- Sweden

- /

- Real Estate

- /

- OM:KLARA B

Shareholders in KlaraBo Sverige (STO:KLARA B) have lost 31%, as stock drops 11% this past week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in KlaraBo Sverige AB (publ) (STO:KLARA B) have tasted that bitter downside in the last year, as the share price dropped 31%. That's well below the market decline of 0.9%. KlaraBo Sverige may have better days ahead, of course; we've only looked at a one year period. The last week also saw the share price slip down another 11%.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for KlaraBo Sverige

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

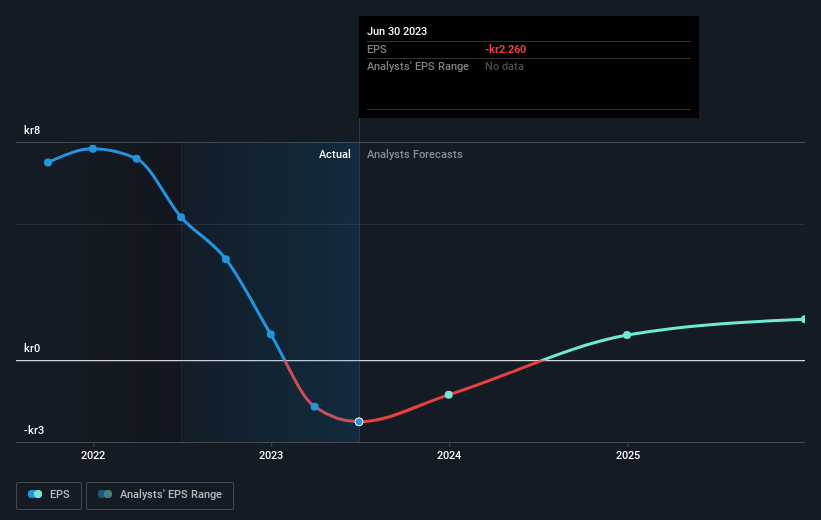

During the last year KlaraBo Sverige saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. We hope for shareholders' sake that the company becomes profitable again soon.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into KlaraBo Sverige's key metrics by checking this interactive graph of KlaraBo Sverige's earnings, revenue and cash flow.

A Different Perspective

We doubt KlaraBo Sverige shareholders are happy with the loss of 31% over twelve months. That falls short of the market, which lost 0.9%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 2.9% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for KlaraBo Sverige that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KlaraBo Sverige might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:KLARA B

KlaraBo Sverige

Engages in the acquisition, building, ownership, and management of residential properties in Sweden.

Reasonable growth potential and overvalued.