Boozt (OM:BOOZT) Net Profit Margin Improvement Challenges Cautious Narratives on Quality and Scalability

Reviewed by Simply Wall St

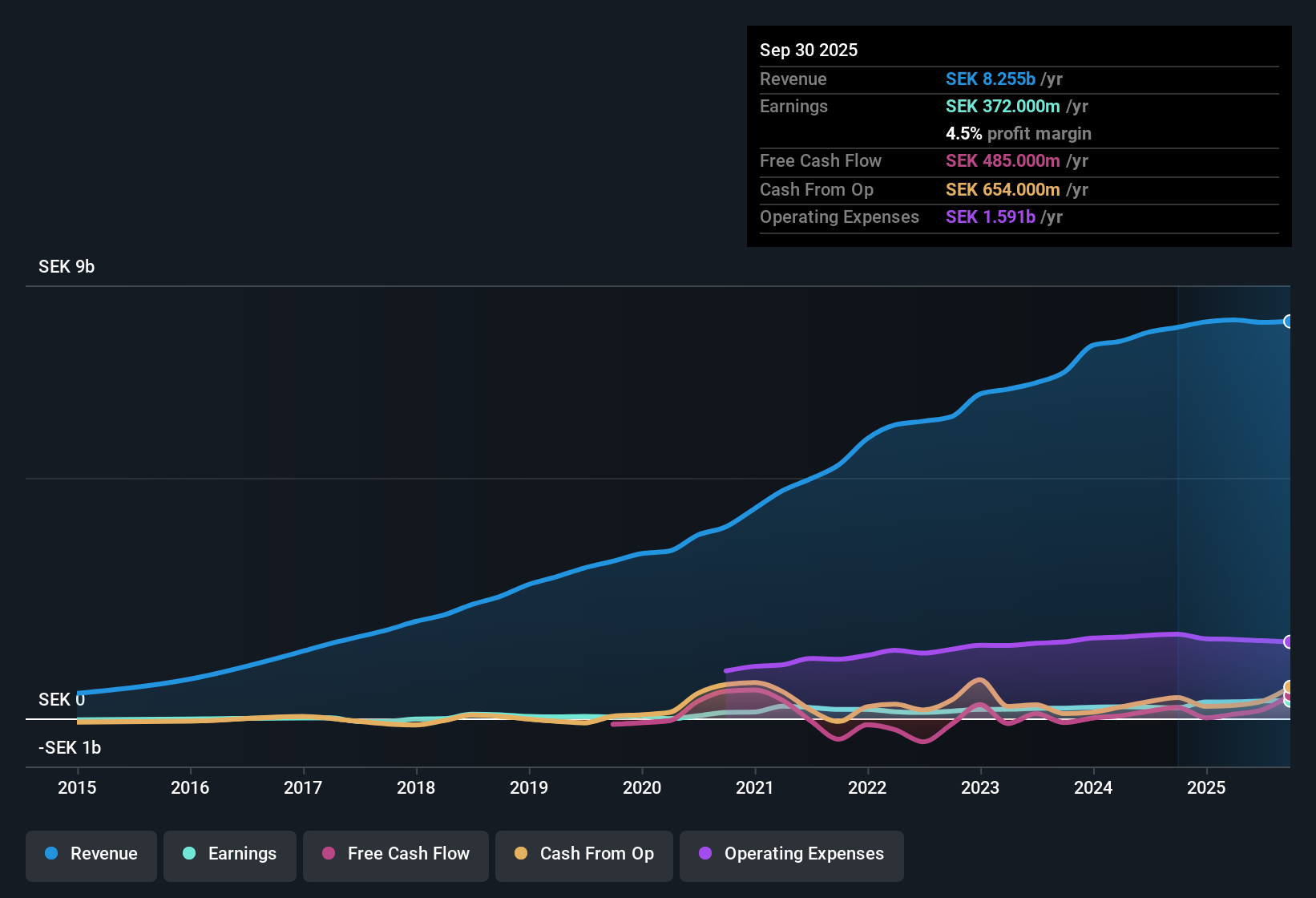

Boozt (OM:BOOZT) reported a net profit margin of 4.5%, up from 2.7% in the previous period, and delivered a strong 69.9% increase in earnings over the last year. Over the past five years, earnings have climbed at an average annual rate of 17.2%. Revenue is expected to grow at 5.1% per year, outpacing the projected 3.7% growth for the broader Swedish market. Favorable valuation metrics and profit growth are driving investor optimism in the current climate.

See our full analysis for Boozt.Next, we will see how these headline results compare with the widely followed narratives in the Boozt investor community, and which assumptions the numbers put to the test.

See what the community is saying about Boozt

Share Buybacks, Free Cash Flow, and Margin Expansion

- Boozt expects the number of shares outstanding to decline by 4.1% per year for the next three years, signaling active buybacks and improving free cash flow expectations as the company leverages recent automation and logistics upgrades to drive cost savings.

- Analysts' consensus view highlights two key tailwinds:

- Enhanced fulfillment automation and cost controls fueled a net profit margin of 4.5%, up from 2.7%. This has boosted cash flow and positioned Boozt to expand margins even in a normalizing retail climate.

- Recent restructuring and ongoing improvements to the proprietary logistics platform are expected to create meaningful operating leverage as consumer confidence recovers. Higher customer lifetime value is supported by diversification and exclusive brands.

- The consensus sees these structural gains driving both profitability and the ability to return capital to shareholders.

- Discover how Boozt’s operational overhaul and buybacks are shaping its future narrative. 📊 Read the full Boozt Consensus Narrative.

Discounted Inventory and Gross Margin Risks

- Boozt's ongoing reliance on discount-driven inventory clearance via Booztlet poses a threat to gross margins, as elevated discounting in this channel produces much slimmer margins than the main Boozt.com platform.

- Analysts' consensus view raises three key points:

- As Boozt grows Booztlet sales, higher overall volume may be offset by structurally lower profitability per item. This could undermine long-term earnings scalability unless improvements are made elsewhere.

- Core Boozt.com performance showed pressure, with flat customer growth despite new client onboarding. This amplifies the risk that boosting total sales could still erode margins if recovery in the premium segment stalls.

Valuation Gap to Peers Remains Wide

- Boozt trades at a price-to-earnings ratio of 16.9x, which is notably lower than the sector average of 33.9x and the global multiline retail industry average of 19.5x. This reflects a substantial valuation discount relative to peers.

- Analysts' consensus view points out:

- Despite positive margin expansion and a current share price of 101.10, Boozt remains below its DCF fair value of 204.83 and also under the top analyst target of 110.00. This suggests there could be meaningful upside if profit growth continues.

- This undervaluation is driving a constructive investor outlook, as comparative metrics and anticipated gains in market share and margins provide a cushion against competitive threats and cyclical demand shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Boozt on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about these figures from a new angle? Your perspective matters, and you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Boozt.

See What Else Is Out There

Boozt’s continued reliance on discount-driven sales and flat core customer growth highlight potential margin pressure and limits to long-term earnings scalability.

If you want stocks that pair reliable growth with less margin risk, check out stable growth stocks screener (2083 results) and discover companies consistently building value year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boozt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOOZT

Boozt

Sells fashion, apparel, shoes, accessories, kids, home, sports, and beauty products online.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives