3 Swedish Growth Companies With High Insider Ownership Up To 42% Earnings Growth

Reviewed by Simply Wall St

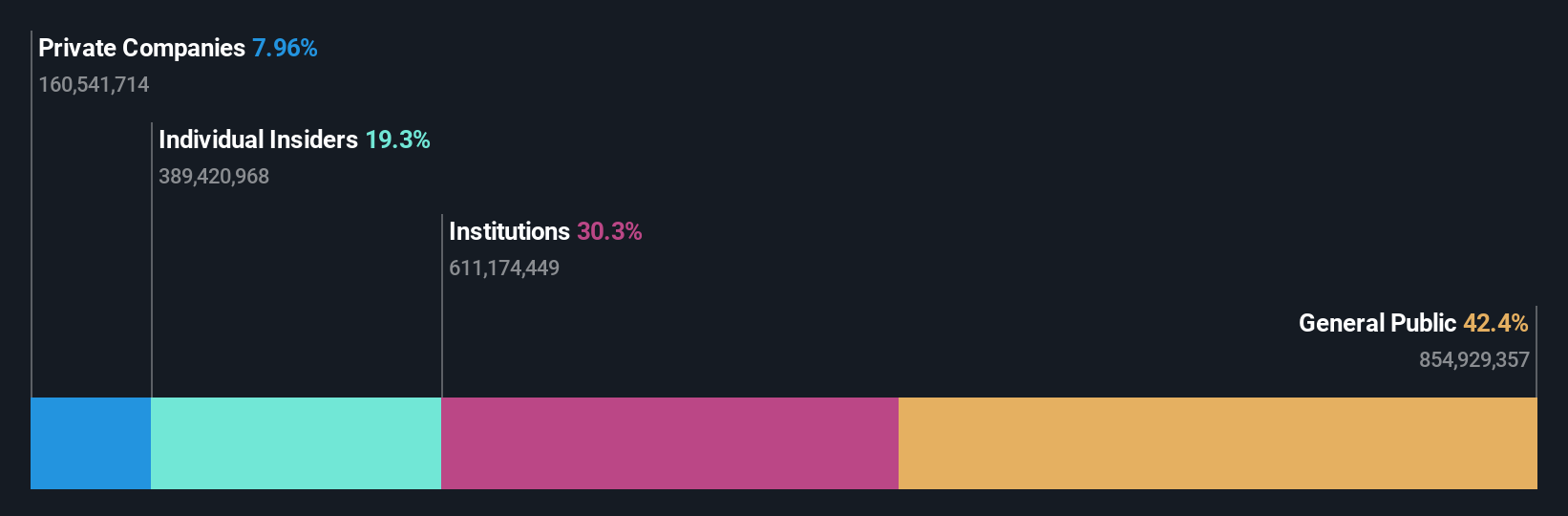

The Swedish stock market has shown resilience amid global economic fluctuations, with growth stocks particularly standing out. As interest rate cuts by the ECB signal a cautious yet optimistic outlook for the European economy, investors are increasingly looking toward companies with strong insider ownership as potential opportunities. In this context, high insider ownership can be an indicator of confidence in a company's future prospects, making it an attractive feature for growth-oriented investors.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We'll examine a selection from our screener results.

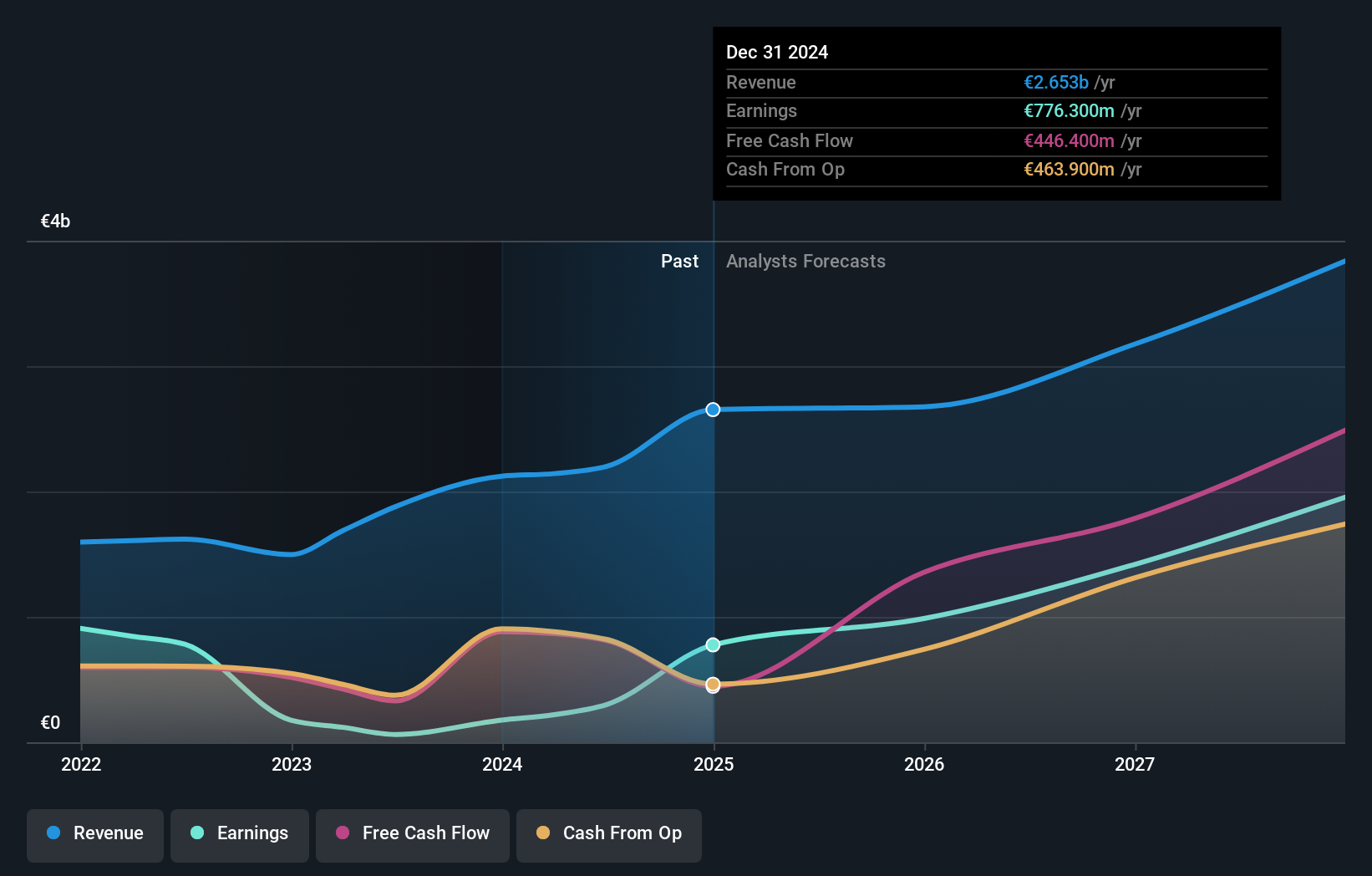

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of SEK427.41 billion.

Operations: The company's revenue segments include €1.28 billion from Private Capital, €878.70 million from Real Assets, and €37.20 million from Central operations.

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.4% p.a.

EQT AB, a prominent private equity firm in Sweden, has shown robust earnings growth of 384.2% over the past year and is forecast to continue growing at 35.4% per year, outpacing the Swedish market's average. Despite significant insider selling recently, EQT insiders have also made substantial purchases. The company is actively involved in multiple high-stakes M&A activities, including potential acquisitions and divestitures valued in billions of dollars (US$).

- Unlock comprehensive insights into our analysis of EQT stock in this growth report.

- According our valuation report, there's an indication that EQT's share price might be on the expensive side.

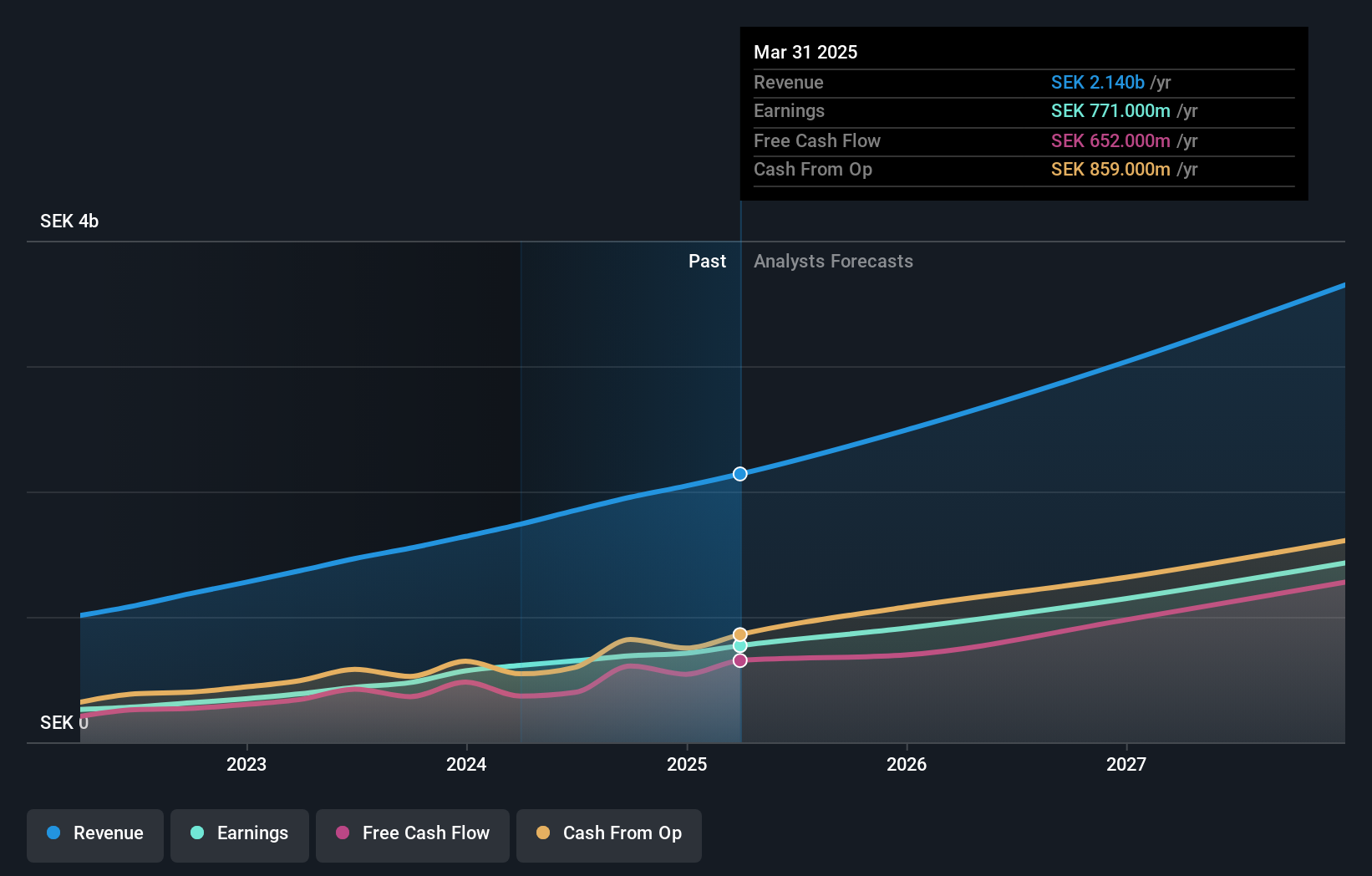

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK40.33 billion.

Operations: Fortnox AB (publ) generates revenue from various segments including Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

Insider Ownership: 21.1%

Earnings Growth Forecast: 22.6% p.a.

Fortnox AB has demonstrated strong growth, with earnings increasing 48.1% over the past year and forecasted to grow 22.6% annually, outpacing the Swedish market's average. Revenue is also expected to rise significantly at 20.2% per year. Recent financial results show a solid performance, with second-quarter sales reaching SEK 515 million and net income at SEK 164 million. Notably, insiders have been buying more shares than selling in the past three months.

- Get an in-depth perspective on Fortnox's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Fortnox is trading beyond its estimated value.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components globally, with a market cap of SEK98.61 billion.

Operations: NIBE Industrier's revenue segments include SEK5.33 billion from Stoves, SEK13.48 billion from Element, and SEK35.22 billion from Climate Solutions.

Insider Ownership: 20.2%

Earnings Growth Forecast: 42.5% p.a.

NIBE Industrier's earnings are forecast to grow significantly at 42.55% per year, outpacing the Swedish market's 15.1%. However, recent financial results show a decline, with second-quarter sales at SEK 10.04 billion and net income dropping to SEK 219 million from SEK 1.32 billion last year. Despite lower profit margins and uncovered interest payments by earnings, substantial insider ownership remains evident through recent acquisitions by Sofia Schörling Högberg and Märta Schörling Andreen.

- Click here to discover the nuances of NIBE Industrier with our detailed analytical future growth report.

- Our valuation report here indicates NIBE Industrier may be overvalued.

Seize The Opportunity

- Embark on your investment journey to our 91 Fast Growing Swedish Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Exceptional growth potential with outstanding track record.