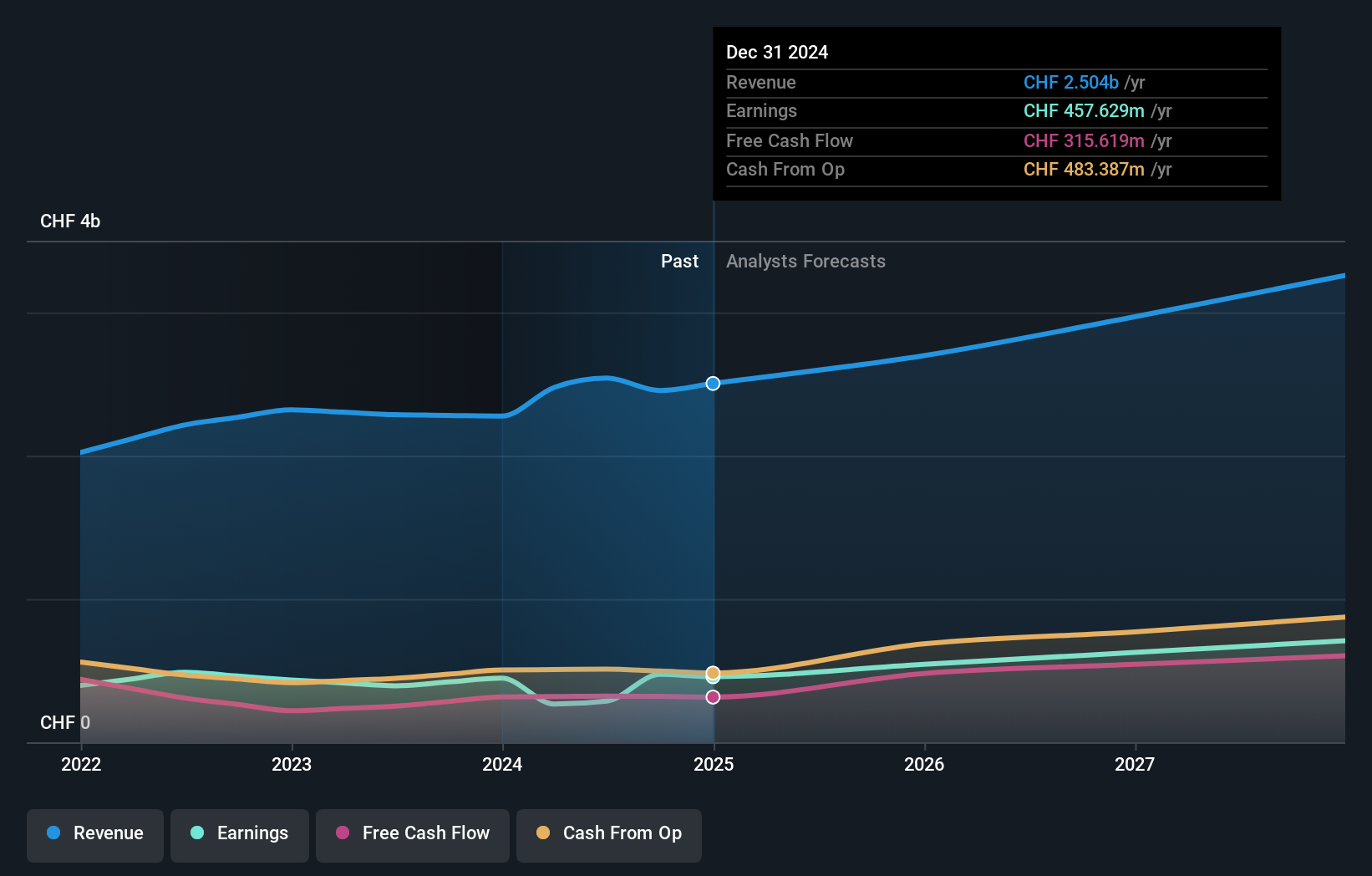

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Straumann Holding AG offers tooth replacement and orthodontic solutions globally, with a market cap of CHF17.15 billion.

Operations: The company's revenue is primarily derived from its operations segment, contributing CHF1.32 billion, with additional sales from regions including Europe, Middle East and Africa at CHF1.11 billion, North America at CHF791.79 million, Asia Pacific at CHF592.70 million, and Latin America at CHF290.28 million.

Insider Ownership: 32.3%

Straumann Holding is positioned for growth, with revenue and earnings forecasted to outpace the Swiss market at 9.5% and 13.4% annually, respectively. The company recently showcased its Straumann AXS platform at the International Dental Show, enhancing digital workflows in dentistry with new solutions like Smile-in-a-Box. While insider trading data is unavailable for recent months, Straumann's P/E ratio of 37.5x remains competitive within the industry context.

- Click here and access our complete growth analysis report to understand the dynamics of Straumann Holding.

- The valuation report we've compiled suggests that Straumann Holding's current price could be inflated.

Next Steps

- Access the full spectrum of 210 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives