4C Group's (STO:4C one-year decrease in earnings delivers investors with a 32% loss

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the 4C Group AB (publ) (STO:4C) share price slid 32% over twelve months. That contrasts poorly with the market decline of 2.0%. 4C Group may have better days ahead, of course; we've only looked at a one year period. Unfortunately the share price momentum is still quite negative, with prices down 30% in thirty days.

Since 4C Group has shed kr102m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for 4C Group

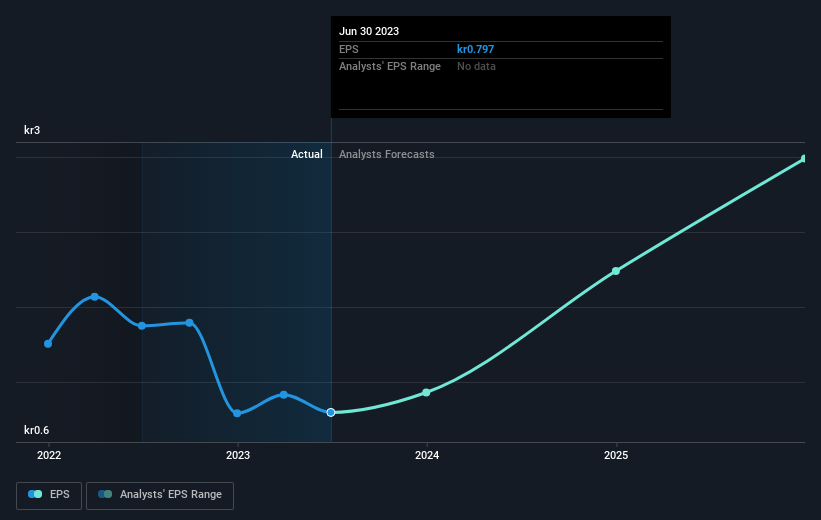

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, 4C Group had to report a 42% decline in EPS over the last year. The share price fall of 32% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that 4C Group has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We doubt 4C Group shareholders are happy with the loss of 32% over twelve months. That falls short of the market, which lost 2.0%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 23%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for 4C Group (of which 1 makes us a bit uncomfortable!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:4C

4C Group

Provides software solutions and expert services for organizational readiness, training, and crisis management worldwide.

High growth potential and good value.