Stock Analysis

24SevenOffice Group (NGM:247) pulls back 11% this week, but still delivers shareholders stellar 233% return over 1 year

24SevenOffice Group AB (publ) (NGM:247) shareholders might be concerned after seeing the share price drop 11% in the last week. Despite this, the stock is a strong performer over the last year, no doubt about that. We're very pleased to report the share price shot up 233% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Although 24SevenOffice Group has shed kr143m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for 24SevenOffice Group

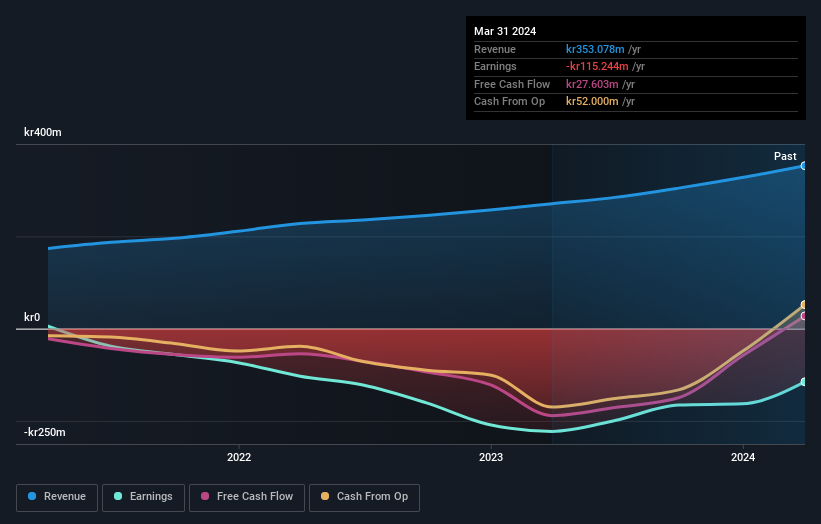

Given that 24SevenOffice Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

24SevenOffice Group grew its revenue by 30% last year. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 233%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at 24SevenOffice Group's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that 24SevenOffice Group shareholders have received a total shareholder return of 233% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with 24SevenOffice Group , and understanding them should be part of your investment process.

But note: 24SevenOffice Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether 24SevenOffice Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:247

24SevenOffice Group

Provides cloud-based AI–accounting/enterprise resource planning platform to automate business administration and allow for data driven decision making for small, medium, and large companies in Norway, Sweden, rest of Europe, Canada, and internationally.

Mediocre balance sheet and overvalued.