- Sweden

- /

- Real Estate

- /

- OM:WALL B

Swedish Growth Companies With High Insider Ownership To Watch In July 2024

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Sweden's market remains a focal point for investors looking for growth opportunities. Amidst this backdrop, Swedish companies with high insider ownership may offer unique insights into corporate confidence and potential resilience.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| Sileon (OM:SILEON) | 14.1% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.7% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's dive into some prime choices out of from the screener.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a global hotel property company that owns, develops, and leases hotel properties, with a market capitalization of approximately SEK 35.67 billion.

Operations: The company generates revenue primarily through two segments: Own operation, which brought in SEK 3.24 billion, and Rental Agreement, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

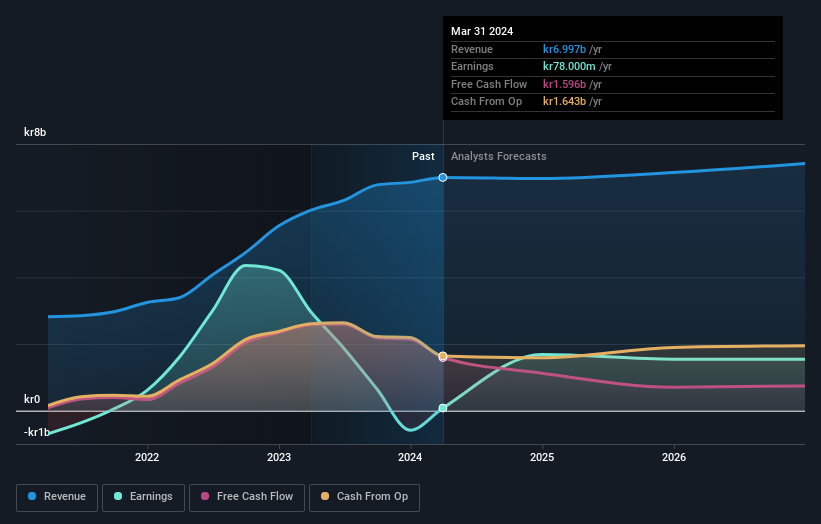

Pandox AB, a Swedish hotel operator, reported a significant turnaround in Q1 2024 with net income of SEK 447 million, reversing from a previous loss and showing robust earnings growth. Despite this, its revenue growth forecast at 2.2% annually is modest compared to the broader market. The company's dividend increase to SEK 4.00 per share suggests confidence but raises questions about sustainability given earnings coverage concerns. Insider transactions have been minimal, indicating stable ownership but limited fresh investment signals from insiders.

- Get an in-depth perspective on Pandox's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Pandox's current price could be inflated.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (ticker: OM:SAGA A) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market cap of approximately SEK 101.84 billion.

Operations: The company generates its revenue primarily through real estate rentals, totaling SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish property investment firm, has shown robust earnings growth, with a 53.3% increase over the past year and expectations of continued significant growth. However, its revenue growth projection of 9.3% annually lags behind more aggressive market benchmarks. Recent activities include issuing €500 million in green bonds to support sustainability initiatives under its Green Finance Framework. Despite these strengths, concerns about debt coverage by operating cash flow persist, suggesting potential financial stress points.

- Take a closer look at AB Sagax's potential here in our earnings growth report.

- The analysis detailed in our AB Sagax valuation report hints at an inflated share price compared to its estimated value.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a property company based in Sweden, with a market capitalization of approximately SEK 34.10 billion.

Operations: The company generates revenue primarily from its operations in Gothenburg and Stockholm, with contributions of SEK 1.89 billion and SEK 0.92 billion respectively.

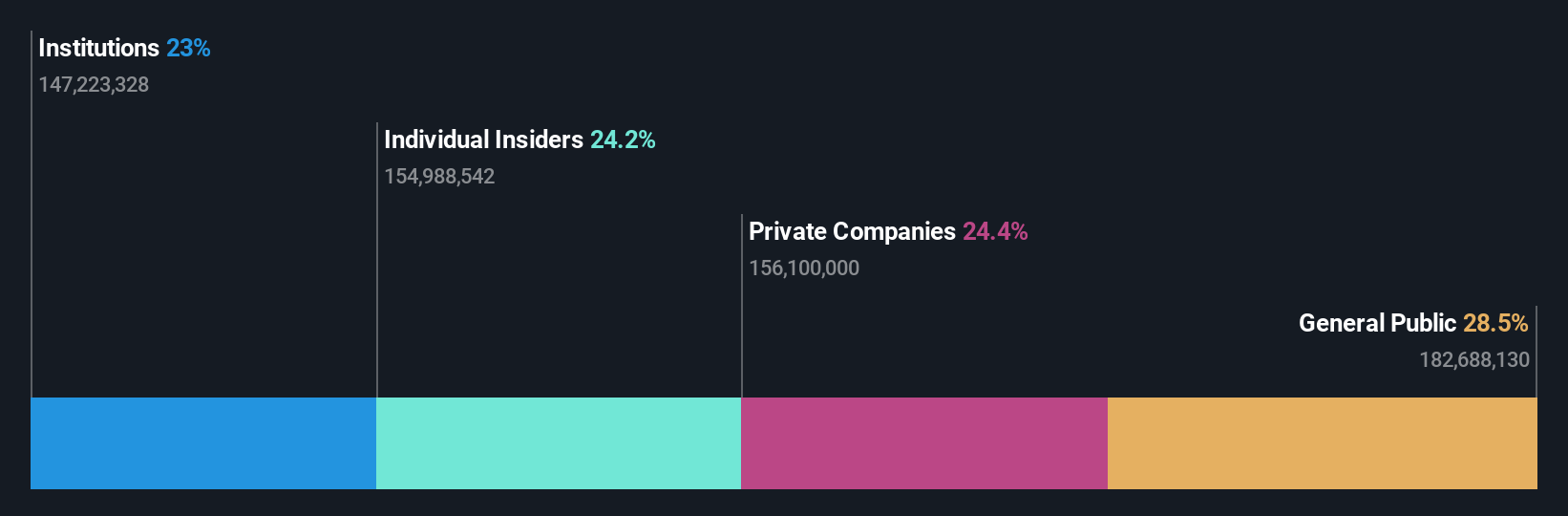

Insider Ownership: 35%

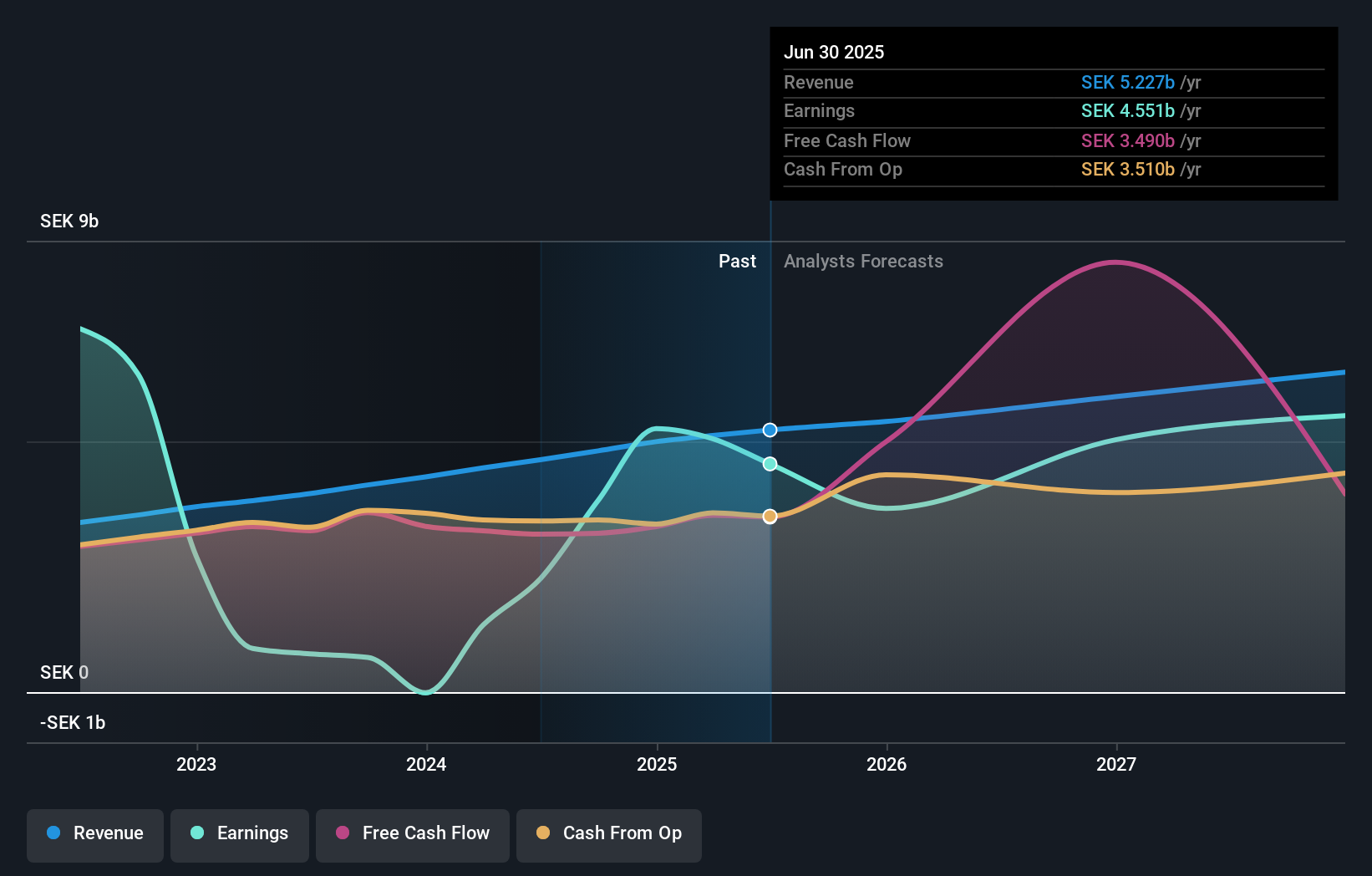

Wallenstam, a Swedish property developer, exhibits moderate growth with a forecasted annual revenue increase of 3%, slightly outpacing the broader Swedish market's 1.7%. Despite this, its projected return on equity is considered low at 4.5% in three years. Recent initiatives include the development of environmentally focused office spaces at Kaserntorget 6, enhancing its appeal to eco-conscious tenants. However, financial challenges are evident as interest payments are poorly covered by earnings. Additionally, insider transactions have not shown significant buying activity in recent months.

- Dive into the specifics of Wallenstam here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Wallenstam shares in the market.

Seize The Opportunity

- Explore the 86 names from our Fast Growing Swedish Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wallenstam might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WALL B

Reasonable growth potential very low.