- Sweden

- /

- Real Estate

- /

- OM:HUFV A

Here's Why We Think Hufvudstaden AB (publ)'s (STO:HUFV A) CEO Compensation Looks Fair for the time being

Despite positive share price growth of 11% for Hufvudstaden AB (publ) (STO:HUFV A) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 25 March 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

Check out our latest analysis for Hufvudstaden

Comparing Hufvudstaden AB (publ)'s CEO Compensation With the industry

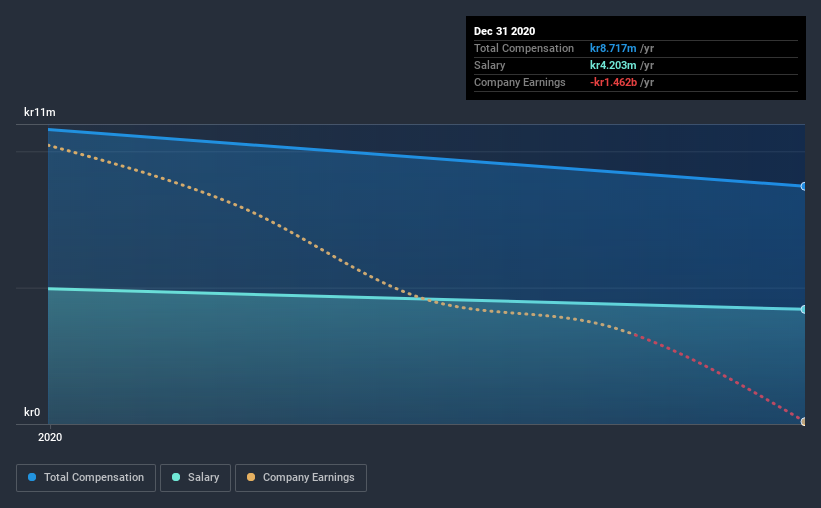

Our data indicates that Hufvudstaden AB (publ) has a market capitalization of kr24b, and total annual CEO compensation was reported as kr8.7m for the year to December 2020. We note that's a decrease of 19% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at kr4.2m.

On examining similar-sized companies in the industry with market capitalizations between kr17b and kr54b, we discovered that the median CEO total compensation of that group was kr8.4m. From this we gather that Ivo Stopner is paid around the median for CEOs in the industry. Moreover, Ivo Stopner also holds kr8.2m worth of Hufvudstaden stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | kr4.2m | kr5.0m | 48% |

| Other | kr4.5m | kr5.8m | 52% |

| Total Compensation | kr8.7m | kr11m | 100% |

On an industry level, around 65% of total compensation represents salary and 35% is other remuneration. Hufvudstaden pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Hufvudstaden AB (publ)'s Growth

Over the last three years, Hufvudstaden AB (publ) has shrunk its earnings per share by 51% per year. It saw its revenue drop 7.2% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Hufvudstaden AB (publ) Been A Good Investment?

Hufvudstaden AB (publ) has generated a total shareholder return of 11% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Hufvudstaden that investors should be aware of in a dynamic business environment.

Important note: Hufvudstaden is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Hufvudstaden, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hufvudstaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:HUFV A

Hufvudstaden

Engages in the ownership, development, and management of commercial properties in Stockholm and Gothenburg, Sweden.

Second-rate dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success