Is Probi AB (publ)'s (STO:PROB) Recent Price Movement Underpinned By Its Weak Fundamentals?

Probi (STO:PROB) has had a rough month with its share price down 1.8%. It seems that the market might have completely ignored the positive aspects of the company's fundamentals and decided to weigh-in more on the negative aspects. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. Specifically, we decided to study Probi's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Probi

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Probi is:

8.3% = kr93m ÷ kr1.1b (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each SEK1 of shareholders' capital it has, the company made SEK0.08 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Probi's Earnings Growth And 8.3% ROE

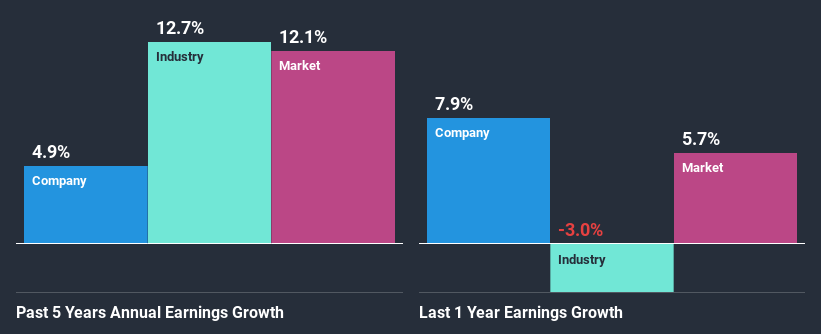

At first glance, Probi's ROE doesn't look very promising. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 14%. As a result, Probi reported a very low income growth of 4.9% over the past five years.

We then compared Probi's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 13% in the same period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Probi fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Probi Using Its Retained Earnings Effectively?

Probi has a low three-year median payout ratio of 13% (meaning, the company keeps the remaining 87% of profits) which means that the company is retaining more of its earnings. This should be reflected in its earnings growth number, but that's not the case. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Moreover, Probi has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 14%. Regardless, the future ROE for Probi is predicted to rise to 12% despite there being not much change expected in its payout ratio.

Conclusion

In total, we're a bit ambivalent about Probi's performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading Probi or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:PROB

Probi

Researches, manufactures, and sells probiotics for dietary supplements and food companies in North America, South America, Europe, Sweden, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026