3 Swedish Stocks Trading Up To 50% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets experience shifts in sentiment driven by central bank policy changes, the Swedish market has been no exception, with the Riksbank recently reducing borrowing costs to support economic activity. Amid these evolving conditions, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities. In this article, we explore three Swedish stocks currently trading up to 50% below their intrinsic value estimates, offering compelling prospects in today's market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK41.50 | SEK80.17 | 48.2% |

| QleanAir (OM:QAIR) | SEK27.40 | SEK51.83 | 47.1% |

| Nilörngruppen (OM:NIL B) | SEK68.00 | SEK135.98 | 50% |

| Paradox Interactive (OM:PDX) | SEK138.00 | SEK258.30 | 46.6% |

| Lindab International (OM:LIAB) | SEK262.00 | SEK523.56 | 50% |

| Dometic Group (OM:DOM) | SEK69.25 | SEK131.54 | 47.4% |

| Cavotec (OM:CCC) | SEK20.80 | SEK41.56 | 49.9% |

| Mentice (OM:MNTC) | SEK25.90 | SEK50.93 | 49.1% |

| Tourn International (OM:TOURN) | SEK8.96 | SEK16.47 | 45.6% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

Let's review some notable picks from our screened stocks.

Fortnox (OM:FNOX)

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK36.64 billion.

Operations: The company's revenue segments include Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

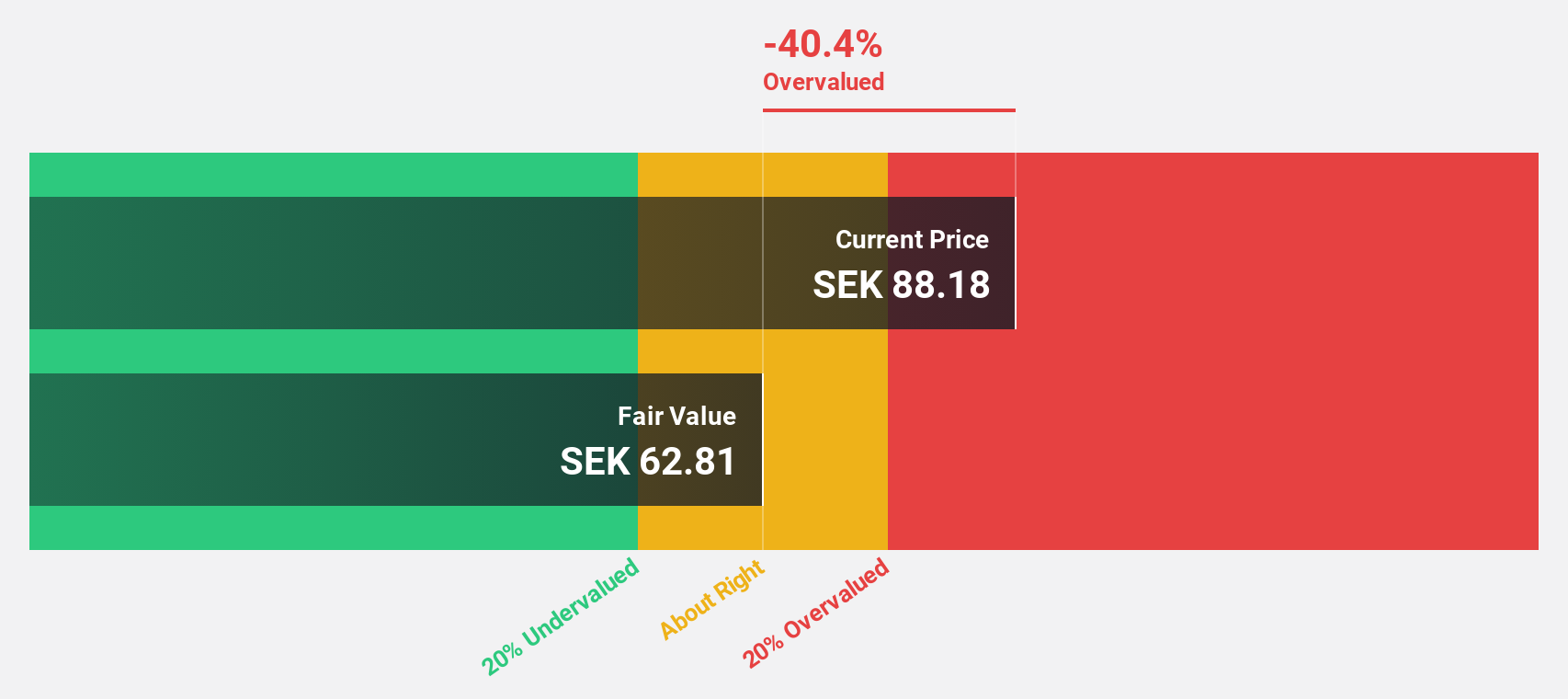

Estimated Discount To Fair Value: 23.4%

Fortnox is trading at SEK60.06, significantly below its estimated fair value of SEK78.45, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow 22.6% annually over the next three years, outpacing the Swedish market's growth rate of 16%. Recent earnings reports show strong performance with Q2 revenue at SEK521 million and net income at SEK164 million, reflecting substantial year-over-year growth.

- The growth report we've compiled suggests that Fortnox's future prospects could be on the up.

- Click here to discover the nuances of Fortnox with our detailed financial health report.

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) manufactures and sells ventilation system products and solutions in Europe, with a market cap of SEK20.14 billion.

Operations: Lindab International AB (publ) generates revenue through two primary segments: Ventilation Systems, which accounts for SEK9.95 billion, and Profile Systems, contributing SEK3.28 billion.

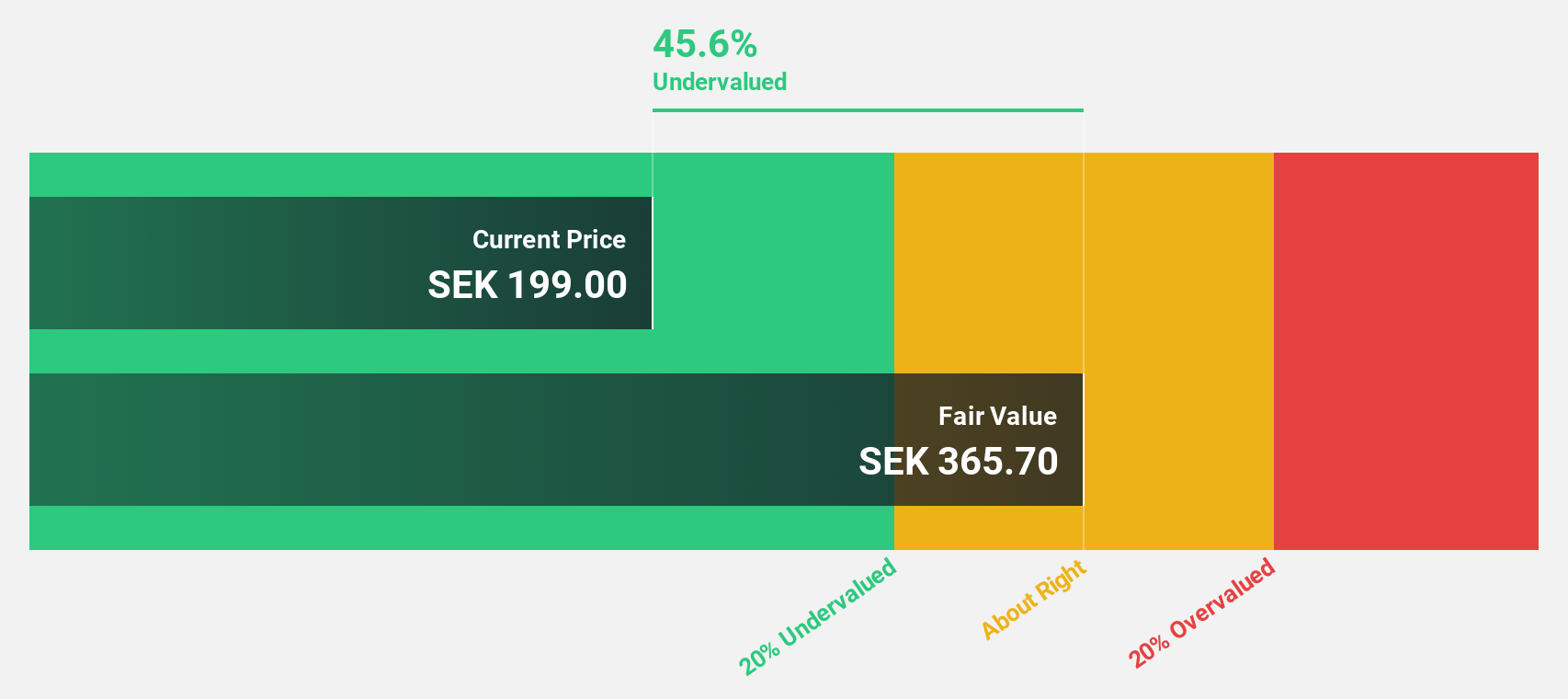

Estimated Discount To Fair Value: 50%

Lindab International is trading at SEK262, significantly below its estimated fair value of SEK523.56, indicating it is highly undervalued based on cash flows. The company's earnings are forecast to grow 25.8% annually over the next three years, outpacing the Swedish market's growth rate of 16%. Recent Q2 results show sales increased to SEK3.52 billion from SEK3.37 billion a year ago, though net income decreased to SEK213 million from SEK240 million.

