- Sweden

- /

- Real Estate

- /

- OM:FABG

How Fabege’s (OM:FABG) Appointment of Bent Oustad as CEO Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Fabege's board of directors has announced the appointment of Bent Oustad, currently CEO of Norwegian Property ASA and a Fabege board member since 2024, as the company's new President and CEO, effective December 1, 2025.

- This leadership change brings in an executive recognized for his leadership and entrepreneurial skills in complex urban development, which are central to Fabege's business model.

- We'll consider how Bent Oustad's appointment as CEO could influence Fabege's approach to urban development and long-term growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fabege Investment Narrative Recap

To be a Fabege shareholder, you need to believe in the long-term rebound of Stockholm’s office market, improvements in occupancy, and the company's ability to extract value from urban development despite recent headwinds. The appointment of Bent Oustad as CEO, set for December 2025, is unlikely to have a material impact on the short-term catalyst, which remains tied to letting activity and reversal of negative rental growth; however, it also does little to address the immediate risk of market rent pressure and ongoing valuation declines.

Among the company’s recent announcements, the sale of 7,800 sqm development rights in Paradiset 23 for SEK 200 million is particularly relevant. This transaction confirms management’s ongoing efforts to realize value from its development pipeline and maintain capital flexibility, which ties directly into the company’s ability to weather weak market demand and unlock future earnings as conditions improve.

But investors should also be aware that, unlike leadership changes, the persistent risk of negative like-for-like rental growth and continued asset value declines could...

Read the full narrative on Fabege (it's free!)

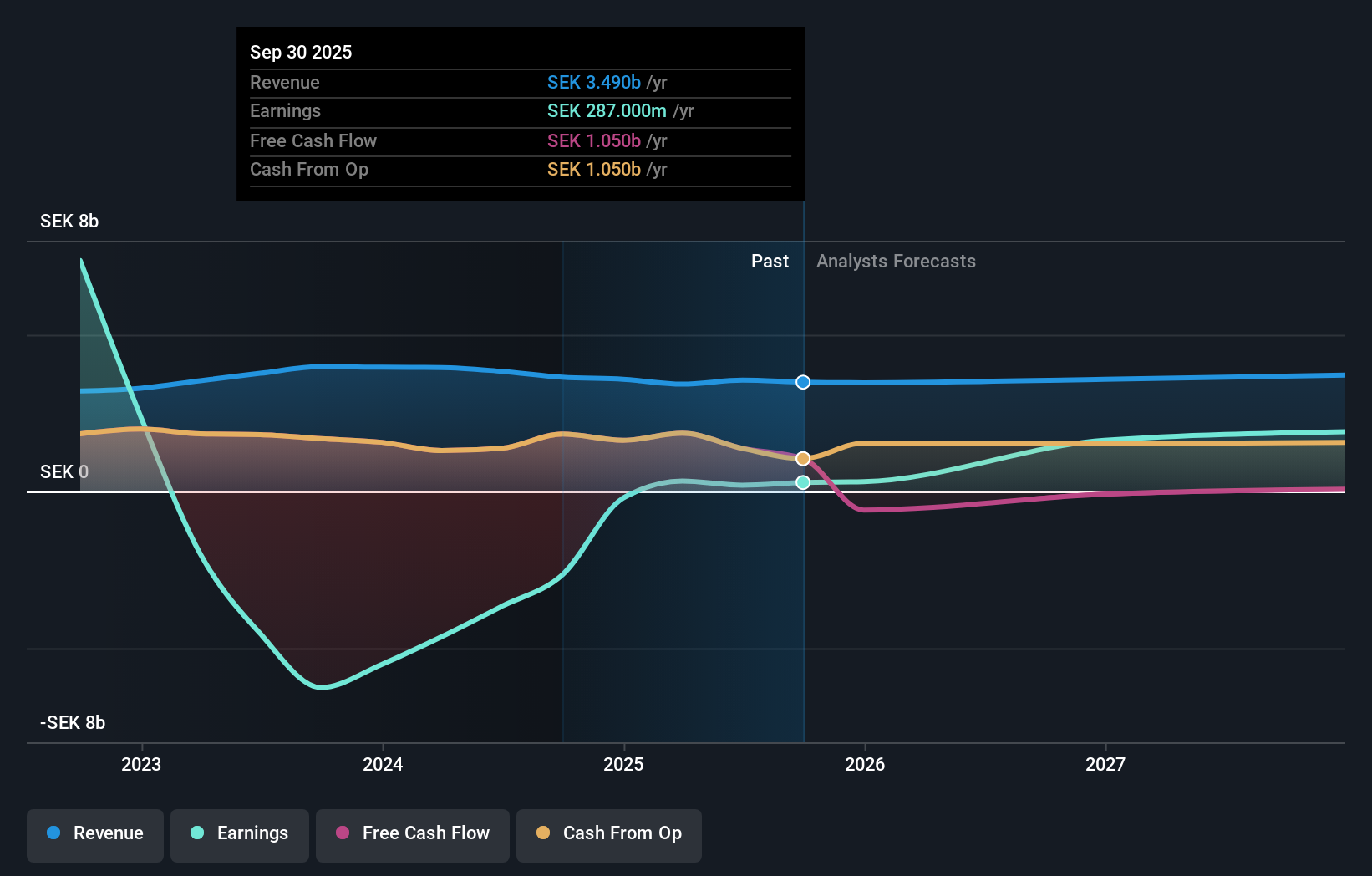

Fabege's outlook anticipates SEK3.7 billion in revenue and SEK3.0 billion in earnings by 2028. This is based on a 1.8% annual revenue growth and a SEK2.8 billion earnings increase from the current SEK202 million.

Uncover how Fabege's forecasts yield a SEK85.98 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members contributed 2 fair value estimates for Fabege, spanning from SEK 0.07 to SEK 85.98 per share. While opinions differ dramatically, weak rental growth and asset value pressures remain central to the future performance conversation.

Explore 2 other fair value estimates on Fabege - why the stock might be worth as much as SEK85.98!

Build Your Own Fabege Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fabege research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Fabege research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fabege's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FABG

Fabege

A property company, primarily engages in the development, investment, and management of commercial premises in Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives