Stock Analysis

Swedish Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As global markets navigate through fluctuating economic indicators and investor sentiments, Sweden's market remains a focal point for those interested in growth companies with high insider ownership. In July 2024, understanding the nuances of such stocks becomes particularly pertinent against the backdrop of broader market trends and monetary policy shifts. In this context, companies with substantial insider ownership may offer a layer of reassurance since insiders are likely to be deeply invested in the company's long-term success, aligning their interests closely with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Sileon (OM:SILEON) | 20.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

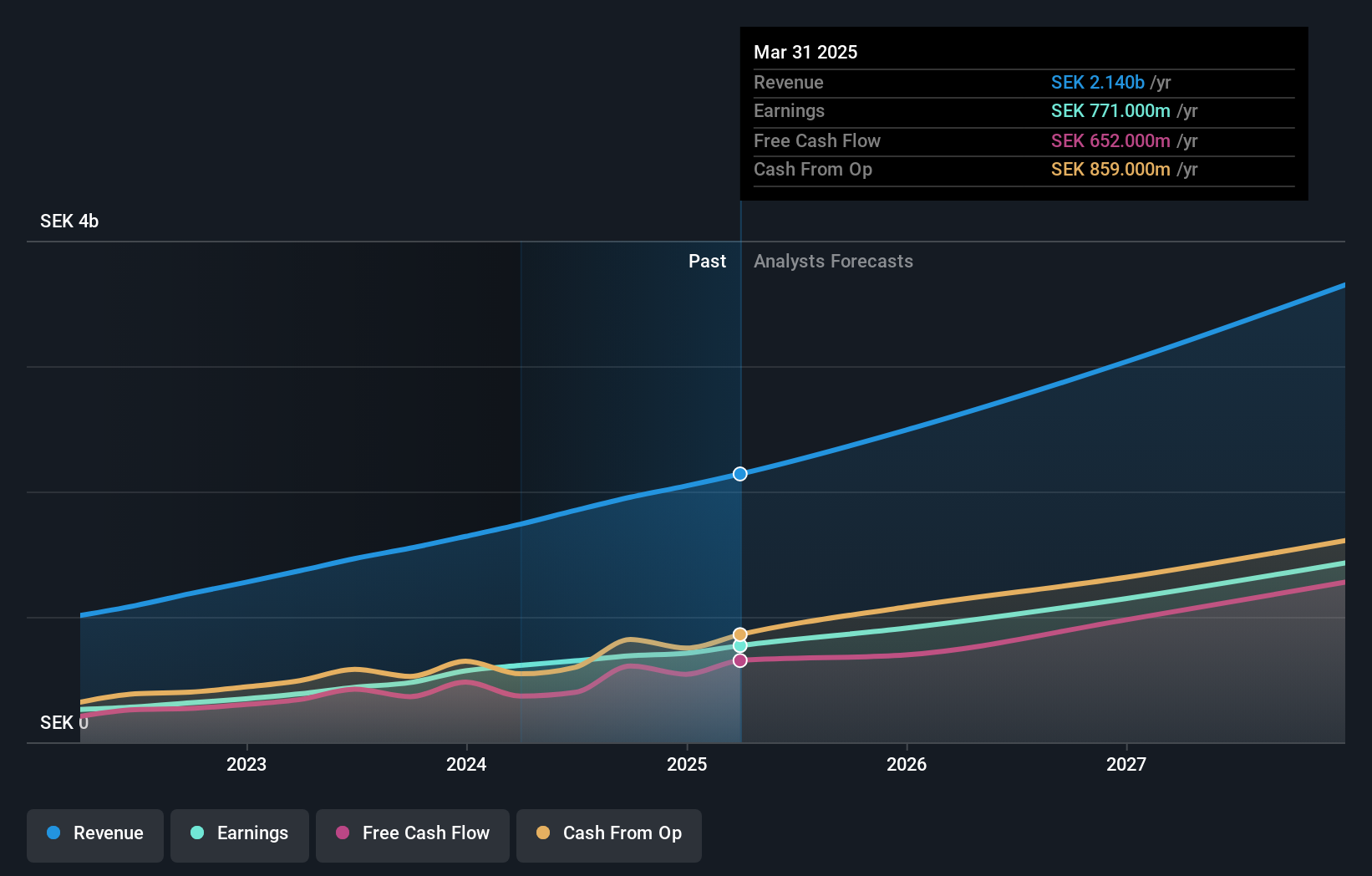

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB operates in providing financial and administrative software solutions to small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 40.87 billion.

Operations: The revenue for Fortnox AB is segmented into businesses generating SEK 0.38 billion, marketplaces at SEK 0.16 billion, core products contributing SEK 0.73 billion, accounting firms with SEF 0.35 billion, and financial services at SEK 0.25 billion.

Insider Ownership: 21%

Earnings Growth Forecast: 22.6% p.a.

Fortnox, a Swedish software company, has shown robust financial growth with earnings increasing by 48.1% over the past year and revenue rising to SEK 521 million in Q2 2024 from SEK 413 million in the same quarter last year. Its earnings are expected to grow at an annual rate of 22.6%, outpacing the broader Swedish market's forecast of 15.2%. Despite this performance, insider transactions have not been substantial recently, suggesting cautious optimism among those closest to the company.

- Take a closer look at Fortnox's potential here in our earnings growth report.

- Our valuation report unveils the possibility Fortnox's shares may be trading at a premium.

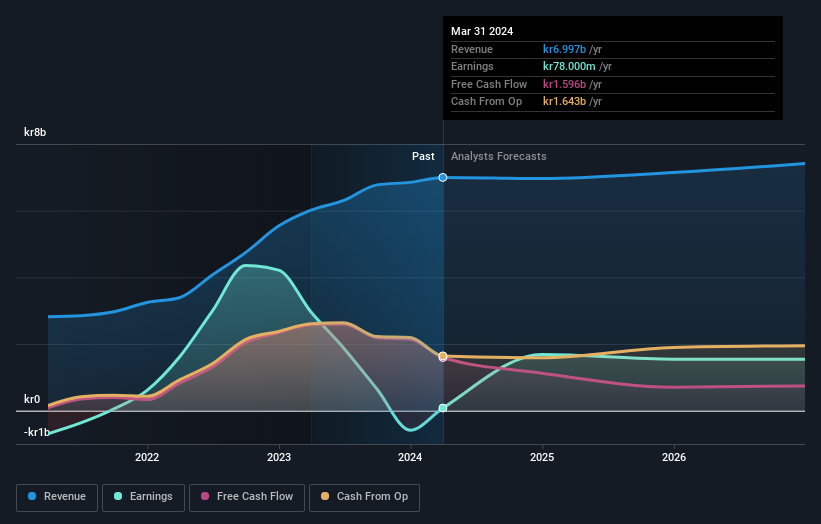

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB, a global hotel property company, focuses on owning, developing, and leasing hotel properties with a market capitalization of approximately SEK 37.87 billion.

Operations: The company generates revenue primarily through two segments: own operation (SEK 3.27 billion) and rental agreements (SEK 3.82 billion).

Insider Ownership: 12.3%

Earnings Growth Forecast: 27.7% p.a.

Pandox AB, a Swedish hotel operator, demonstrated strong financial results in 2024 with Q2 net income reaching SEK 704 million, a significant increase from SEK 287 million the previous year. Despite robust earnings growth projected at 27.7% annually—surpassing Sweden's market average—challenges persist. The company's return on equity is expected to remain low at 4.9%, and its dividend coverage is weak. Additionally, interest payments are poorly covered by earnings, indicating potential financial strain despite growth prospects.

- Click here to discover the nuances of Pandox with our detailed analytical future growth report.

- Our valuation report here indicates Pandox may be overvalued.

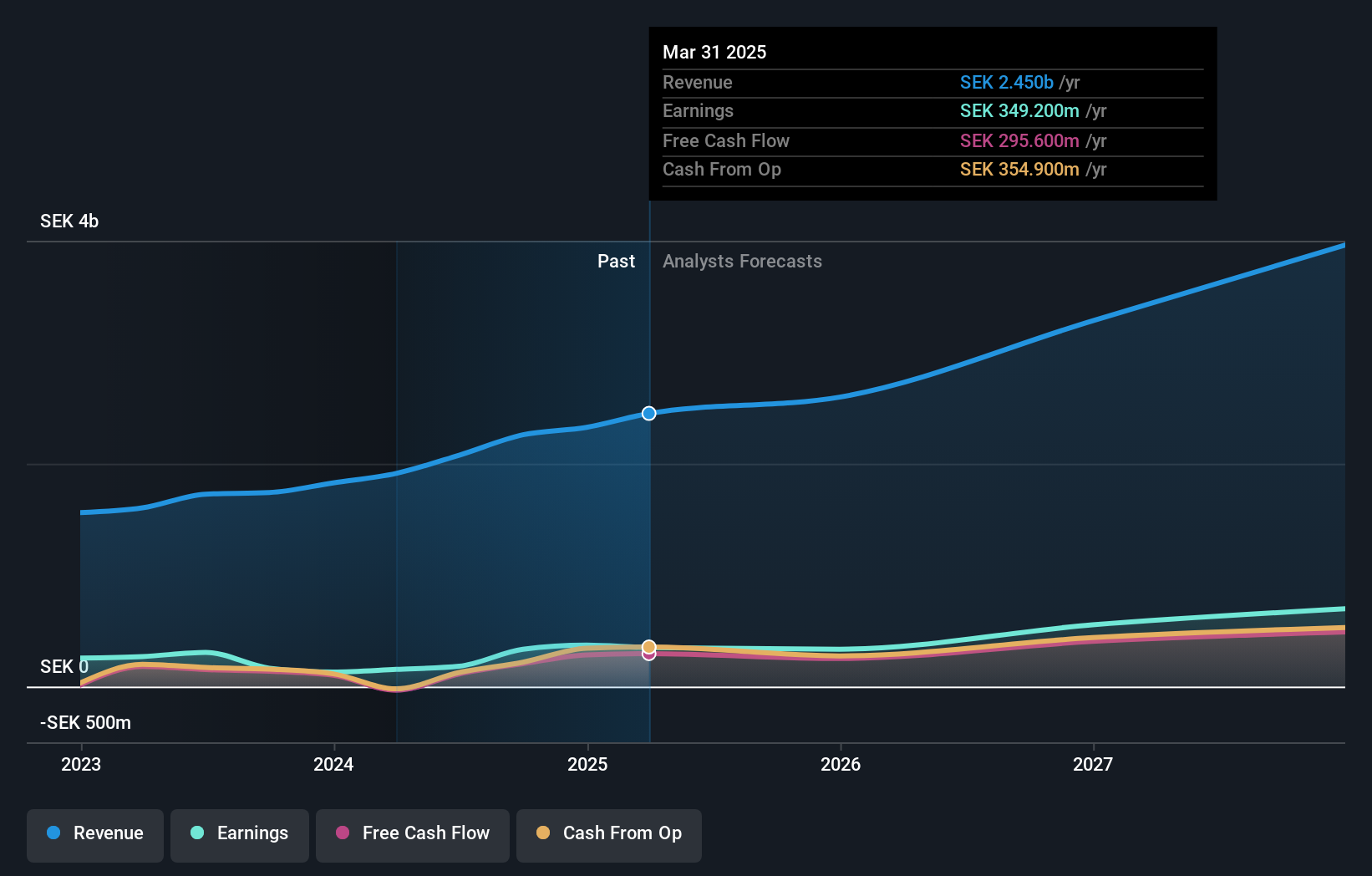

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 22.48 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Earnings Growth Forecast: 43.8% p.a.

Yubico, a key player in secure authentication technologies, has shown promising growth with substantial insider purchases over the past three months, indicating strong confidence from within. Despite less than three years of financial data and recent shareholder dilution, Yubico's earnings are expected to surge by 43.81% annually. Additionally, its latest product launch with Straxis enhances DOD web security, potentially boosting future revenue streams which are already projected to grow at 22.9% annually.

- Unlock comprehensive insights into our analysis of Yubico stock in this growth report.

- Our comprehensive valuation report raises the possibility that Yubico is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Reveal the 88 hidden gems among our Fast Growing Swedish Companies With High Insider Ownership screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Fortnox is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Outstanding track record with flawless balance sheet.