- Sweden

- /

- Real Estate

- /

- OM:BALD B

Investing in Fastighets AB Balder (STO:BALD B) a year ago would have delivered you a 58% gain

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Fastighets AB Balder (publ) (STO:BALD B) share price is up 58% in the last 1 year, clearly besting the market return of around 15% (not including dividends). That's a solid performance by our standards! In contrast, the longer term returns are negative, since the share price is 25% lower than it was three years ago.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for Fastighets AB Balder

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months Fastighets AB Balder went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

We think that the revenue growth of 10% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

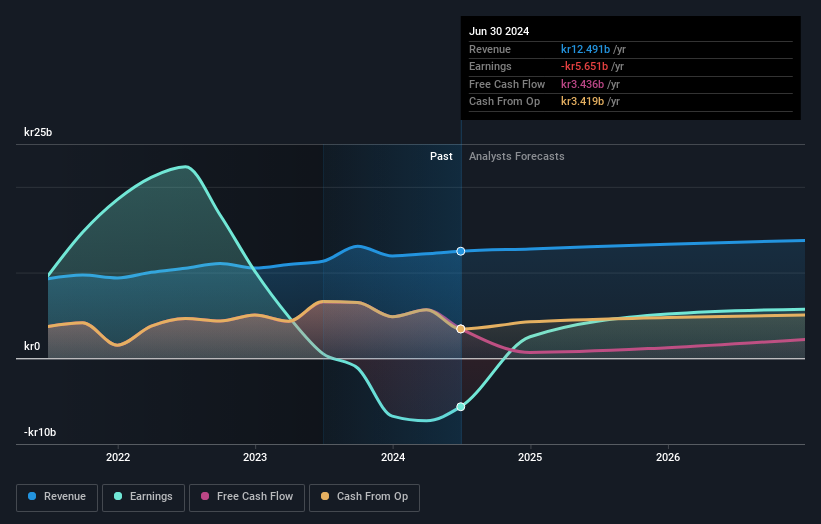

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Fastighets AB Balder stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Fastighets AB Balder shareholders have received a total shareholder return of 58% over the last year. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Fastighets AB Balder is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

But note: Fastighets AB Balder may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BALD B

Fastighets AB Balder

Develops, owns, and manages residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany, and the United Kingdom.

Reasonable growth potential and slightly overvalued.