- Sweden

- /

- Medical Equipment

- /

- OM:SUS

Swedish Exchange Growth Companies With At Least 12% Insider Ownership

Reviewed by Simply Wall St

As global markets experience fluctuations, with some indices reaching new highs and others showing modest declines, investors are keenly observing trends and shifts. In this context, growth companies in Sweden with high insider ownership present a unique appeal, as such stakes can signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| BioArctic (OM:BIOA B) | 35.1% | 63% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| InCoax Networks (OM:INCOAX) | 18.9% | 104.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43% |

| SaveLend Group (OM:YIELD) | 24.8% | 106.8% |

Let's review some notable picks from our screened stocks.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB, a Swedish hotel property company, focuses on owning, operating, and leasing hotel properties with a market capitalization of approximately SEK 33.50 billion.

Operations: The company generates revenue primarily through two segments: own operation, which brought in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Pandox AB, a Swedish hotel operator, has shown robust earnings growth with forecasts indicating a 46.3% annual increase, outpacing the broader Swedish market significantly. Despite this positive outlook, challenges persist; the company’s profit margins have declined sharply from last year and its dividend coverage remains weak due to earnings not sufficiently covering interest payments. Recent financial reports highlight a strong rebound with substantial increases in sales and net income compared to previous losses, reflecting potential resilience and recovery in operations.

- Dive into the specifics of Pandox here with our thorough growth forecast report.

- Our valuation report here indicates Pandox may be undervalued.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RaySearch Laboratories AB, a medical technology company, develops software solutions for cancer care across various global regions and has a market capitalization of approximately SEK 5.01 billion.

Operations: The company generates its revenue by providing software solutions for cancer care across diverse global regions including the Americas, Europe, Africa, Asia-Pacific, and the Middle East.

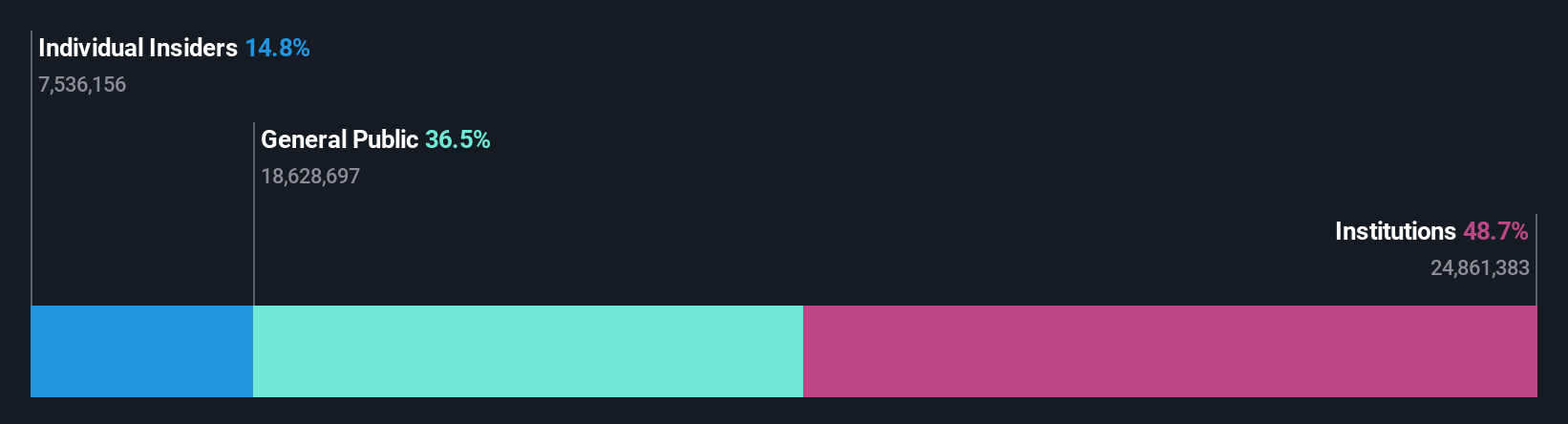

Insider Ownership: 24.1%

RaySearch Laboratories, a Swedish medical technology firm, has demonstrated significant insider ownership stability and growth potential. Recently, the company reported a strong earnings increase with net income more than doubling in the first quarter of 2024. This performance is coupled with strategic alliances, such as with C-RAD to enhance radiation therapy quality. However, its revenue growth forecast at 10.5% annually trails behind faster-growing peers but outpaces the broader Swedish market's 2.1% expected rate.

- Unlock comprehensive insights into our analysis of RaySearch Laboratories stock in this growth report.

- Upon reviewing our latest valuation report, RaySearch Laboratories' share price might be too optimistic.

Surgical Science Sweden (OM:SUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB operates globally, developing and marketing virtual reality simulators for evidence-based medical training, with a market capitalization of approximately SEK 7.36 billion.

Operations: The company generates its revenue from the development and sale of virtual reality simulators for medical training across Europe, North and South America, and Asia.

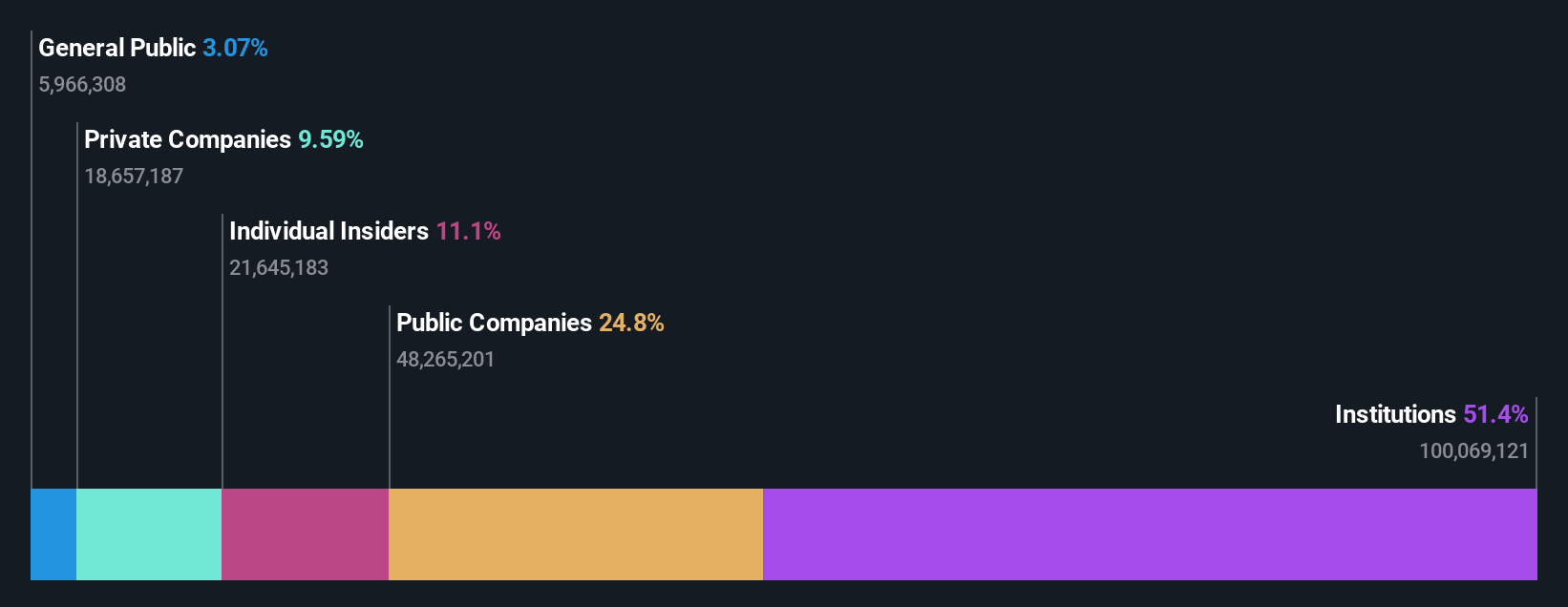

Insider Ownership: 26.6%

Surgical Science Sweden, a key player in medical simulation, is trading at 58.5% below its estimated fair value, suggesting potential undervaluation. The company's earnings are projected to grow by 26.67% annually, outpacing the Swedish market's forecast of 14.3%. Despite this growth, its expected Return on Equity of 6.3% is considered low. Recent leadership changes with CEO Gisli Hennermark planning to step down could signal a pivotal moment for strategic direction and investor relations.

- Get an in-depth perspective on Surgical Science Sweden's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Surgical Science Sweden implies its share price may be lower than expected.

Taking Advantage

- Discover the full array of 85 Fast Growing Swedish Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SUS

Surgical Science Sweden

Develops and markets virtual reality simulators for evidence-based medical training in Europe, North and South America, Asia, and internationally.

Flawless balance sheet with reasonable growth potential.