Addnode Group (OM:ANOD B): Earnings Growth Accelerates, Reinforcing Bullish Profitability Narratives

Reviewed by Simply Wall St

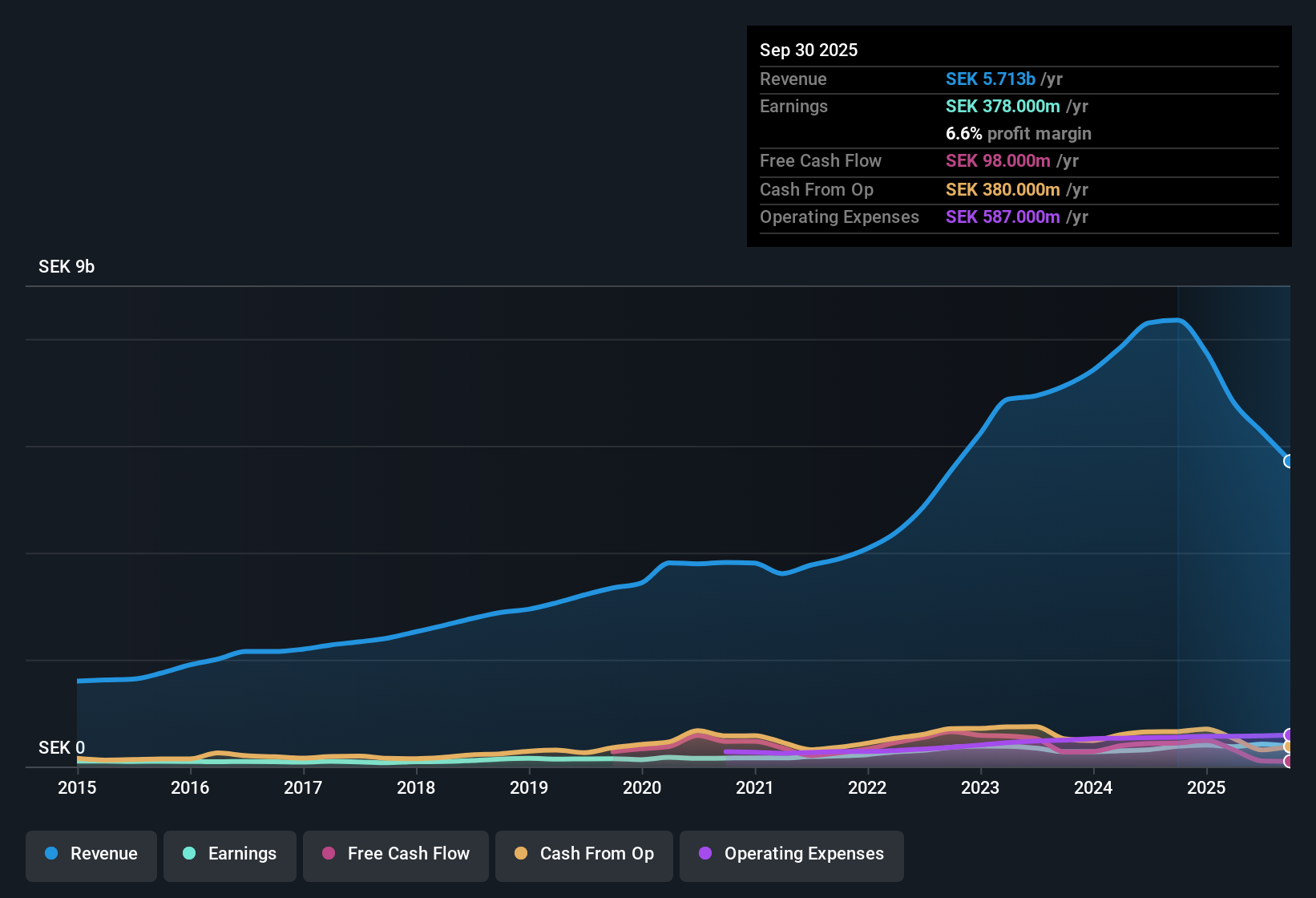

Addnode Group (OM:ANOD B) has delivered standout earnings growth, with profits rising 16.8% per year over the past five years and accelerating to 33.7% growth in the most recent year. Net profit margins improved to 6.7%, up from 3.8% the prior year, and forecasts show revenue expanding by 7.4% per year, outpacing the broader Swedish market’s 3.9% rate. With EPS expected to rise by 18.8% annually, easily beating the market average of 12.6%, investors are watching these quality metrics closely against a high price-to-earnings ratio of 36.8x (versus a peer average of 26.5x). This reflects both optimism and a justified scrutiny of the company’s premium valuation.

See our full analysis for Addnode Group.Next, we’ll see how these earnings numbers stack up against the stories and expectations circulating in the market, and whether they support or challenge the narratives followed by investors.

See what the community is saying about Addnode Group

Recurring Revenue Lifts Stability

- Analysts highlight that a large portion of Addnode’s sales is recurring, which is becoming increasingly valuable as digital demand rises across industries and the company diversifies its service segments.

- The consensus narrative argues that steady recurring revenue streams and growth in software and digital services offer resilience and capacity for stable future cash flows.

- This is reinforced by the spread into sectors like defense and public, paired with a strong financial position that can support continued expansion.

- Analysts see the company’s low debt and successful acquisitions as key factors that set Addnode up for consistent, sustainable revenue over the coming years.

Curious how recurring revenue influences Addnode’s long-term prospects? See what the community is saying about OM:ANOD B

Cost Savings Drive Margin Upside

- The company is implementing cost-saving initiatives in the PLM division, estimated to achieve SEK 45 million in annual reductions, following challenges in Germany’s market environment.

- The consensus narrative claims that these expense controls, combined with the migration to a higher-margin business model and more proprietary software, will support margin expansion and profit stability as the business scales.

- Net margins have already risen to 6.7% from 3.8% and are forecast to reach 8.6% within three years, reflecting anticipated benefits from both division cost reductions and changing vendor agreements.

- This focus on efficiency is especially important in light of volatile market conditions and shifting customer spending patterns in key regions.

Premium Valuation Hinges on Growth

- Addnode trades at 36.8x earnings, a significant premium to both the European IT industry average of 19x and the peer average of 26.5x, as well as above its DCF fair value of 87.85.

- Analysts’ consensus view is that for the company’s current valuation to be maintained, ongoing growth in revenues, margins, and profit must stay on course with expectations, or the share price could come under pressure.

- At a current share price of 114.20, the stock is 9.9% below the analyst price target of 125.0, suggesting that the market already assumes future growth will materialize as projected.

- Key to justifying this premium will be Addnode’s follow-through on margin gains and successful navigation of cash flow pressures from region-specific challenges and changes in payment models.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Addnode Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your perspective and put together your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Addnode Group.

See What Else Is Out There

Despite impressive top-line growth, Addnode’s premium valuation depends on delivering sustained margin gains and profit expansion. This could disappoint if market conditions shift or challenges persist.

If you’d rather sidestep potential overvaluation concerns, uncover stronger value opportunities aligned with your goals through these 873 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ANOD B

Addnode Group

Offers software and services for the design, construction, product data information, project collaboration, and facility management in Sweden, Nordic countries, the United States, the United Kingdom, Germany, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives