There's No Escaping Camurus AB (publ)'s (STO:CAMX) Muted Revenues Despite A 27% Share Price Rise

Camurus AB (publ) (STO:CAMX) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

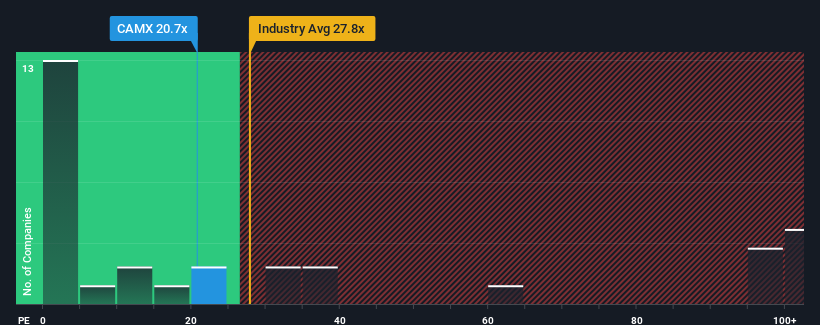

Even after such a large jump in price, Camurus may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 20.7x, considering almost half of all companies in the Pharmaceuticals industry in Sweden have P/S ratios greater than 27.8x and even P/S higher than 99x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Camurus

How Camurus Has Been Performing

With revenue growth that's inferior to most other companies of late, Camurus has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Camurus' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Camurus would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.8% last year. This was backed up an excellent period prior to see revenue up by 211% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 42% per year over the next three years. With the industry predicted to deliver 148% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Camurus' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Camurus' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Camurus' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Camurus with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CAMX

Camurus

A biopharmaceutical company, develops and commercializes medicines for severe and chronic diseases in Europe, Africa, the Middle East, North America, and Asia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives