- China

- /

- Electronic Equipment and Components

- /

- SZSE:300502

3 High-Growth Insider Owned Stocks With Up To 44% Revenue Growth

Reviewed by Simply Wall St

Amid concerns over an economic slowdown and a significant drop in the S&P 500 Index, investors are increasingly cautious about their stock choices. In such uncertain times, companies with high insider ownership and robust revenue growth can offer a measure of confidence, as insiders' stakes often align their interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

Here's a peek at a few of the choices from the screener.

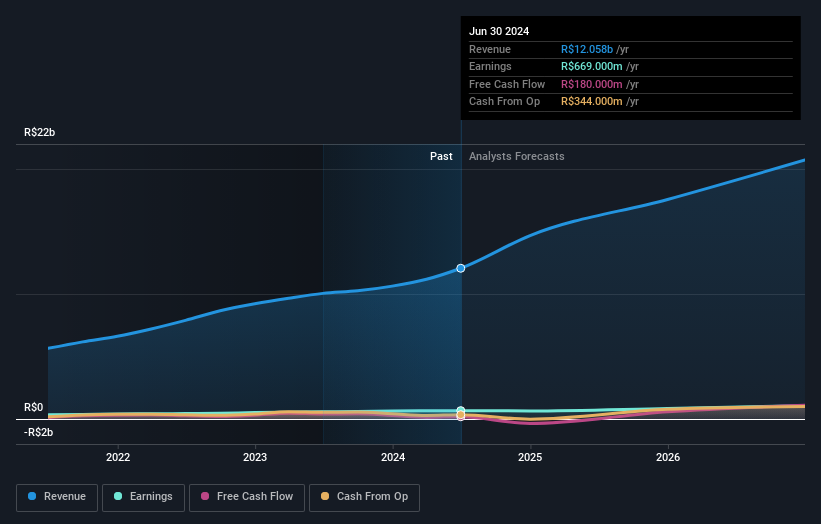

GPS Participações e Empreendimentos (BOVESPA:GGPS3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GPS Participações e Empreendimentos S.A. and its subsidiaries provide a range of services including facilities management, security, logistics, utility engineering, industrial services, catering, and infrastructure in Brazil with a market cap of R$12.22 billion.

Operations: The company's revenue segments include facilities management, security, logistics, utility engineering, industrial services, catering, and infrastructure services in Brazil.

Insider Ownership: 24%

Revenue Growth Forecast: 18.7% p.a.

GPS Participações e Empreendimentos demonstrates strong growth potential with earnings forecast to grow 19.7% annually, outpacing the Brazilian market's 14.3%. Its Price-To-Earnings ratio of 18.3x is attractive compared to the industry average of 30.4x, and analysts expect a stock price increase of 38.5%. Recent inclusion in the Brazil IBRX Index and consistent profit growth—net income rose to BRL 138 million in Q2—underscore its promising trajectory despite debt concerns.

- Click to explore a detailed breakdown of our findings in GPS Participações e Empreendimentos' earnings growth report.

- Our valuation report here indicates GPS Participações e Empreendimentos may be undervalued.

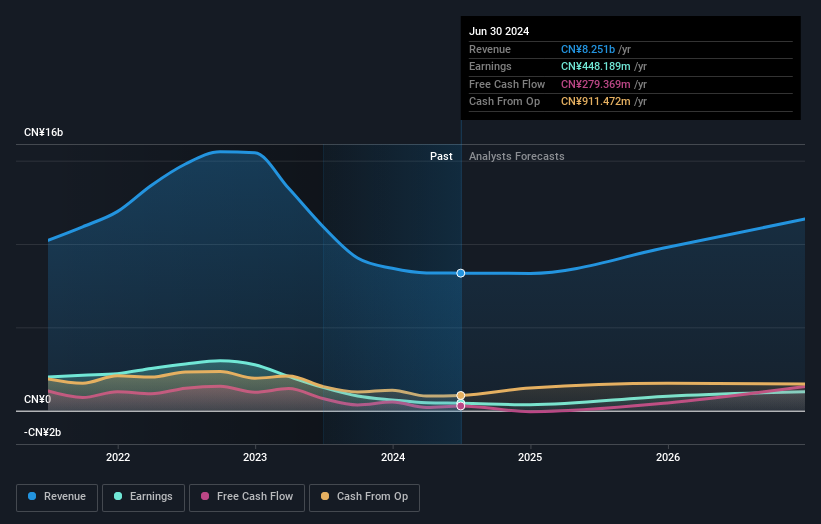

Guangzhou Kingmed Diagnostics Group (SHSE:603882)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Kingmed Diagnostics Group Co., Ltd. (ticker: SHSE:603882) operates in the medical diagnostics industry, providing clinical testing and laboratory services, with a market cap of CN¥12.89 billion.

Operations: Guangzhou Kingmed Diagnostics Group generates revenue primarily from third-party medical diagnostic services, amounting to CN¥8.25 billion.

Insider Ownership: 17.6%

Revenue Growth Forecast: 14.1% p.a.

Guangzhou Kingmed Diagnostics Group's earnings are expected to grow significantly at 43.33% annually over the next three years, surpassing the CN market's 23.1%. Despite this, recent earnings reports show a decline in revenue and net income compared to last year, with sales at ¥3.60 billion and net income dropping to ¥89.65 million. The company also faces challenges with low profit margins and a volatile share price, although it benefits from high insider ownership supporting its growth potential.

- Get an in-depth perspective on Guangzhou Kingmed Diagnostics Group's performance by reading our analyst estimates report here.

- The analysis detailed in our Guangzhou Kingmed Diagnostics Group valuation report hints at an inflated share price compared to its estimated value.

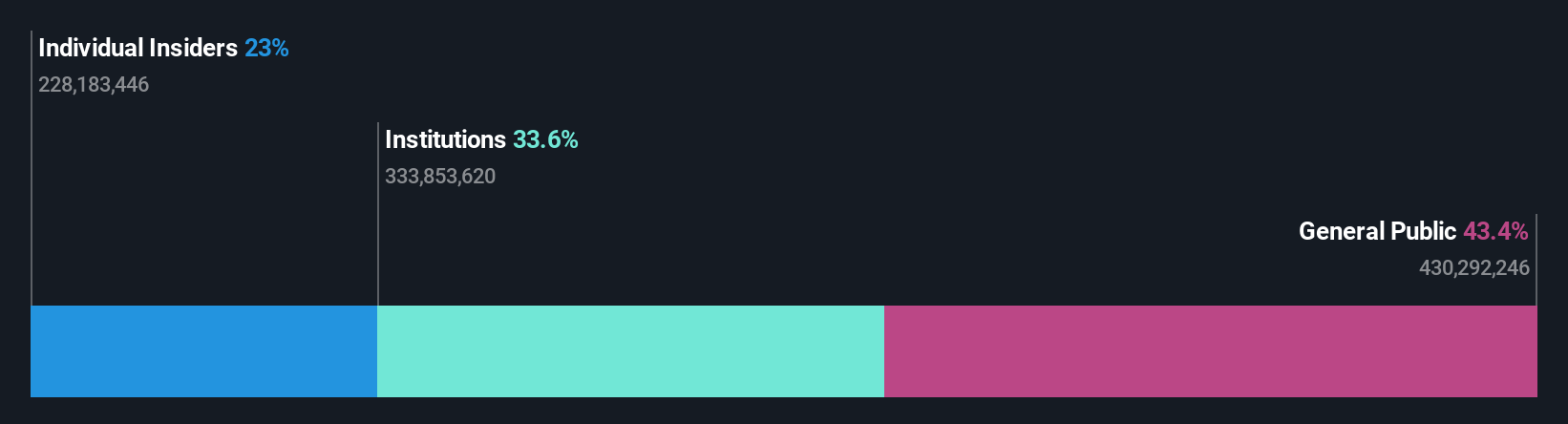

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market cap of CN¥62.81 billion.

Operations: The company's revenue primarily comes from its Optical Communication Equipment segment, which generated CN¥4.52 billion.

Insider Ownership: 26.7%

Revenue Growth Forecast: 44.1% p.a.

Eoptolink Technology's earnings are forecast to grow significantly at 41.49% annually, outpacing the CN market's 23.1%. Recent half-year results show revenue nearly doubling to ¥2.73 billion and net income tripling to ¥865.14 million, reflecting robust performance. Despite high volatility in its share price, the company benefits from substantial insider ownership and a strong growth trajectory in both revenue (44.1% per year) and earnings, positioning it well among growth companies with high insider stakes.

- Take a closer look at Eoptolink Technology's potential here in our earnings growth report.

- Our valuation report here indicates Eoptolink Technology may be overvalued.

Turning Ideas Into Actions

- Delve into our full catalog of 1514 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eoptolink Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300502

Eoptolink Technology

Engages in the research and development, manufacture, and sale of optical transceivers in China and internationally.

Exceptional growth potential with flawless balance sheet.