As global markets celebrate the prospect of upcoming interest rate cuts, small-cap stocks have been outperforming their larger counterparts, signaling a renewed investor confidence. In Sweden, this optimism is mirrored by the Riksbank's recent decision to reduce borrowing costs, creating a favorable environment for high-growth tech companies. When evaluating potential investments in this sector, it's essential to consider factors such as innovation potential and market adaptability—qualities that can thrive under current economic conditions.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.18% | 22.60% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Xbrane Biopharma | 58.82% | 99.79% | ★★★★★★ |

| BioArctic | 39.57% | 102.80% | ★★★★★★ |

| Yubico | 22.52% | 43.69% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| Sileon | 40.13% | 109.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

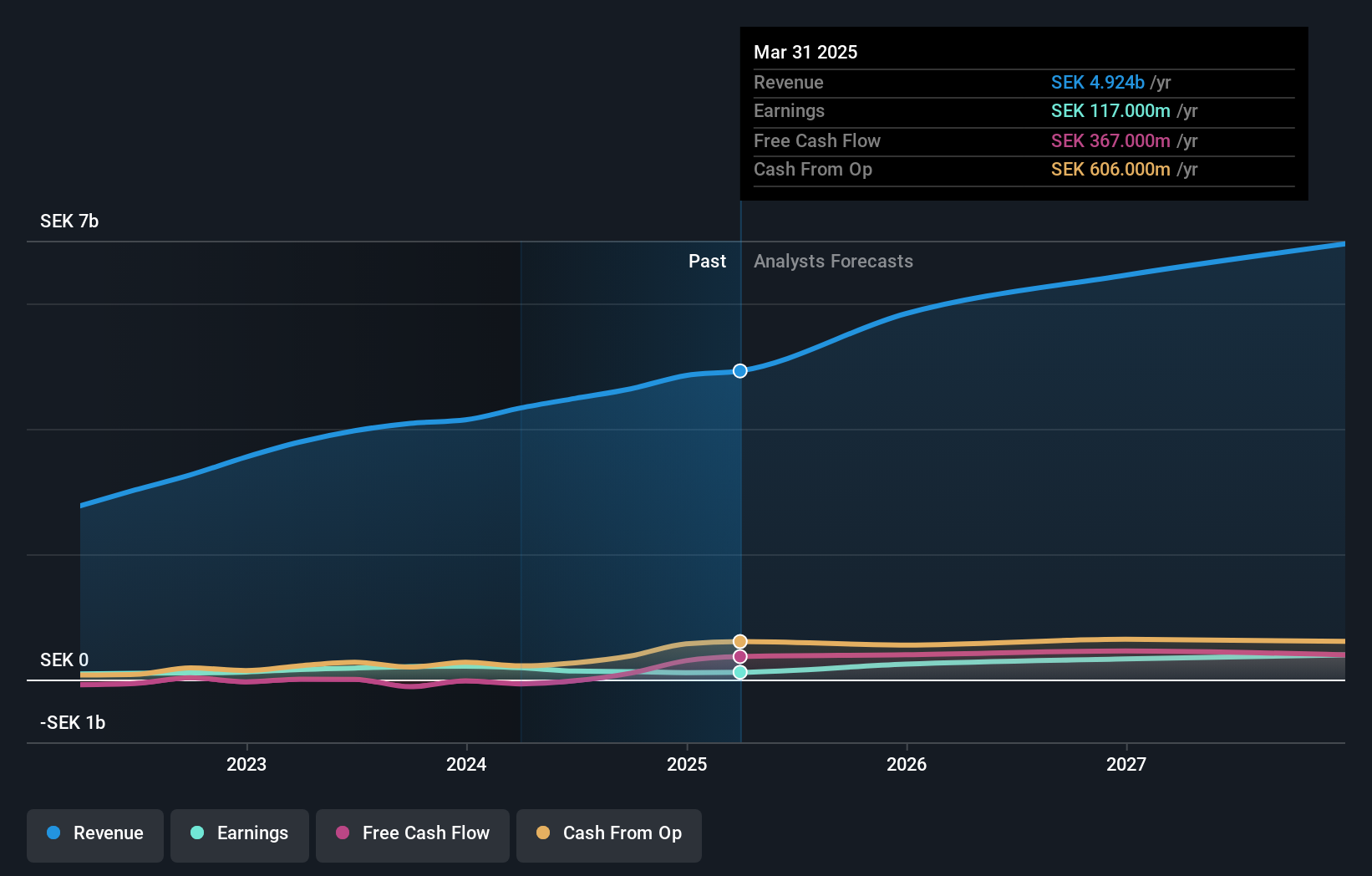

Overview: Hanza AB (publ) offers comprehensive manufacturing solutions and has a market cap of SEK2.74 billion.

Operations: The company generates revenue primarily from its Main Markets (SEK2.70 billion) and Other Markets (SEK1.83 billion), with a minor contribution from Business Development and Services (SEK19 million). Segment Adjustment accounts for a reduction of SEK66 million.

HANZA's recent strategic manufacturing agreement with a German company aims to streamline supply chains and consolidate parts production, enhancing efficiency and flexibility. Despite a 26.1% earnings drop last year, revenue is expected to grow 10.1% annually, outpacing the Swedish market's 1.1%. R&D expenses have been pivotal in driving innovation, with an anticipated earnings growth of 29.7% per year over the next three years. Net profit margins fell from 4.6% to 3%, highlighting cost challenges amidst expansion efforts.

- Get an in-depth perspective on Hanza's performance by reading our health report here.

Examine Hanza's past performance report to understand how it has performed in the past.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of SEK 4.67 billion.

Operations: The company generates revenue primarily through selling and implementing CRM software, amounting to SEK 631.84 million. The focus is on providing SaaS-based solutions within the Nordic region.

Lime Technologies, a prominent player in the Swedish tech landscape, reported a solid revenue increase to SEK 344.14 million for H1 2024 from SEK 290.38 million last year. Despite high R&D expenses driving innovation, net income slightly dipped to SEK 20.42 million in Q2 compared to SEK 20.57 million previously. With earnings projected to grow at an impressive annual rate of 24.1% and revenue anticipated to rise by 14.6% annually, Lime's robust SaaS model ensures recurring revenue streams and sustained market presence.

- Unlock comprehensive insights into our analysis of Lime Technologies stock in this health report.

Explore historical data to track Lime Technologies' performance over time in our Past section.

Vitrolife (OM:VITR)

Simply Wall St Growth Rating: ★★★★☆☆

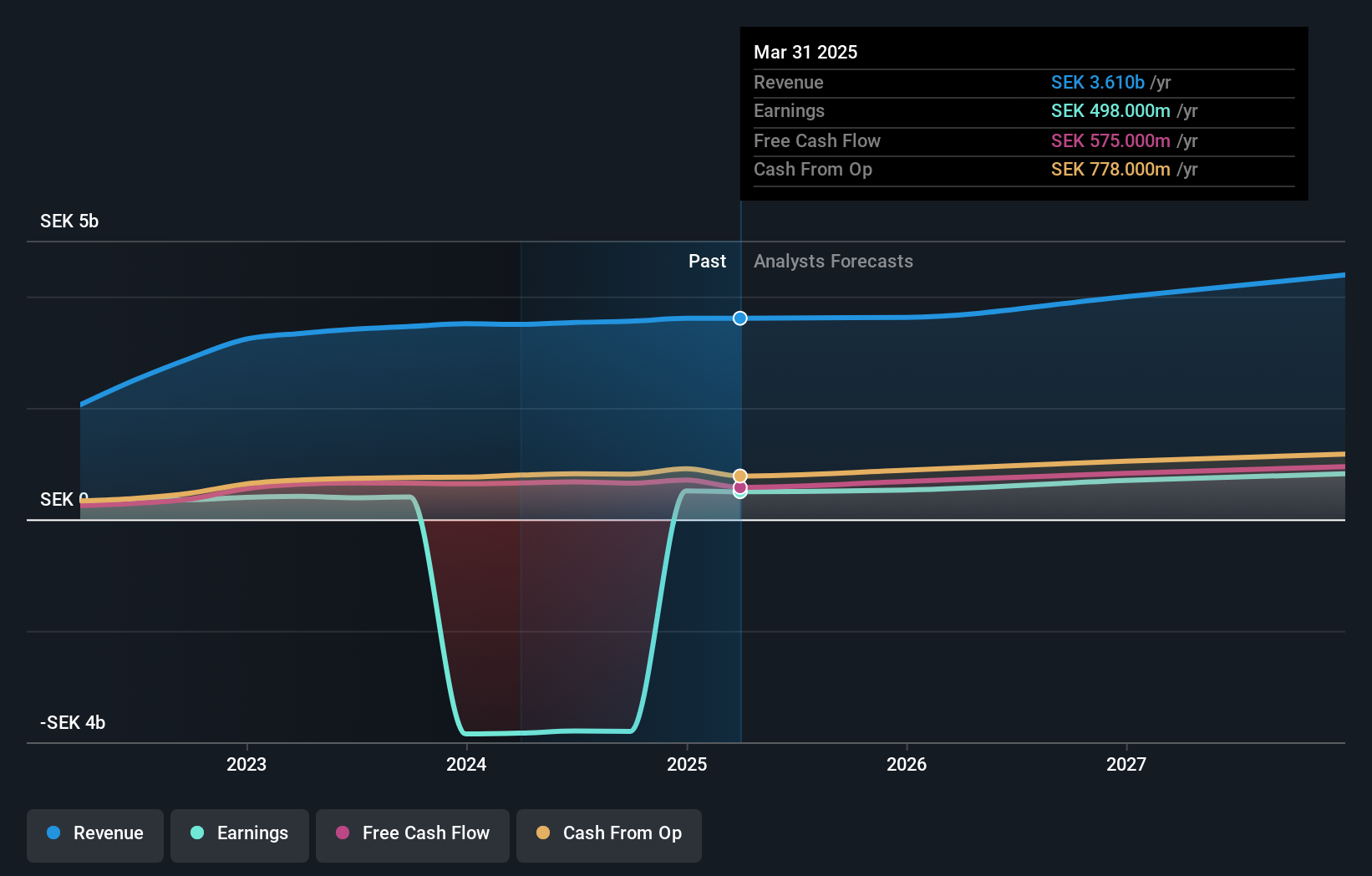

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market cap of SEK30.41 billion.

Operations: The company generates revenue through three primary segments: Genetics (SEK 1.25 billion), Consumables (SEK 1.57 billion), and Technologies (SEK 708 million).

Vitrolife's recent performance showcases a robust trajectory, with Q2 sales rising to SEK 941 million from SEK 905 million and net income jumping to SEK 143 million compared to SEK 106 million last year. Despite unprofitability, earnings are forecasted to grow at an impressive rate of 105.81% annually over the next three years, driven by strategic R&D investments. The company spent significantly on R&D in recent periods, underscoring its commitment to innovation within the biotech sector.

- Click to explore a detailed breakdown of our findings in Vitrolife's health report.

Understand Vitrolife's track record by examining our Past report.

Next Steps

- Embark on your investment journey to our 80 Swedish High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Reasonable growth potential with adequate balance sheet.