3 Growth Companies With High Insider Ownership Growing Earnings Up To 96%

Reviewed by Simply Wall St

As global markets grapple with economic slowdown concerns and fluctuating investor sentiment, identifying resilient growth companies becomes increasingly vital. Amidst this backdrop, stocks with high insider ownership can offer a unique advantage, signaling confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Here we highlight a subset of our preferred stocks from the screener.

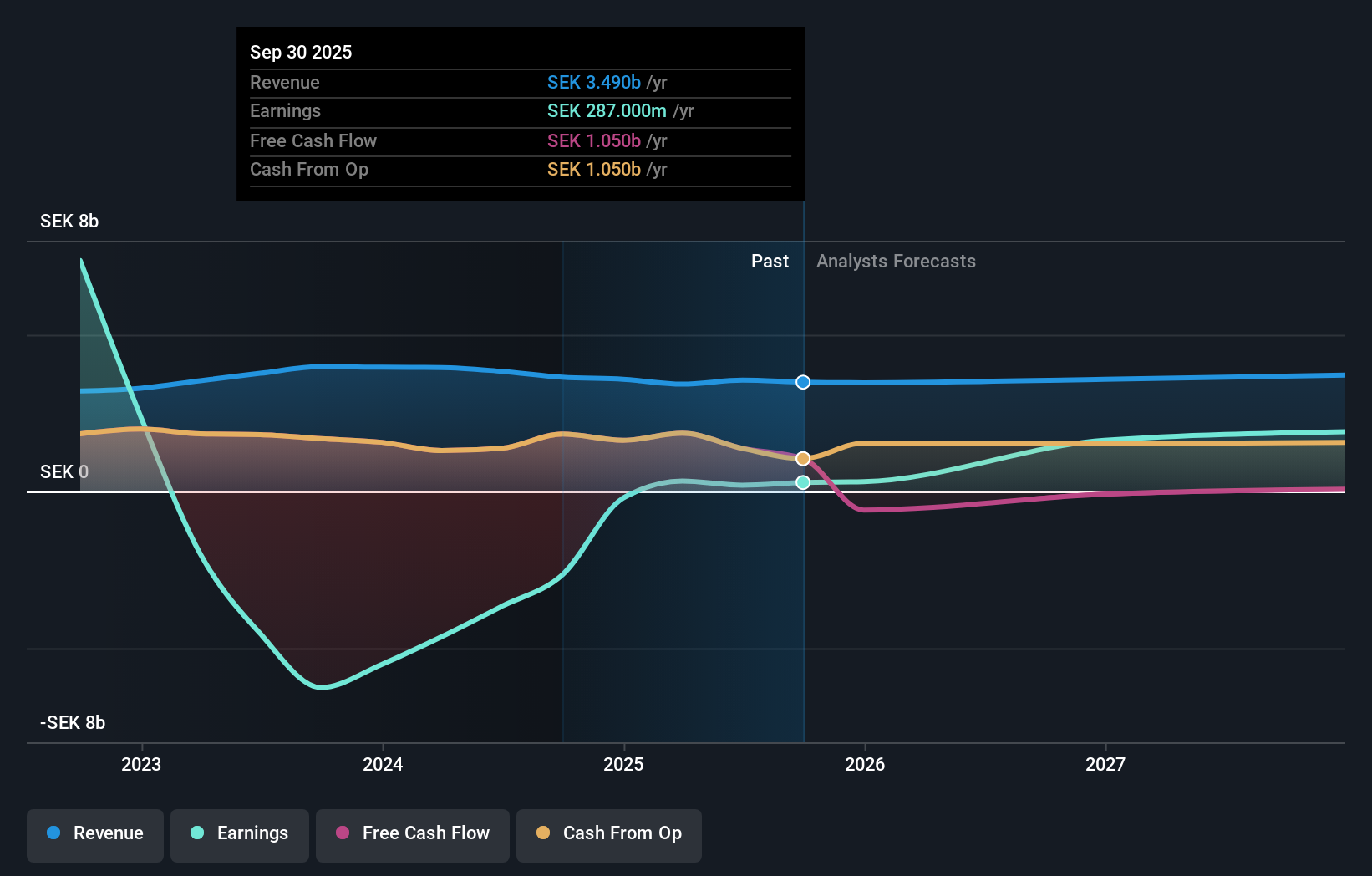

Fabege (OM:FABG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fabege AB (publ) is a Swedish property company specializing in the development, investment, and management of commercial premises, with a market cap of SEK29.52 billion.

Operations: The company's revenue segments are as follows: Project (SEK 36 million), Management (SEK 3.13 billion), Refinement (SEK 244 million), and Birgers Residence (SEK 420 million).

Insider Ownership: 13.8%

Earnings Growth Forecast: 96.4% p.a.

Fabege, a company with high insider ownership, is forecast to achieve significant earnings growth of 96.39% annually and become profitable within three years. Recent results show improved net income of SEK 17 million for Q2 2024 compared to a substantial loss last year. However, revenue growth remains modest at 1.5% per year, and interest payments are not well covered by earnings. Insider buying has been more frequent than selling in the past three months but not in substantial volumes.

- Get an in-depth perspective on Fabege's performance by reading our analyst estimates report here.

- Our valuation report here indicates Fabege may be overvalued.

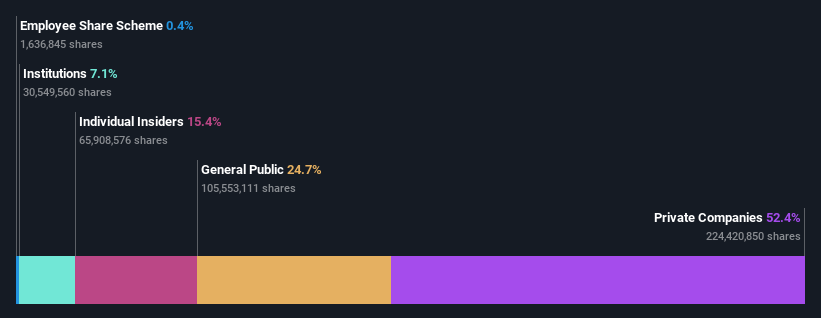

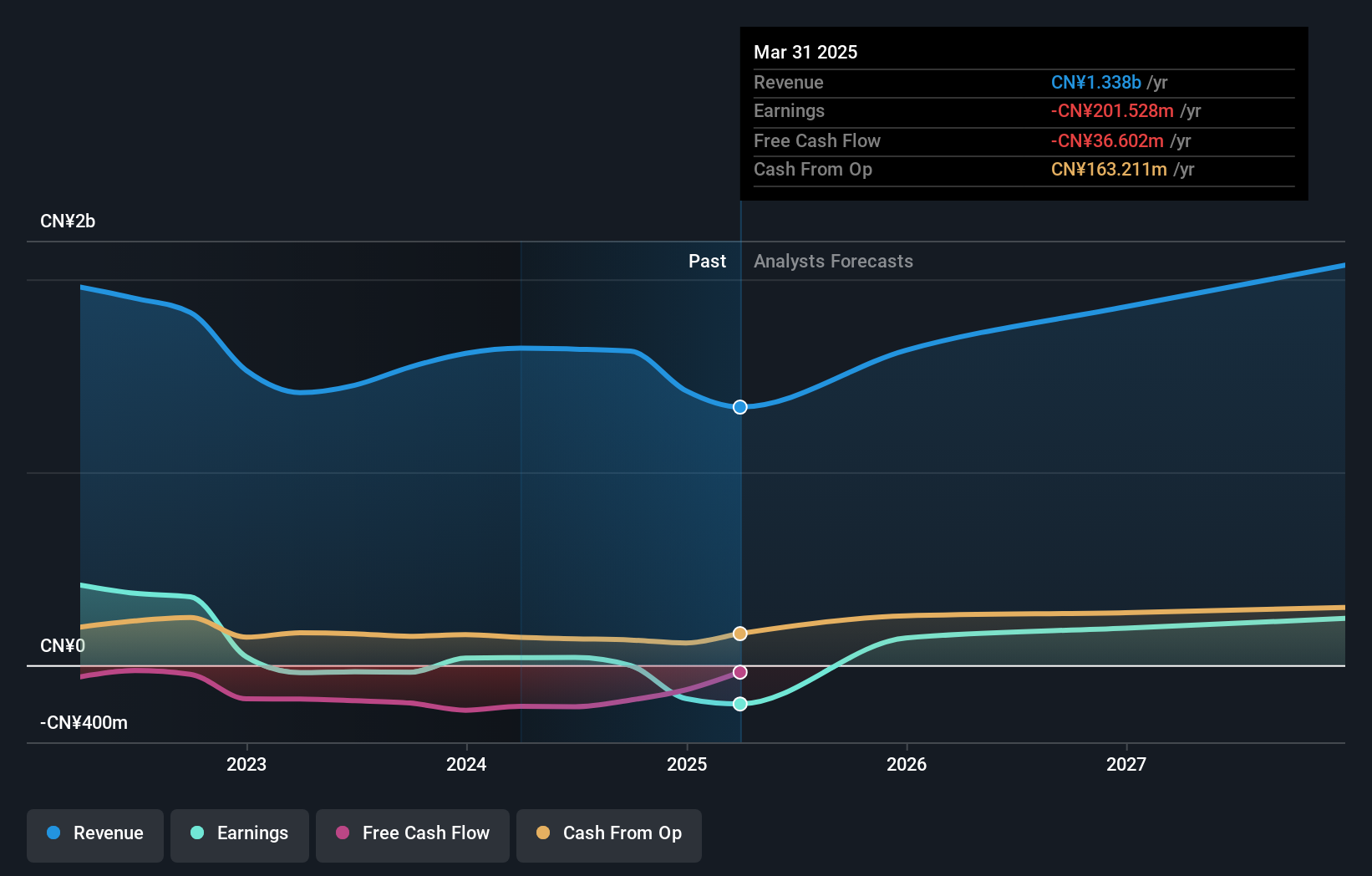

Asia Cuanon Technology (Shanghai)Ltd (SHSE:603378)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asia Cuanon Technology (Shanghai) Ltd (ticker: SHSE:603378) specializes in the production and sale of environmentally friendly building materials, with a market cap of CN¥2.98 billion.

Operations: Asia Cuanon Technology (Shanghai) Ltd generates its revenue primarily from the production and sale of environmentally friendly building materials.

Insider Ownership: 15.4%

Earnings Growth Forecast: 64.8% p.a.

Asia Cuanon Technology (Shanghai) Ltd. is forecast to achieve significant annual earnings growth of 64.82%, outpacing the Chinese market's average. Despite this, recent financial results for H1 2024 show a net loss of CNY 19.13 million compared to a net income of CNY 39.21 million last year, with sales dropping from CNY 1,486.55 million to CNY 1,042.67 million. The company's share price has been highly volatile recently and profit margins have declined over the past year.

- Unlock comprehensive insights into our analysis of Asia Cuanon Technology (Shanghai)Ltd stock in this growth report.

- Our valuation report unveils the possibility Asia Cuanon Technology (Shanghai)Ltd's shares may be trading at a discount.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China with a market cap of approximately CN¥5.22 billion.

Operations: B-SOFT Co., Ltd. generates revenue from various segments within the medical and health industry in China.

Insider Ownership: 16.4%

Earnings Growth Forecast: 54.7% p.a.

B-SOFT Ltd. is expected to see annual earnings growth of 54.69%, surpassing the Chinese market's average of 23.1%. The company recently reported H1 2024 revenue of CNY 726.74 million, up from CNY 704.39 million a year ago, and net income increased to CNY 27.38 million from CNY 24.01 million last year. Despite these positive financials, B-SOFT has been removed from key Shenzhen Stock Exchange indices as of June 2024, which may impact investor sentiment.

- Delve into the full analysis future growth report here for a deeper understanding of B-SOFTLtd.

- The analysis detailed in our B-SOFTLtd valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Discover the full array of 1515 Fast Growing Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603378

Asia Cuanon Technology (Shanghai)Ltd

Asia Cuanon Technology (Shanghai) Co.,Ltd.

Reasonable growth potential and fair value.