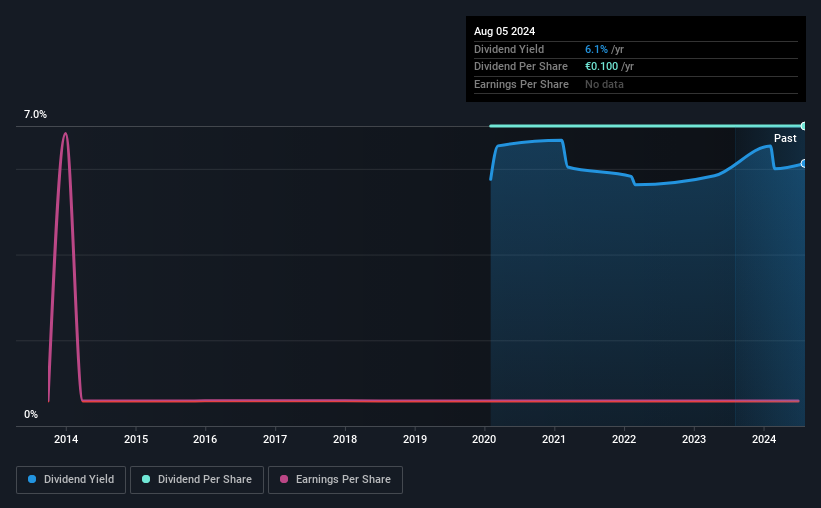

Akelius Residential Property AB (publ) (STO:AKEL D) will pay a dividend of €0.025 on the 12th of November. This means the annual payment is 6.1% of the current stock price, which is above the average for the industry.

See our latest analysis for Akelius Residential Property

Akelius Residential Property Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The company is paying out a large amount of its cash flows, even though it isn't generating any profit. This makes us feel that the dividend will be hard to maintain.

Recent, EPS has fallen by 58.4%, so this could continue over the next year. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Akelius Residential Property Is Still Building Its Track Record

It is great to see that Akelius Residential Property has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. There hasn't been much of a change in the dividend over the last 5 years. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Earnings per share has been sinking by 58% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Akelius Residential Property's Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 3 warning signs for Akelius Residential Property that investors should take into consideration. Is Akelius Residential Property not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AKEL D

Akelius Residential Property

Through its subsidiaries, owns, manages, rents, restores, and upgrades residential properties in the United States, Canada, and Europe.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives