Daniel Ekberger has been the CEO of Paynova AB (NGM:PAY) since 2013, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Paynova

How Does Total Compensation For Daniel Ekberger Compare With Other Companies In The Industry?

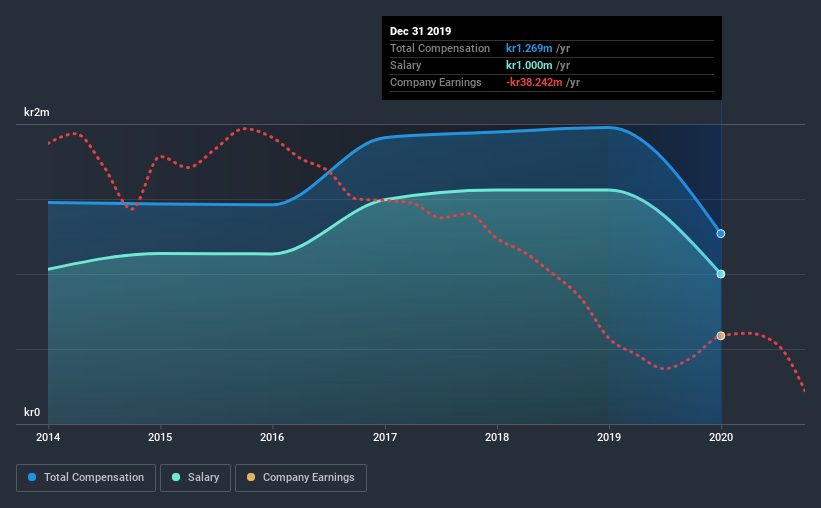

According to our data, Paynova AB has a market capitalization of kr192m, and paid its CEO total annual compensation worth kr1.3m over the year to December 2019. We note that's a decrease of 36% compared to last year. In particular, the salary of kr1.00m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below kr1.7b, reported a median total CEO compensation of kr1.7m. From this we gather that Daniel Ekberger is paid around the median for CEOs in the industry. Moreover, Daniel Ekberger also holds kr4.1m worth of Paynova stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | kr1.0m | kr1.6m | 79% |

| Other | kr269k | kr416k | 21% |

| Total Compensation | kr1.3m | kr2.0m | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. Paynova pays out 79% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Paynova AB's Growth Numbers

Paynova AB's earnings per share (EPS) grew 17% per year over the last three years. It saw its revenue drop 12% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Paynova AB Been A Good Investment?

With a three year total loss of 54% for the shareholders, Paynova AB would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, Paynova pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, the company has logged negative shareholder returns over the previous three years. But on the bright side, EPS growth is positive over the same period. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 5 warning signs for Paynova you should be aware of, and 2 of them are a bit unpleasant.

Important note: Paynova is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Paynova, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:SILEON

Sileon

A fintech company, provides SaaS platform that supports businesses in Sweden.

Moderate risk with weak fundamentals.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026