How Sobi’s Clinical Trial Results and FDA Approvals at ACR 2025 Will Impact (OM:SOBI) Investors

Reviewed by Sasha Jovanovic

- In October 2025, Swedish Orphan Biovitrum (Sobi) presented 15 scientific abstracts, including late-stage clinical trial results for Nanoencapsulated Sirolimus plus Pegadricase, Vonjo, and Gamifant, at the American College of Rheumatology (ACR) Convergence meeting in Chicago, with updates on both new safety data and recent US FDA approvals.

- The company highlighted its strengthened leadership in rare and underserved inflammatory conditions, with the presentation of advanced clinical data and regulatory milestones supporting future growth in its immunology portfolio.

- We'll examine how Sobi's promising phase III data and product approvals showcased at ACR 2025 influence the investment case for the company.

Find companies with promising cash flow potential yet trading below their fair value.

Swedish Orphan Biovitrum Investment Narrative Recap

To believe in Swedish Orphan Biovitrum as a shareholder, one needs confidence in its ability to turn clinical innovation in rare and underserved inflammatory diseases, such as the advances presented at ACR 2025, into sustained commercial momentum. While the positive clinical data and recent US FDA approval further strengthen near-term prospects for Gamifant and Nanoencapsulated Sirolimus, they do not materially shift the most important current catalyst, which remains regulatory progress and market uptake for its new immunology therapies; likewise, the biggest risk continues to be execution on these launches amid ongoing competition and pricing pressures.

Among recent announcements, the SEK6,612 million non-cash impairment on Vonjo stands out, signaling ongoing challenges in maximizing the value of this asset. This context is particularly relevant given the company’s reliance on expanding Vonjo’s indications and international approvals as a driver for future growth and margin improvement.

Yet, despite the stronger product pipeline, investors should also consider the recent impairment charges as a signal that...

Read the full narrative on Swedish Orphan Biovitrum (it's free!)

Swedish Orphan Biovitrum's narrative projects SEK36.3 billion in revenue and SEK7.5 billion in earnings by 2028. This requires 10.4% yearly revenue growth and a SEK3.1 billion increase in earnings from the current SEK4.4 billion.

Uncover how Swedish Orphan Biovitrum's forecasts yield a SEK336.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

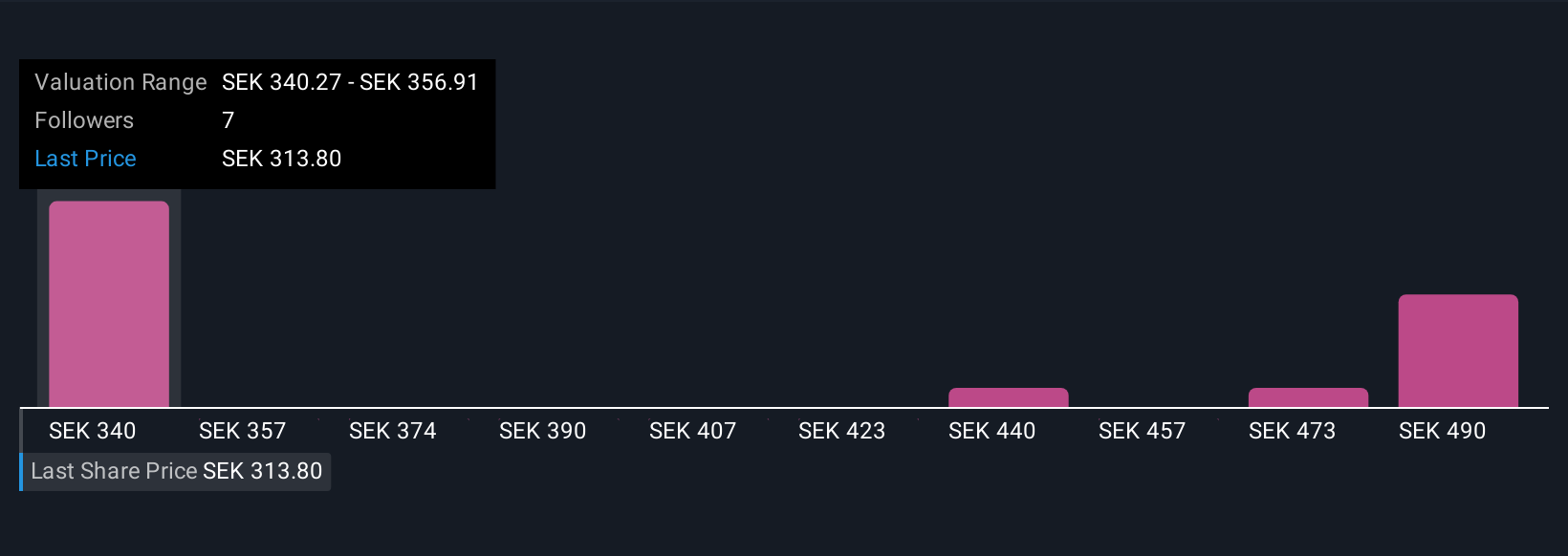

Simply Wall St Community members valued Sobi shares from SEK336 to SEK705, with four different viewpoints captured. With such a broad spread, it’s clear that expectations for new regulatory approvals and product launches can lead to widely varying forecasts for Sobi’s future trajectory.

Explore 4 other fair value estimates on Swedish Orphan Biovitrum - why the stock might be worth just SEK336.00!

Build Your Own Swedish Orphan Biovitrum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Swedish Orphan Biovitrum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Swedish Orphan Biovitrum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Swedish Orphan Biovitrum's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOBI

Swedish Orphan Biovitrum

A biopharma company, provides medicines in the areas of haematology, immunology, and specialty care in Europe, North America, the Middle East, Asia, and Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives