ExpreS2ion Biotech Holding (STO:EXPRS2) Shareholders Have Enjoyed A Whopping 349% Share Price Gain

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the ExpreS2ion Biotech Holding AB (publ) (STO:EXPRS2) share price rocketed moonwards 349% in just one year. Also pleasing for shareholders was the 101% gain in the last three months. Also impressive, the stock is up 145% over three years, making long term shareholders happy, too.

See our latest analysis for ExpreS2ion Biotech Holding

We don't think ExpreS2ion Biotech Holding's revenue of kr13,597,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that ExpreS2ion Biotech Holding comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. ExpreS2ion Biotech Holding has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

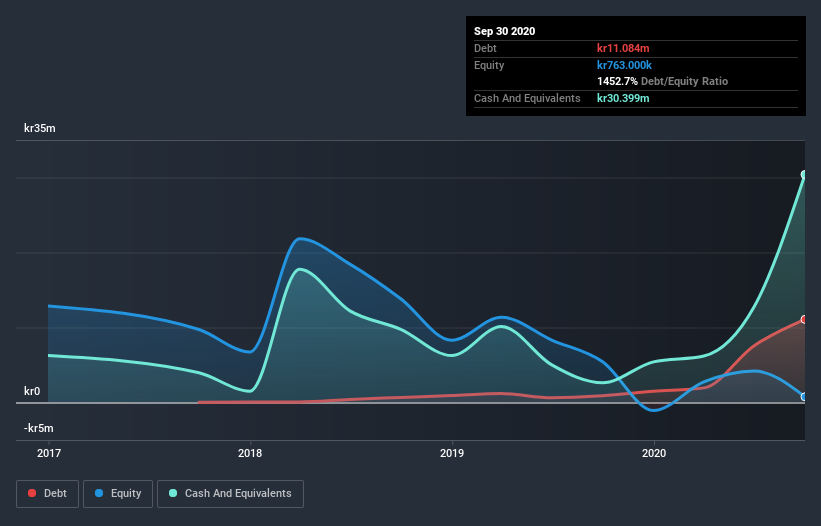

Our data indicates that ExpreS2ion Biotech Holding had kr12m more in total liabilities than it had cash, when it last reported in September 2020. That makes it extremely high risk, in our view. So we're surprised to see the stock up 54% in the last year , but we're happy for holders. Investors must really like its potential. The image below shows how ExpreS2ion Biotech Holding's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

Pleasingly, ExpreS2ion Biotech Holding's total shareholder return last year was 349%. That's better than the annualized TSR of 35% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand ExpreS2ion Biotech Holding better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with ExpreS2ion Biotech Holding (including 2 which are a bit concerning) .

We will like ExpreS2ion Biotech Holding better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading ExpreS2ion Biotech Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ExpreS2ion Biotech Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:EXPRS2

ExpreS2ion Biotech Holding

A biotechnology company, develops vaccines and biologics products to address critical unmet medical needs in the Nordics and internationally.

Medium-low risk with adequate balance sheet.

Market Insights

Community Narratives