- Sweden

- /

- Specialty Stores

- /

- OM:NELLY

Nelly Group AB (publ)'s (STO:NELLY) Share Price Boosted 32% But Its Business Prospects Need A Lift Too

Nelly Group AB (publ) (STO:NELLY) shares have continued their recent momentum with a 32% gain in the last month alone. The annual gain comes to 123% following the latest surge, making investors sit up and take notice.

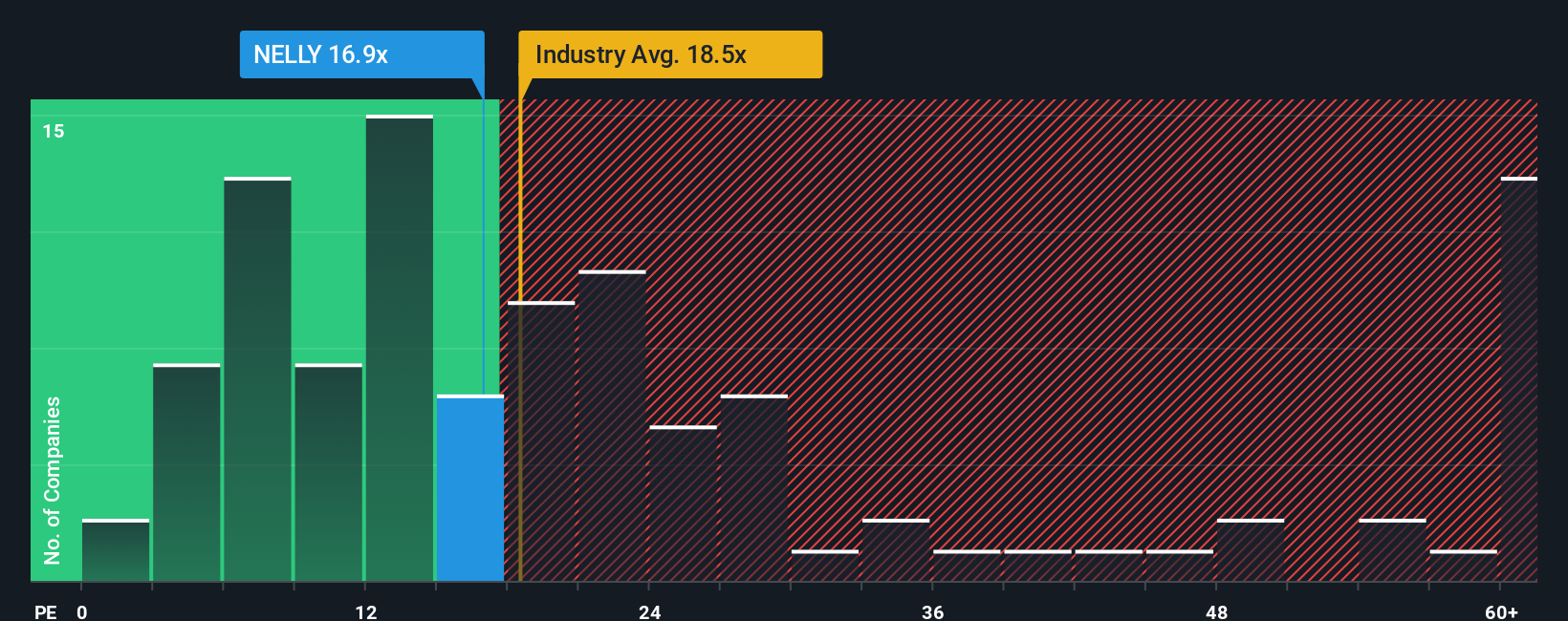

Even after such a large jump in price, Nelly Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.9x, since almost half of all companies in Sweden have P/E ratios greater than 24x and even P/E's higher than 38x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Nelly Group certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Nelly Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nelly Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 214%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 27% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Nelly Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Nelly Group's P/E

Nelly Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Nelly Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Nelly Group that you should be aware of.

If these risks are making you reconsider your opinion on Nelly Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nelly Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NELLY

Nelly Group

Operates as a fashion company in Sweden, rest of Nordics, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives