- Canada

- /

- Industrial REITs

- /

- TSX:PRV.UN

Exploring 3 Undervalued Small Caps With Insider Activity In Global Markets

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable shift in sentiment, with U.S. stocks snapping a three-week winning streak amid concerns over elevated valuations and the impact of a prolonged government shutdown on economic growth. As broader market volatility continues to weigh on investor confidence, small-cap stocks present an intriguing opportunity for investors seeking value, particularly those with insider activity that may indicate potential resilience or growth prospects amidst these challenging conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 15.8x | 3.8x | 26.04% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.57% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.0x | 1.7x | 27.35% | ★★★★★☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.18% | ★★★★☆☆ |

| Coveo Solutions | NA | 3.0x | 5.75% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.46% | ★★★★☆☆ |

| Bumitama Agri | 11.8x | 1.7x | 44.04% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.7x | 0.4x | -437.84% | ★★★☆☆☆ |

| Chinasoft International | 24.2x | 0.7x | -1326.83% | ★★★☆☆☆ |

| GDI Integrated Facility Services | 16.2x | 0.3x | -13.56% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focusing on property management and development in several regional cities, with a market capitalization of approximately SEK 6.95 billion.

Operations: Diös Fastigheter's revenue is primarily generated from various regions, with significant contributions from Luleå and Dalarna. The company has seen fluctuations in its net income margin, which reached a high of 1.24% in early 2022 before experiencing negative margins in subsequent periods. Gross profit margin has shown an upward trend, reaching 0.69% by the end of September 2024. Operating expenses have remained relatively stable over time, while non-operating expenses have significantly impacted net income results.

PE: 11.3x

Diös Fastigheter, a company with insider confidence shown by Ragnhild Backman's purchase of 15,000 shares valued at approximately SEK 987,450 in September 2025, has seen recent financial improvements. For Q3 2025, sales climbed to SEK 666 million from SEK 622 million the previous year, and net income reached SEK 303 million compared to a loss previously. The firm’s strategic green lease agreements with companies like Clear Street and AcadeMedia highlight its commitment to sustainable growth despite reliance on higher-risk external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Diös Fastigheter.

Assess Diös Fastigheter's past performance with our detailed historical performance reports.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ever Sunshine Services Group is a company that primarily provides property management services, with a market capitalization of CN¥16.35 billion.

Operations: The company generates revenue primarily from property management services, with a recent figure of CN¥6.93 billion. Over the years, its cost of goods sold (COGS) has increased, impacting the gross profit margin which recently stood at 18.43%. Operating expenses include significant general and administrative costs, contributing to a net income margin that was most recently 6.16%.

PE: 6.7x

Ever Sunshine Services Group, known for its property management services, is drawing attention as a potentially undervalued investment. Recent insider confidence was demonstrated when Zhubo Lin purchased 300,000 shares valued at approximately HK$543,000 in September 2025. Despite a dip in net income to CNY 213.78 million for the first half of 2025 from CNY 265.05 million last year, sales increased slightly to CNY 3.46 billion. The company has not repurchased any shares recently and announced special dividends of HK$0.0271 per share for June-end results alongside ordinary interim dividends of HK$0.0678 per share, reflecting ongoing shareholder returns amidst strategic shifts and leadership changes within the boardroom aimed at strengthening management capabilities and future growth prospects.

- Unlock comprehensive insights into our analysis of Ever Sunshine Services Group stock in this valuation report.

Learn about Ever Sunshine Services Group's historical performance.

Pro Real Estate Investment Trust (TSX:PRV.UN)

Simply Wall St Value Rating: ★★★☆☆☆

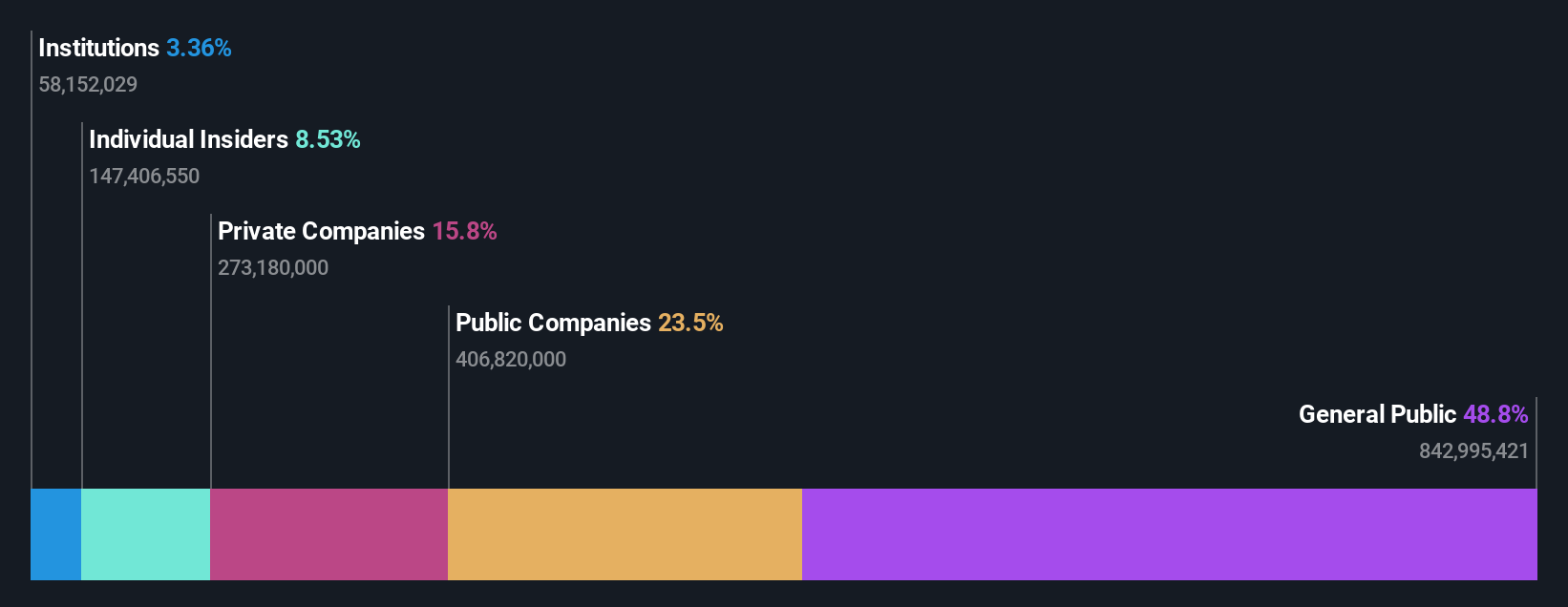

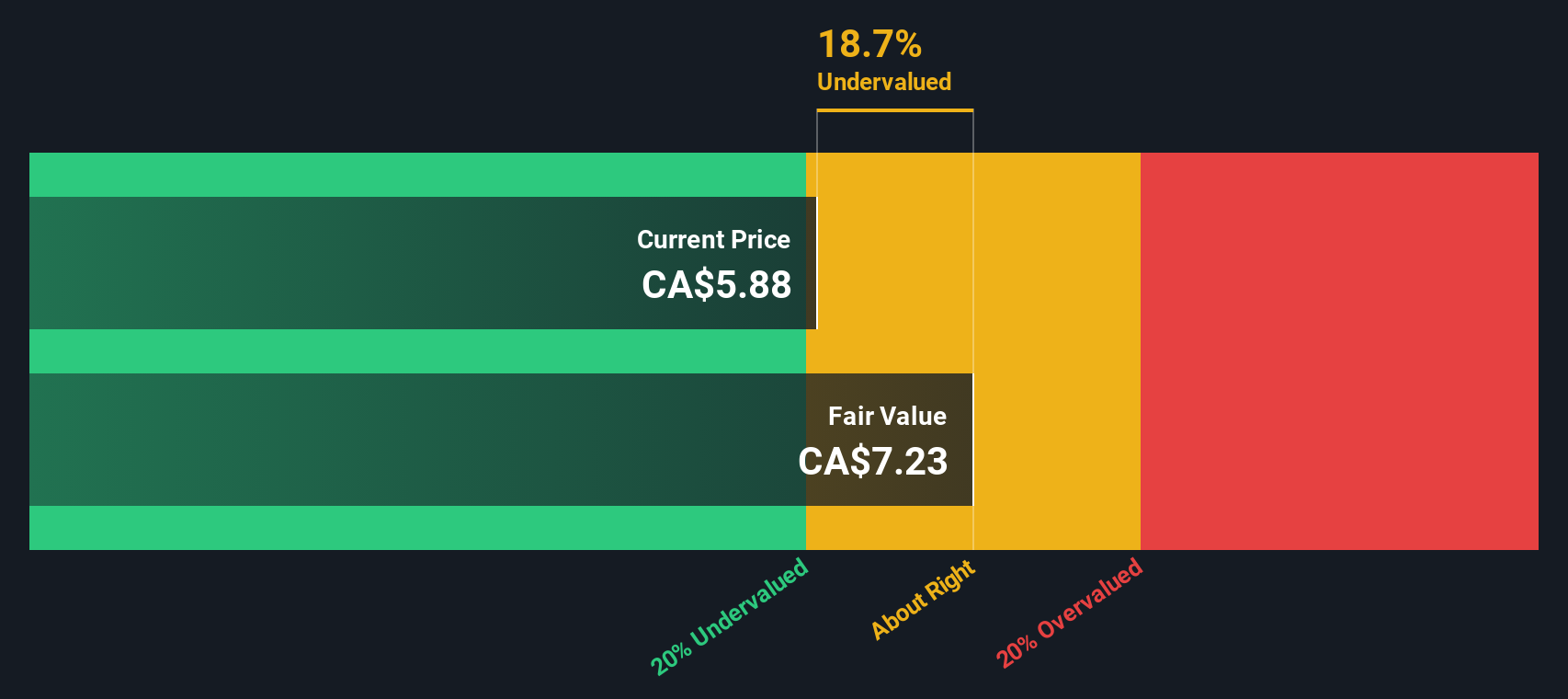

Overview: Pro Real Estate Investment Trust operates in the real estate sector with a focus on office and retail properties, and it has a market capitalization of CA$80.38 million.

Operations: The primary revenue streams are derived from the office and retail segments, with a significant segment adjustment contributing to the overall revenue. The cost of goods sold (COGS) consistently impacts gross profit, which has shown a gross profit margin ranging from 58.00% to 63.75% over various periods. Operating expenses include general and administrative costs, which have fluctuated but generally remain a notable portion of total expenses. Non-operating expenses have varied significantly over time, affecting net income margins accordingly.

PE: 15.1x

Pro Real Estate Investment Trust, a smaller player in the market, has seen insider confidence with recent share purchases. Despite a 12.2% annual earnings decline over the past five years, its revenue is forecasted to grow by 6.64% annually. Recent announcements include consistent monthly cash distributions of C$0.0375 per unit and an upcoming Q3 earnings release on November 11, 2025. However, reliance on external borrowing poses financial risks as interest payments aren't fully covered by earnings yet offer potential for future growth amidst these challenges.

Taking Advantage

- Explore the 119 names from our Undervalued Global Small Caps With Insider Buying screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRV.UN

Pro Real Estate Investment Trust

PROREIT (TSX:PRV.UN) is an unincorporated open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario.

Proven track record average dividend payer.

Market Insights

Community Narratives