- Sweden

- /

- Semiconductors

- /

- OM:SIVE

Take Care Before Jumping Onto Sivers Semiconductors AB (publ) (STO:SIVE) Even Though It's 47% Cheaper

Unfortunately for some shareholders, the Sivers Semiconductors AB (publ) (STO:SIVE) share price has dived 47% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

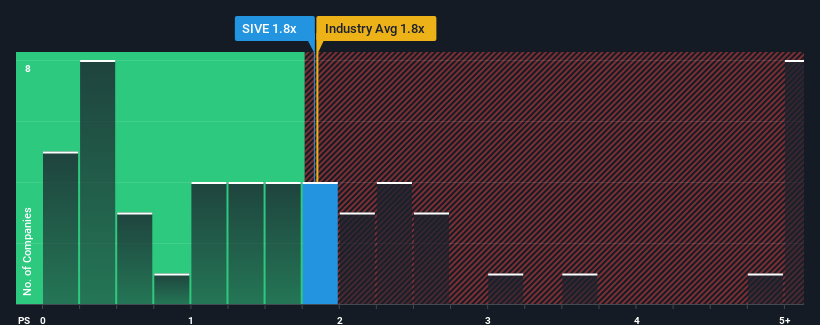

Even after such a large drop in price, there still wouldn't be many who think Sivers Semiconductors' price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in Sweden's Semiconductor industry is similar at about 2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Sivers Semiconductors

How Has Sivers Semiconductors Performed Recently?

Recent times have been advantageous for Sivers Semiconductors as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sivers Semiconductors.Is There Some Revenue Growth Forecasted For Sivers Semiconductors?

The only time you'd be comfortable seeing a P/S like Sivers Semiconductors' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 96% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 63% each year as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Sivers Semiconductors' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Sivers Semiconductors' P/S

With its share price dropping off a cliff, the P/S for Sivers Semiconductors looks to be in line with the rest of the Semiconductor industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Sivers Semiconductors' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Sivers Semiconductors you should be aware of, and 3 of them are potentially serious.

If you're unsure about the strength of Sivers Semiconductors' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SIVE

Sivers Semiconductors

Through its subsidiaries, develops, manufactures, and sells chips, components, modules, and subsystems in North America, Europe, and Asia.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.