- Sweden

- /

- Real Estate

- /

- OM:HUFV A

How Hufvudstaden’s Return to Profitability Will Impact Hufvudstaden (OM:HUFV A) Investors

Reviewed by Sasha Jovanovic

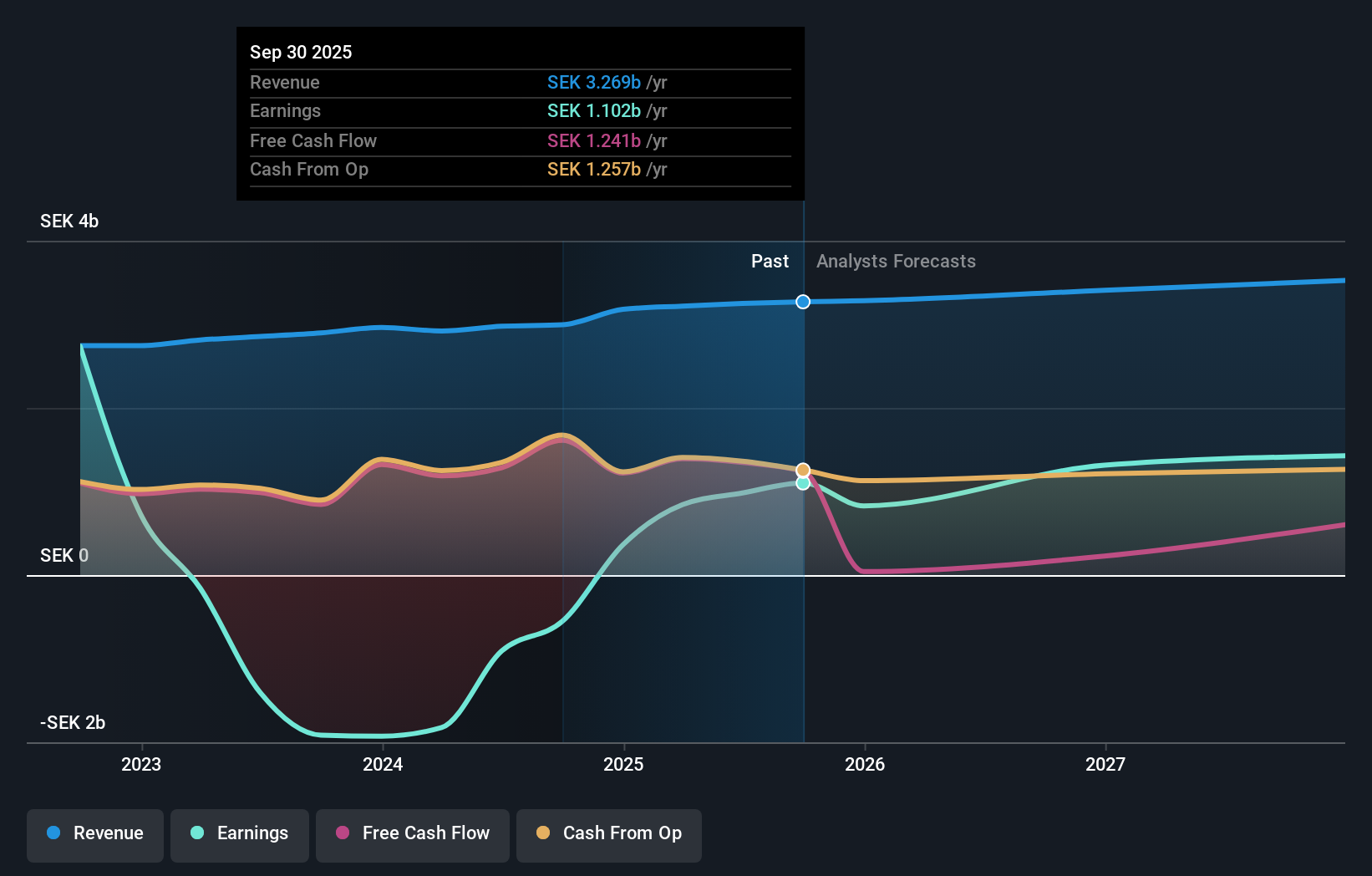

- Hufvudstaden AB (publ) has reported its third quarter and nine-month 2025 results, recording sales of SEK 801.6 million and SEK 2,425.3 million, with net income turning positive to SEK 262.6 million for the quarter and SEK 526.9 million for the nine-month period, compared to a net loss last year.

- This return to profitability, marked by a significant increase in basic earnings per share from continuing operations, breaks a trend of prior losses for the company.

- We'll explore how Hufvudstaden's reversal from a net loss to strong profitability shapes its ongoing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Hufvudstaden's Investment Narrative?

Believing in Hufvudstaden as a shareholder means having confidence in its ability to sustain stable property income, foster high-quality tenant relationships in prime Swedish locations, and manage through market shifts with a seasoned leadership team. The company's sharp return to profitability in the latest quarter, highlighted by significant year-on-year improvements in net income and earnings per share, may influence immediate investor sentiment and bring a renewed focus on revenue resilience and lease agreements with high-profile brands. Still, with much of the profit boost driven by large one-off items, it is important to note that the biggest near-term catalyst remains the sustained recovery of core real estate rents and occupancy rates, rather than exceptional gains. As a result, while the headline numbers look positive, the underlying risks tied to low return on equity, premium valuation multiples, and potential earnings volatility from non-recurring items are still relevant for any investment outlook. But it’s important not to overlook the potential for future earnings to be affected by these one-off gains.

Hufvudstaden's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Hufvudstaden - why the stock might be worth just SEK126.80!

Build Your Own Hufvudstaden Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hufvudstaden research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hufvudstaden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hufvudstaden's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hufvudstaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUFV A

Hufvudstaden

Engages in the ownership, development, and management of commercial properties in Stockholm and Gothenburg, Sweden.

Second-rate dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives