David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Acrinova AB (publ) (STO:ACRI A) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Acrinova

How Much Debt Does Acrinova Carry?

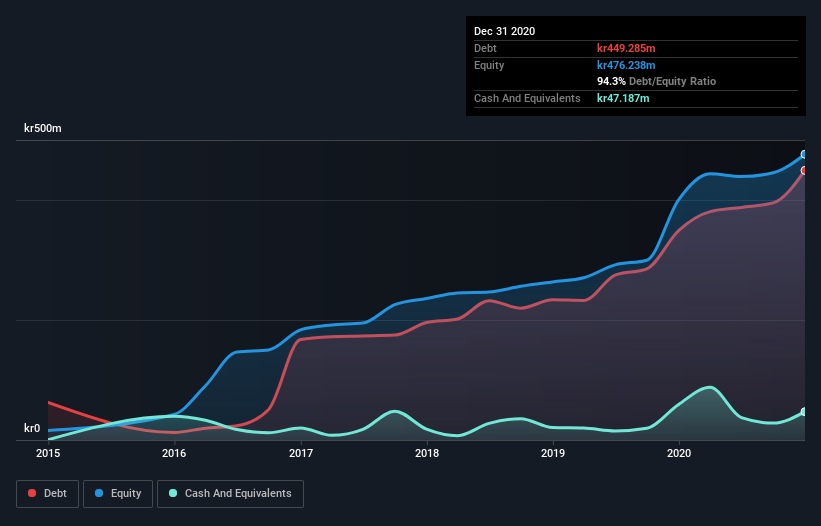

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Acrinova had kr448.4m of debt, an increase on kr349.1m, over one year. On the flip side, it has kr47.2m in cash leading to net debt of about kr401.2m.

How Healthy Is Acrinova's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Acrinova had liabilities of kr49.0m due within 12 months and liabilities of kr489.2m due beyond that. Offsetting these obligations, it had cash of kr47.2m as well as receivables valued at kr12.8m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr478.3m.

This deficit casts a shadow over the kr297.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Acrinova would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 10.3, it's fair to say Acrinova does have a significant amount of debt. However, its interest coverage of 3.5 is reasonably strong, which is a good sign. The good news is that Acrinova grew its EBIT a smooth 95% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Acrinova's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Acrinova produced sturdy free cash flow equating to 68% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

On the face of it, Acrinova's net debt to EBITDA left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Acrinova's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for Acrinova (of which 1 is potentially serious!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Acrinova, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ACRI A

Acrinova

A real estate company, owns, develops, and manages real estate properties in Sweden.

Medium-low risk with acceptable track record.

Market Insights

Community Narratives