- Insights from our recent growth report point to a promising forecast for Lindab International's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Lindab International.

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of approximately SEK4.38 billion.

Operations: The company's revenue primarily comes from selling and implementing CRM software systems, amounting to SEK631.84 million.

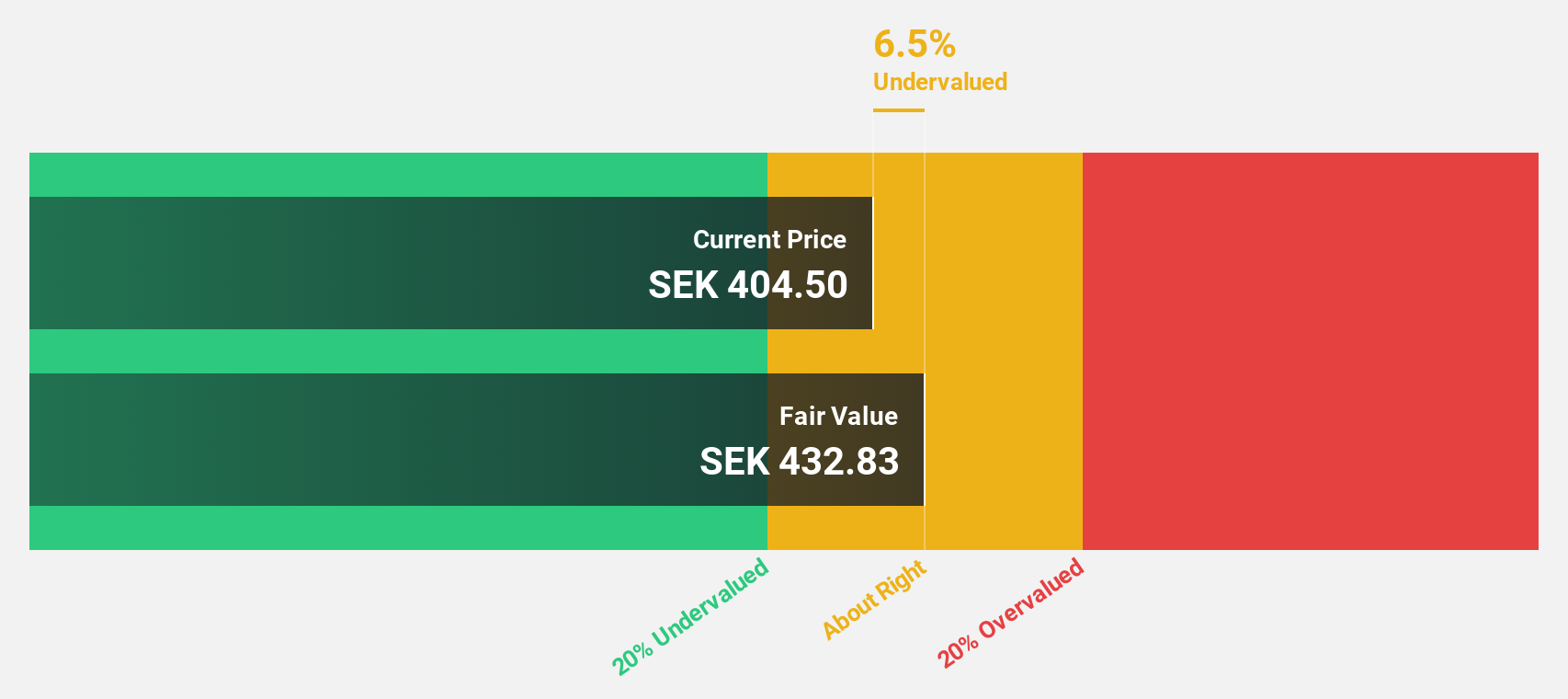

Estimated Discount To Fair Value: 30.8%

Lime Technologies is trading at SEK330, 30.8% below its estimated fair value of SEK477.17, suggesting it is undervalued based on cash flows. Recent Q2 results show sales and revenue growth to SEK174.49 million and SEK174.71 million respectively, though net income remained stable at approximately SEK20 million. Earnings are forecast to grow 24.13% annually, outpacing the Swedish market's 16%. However, the company carries a high level of debt which investors should consider.

- In light of our recent growth report, it seems possible that Lime Technologies' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Lime Technologies.

Make It Happen

- Unlock our comprehensive list of 42 Undervalued Swedish Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Exceptional growth potential with outstanding track record.