- Sweden

- /

- Life Sciences

- /

- OM:BIOT

Subdued Growth No Barrier To Biotage AB (publ) (STO:BIOT) With Shares Advancing 32%

Despite an already strong run, Biotage AB (publ) (STO:BIOT) shares have been powering on, with a gain of 32% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 9.9% isn't as attractive.

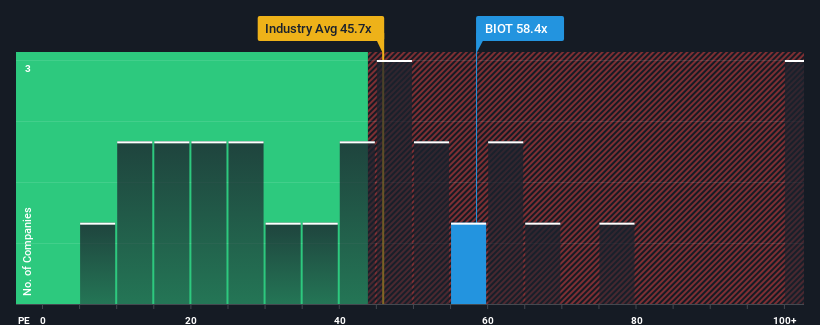

Since its price has surged higher, Biotage may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 58.4x, since almost half of all companies in Sweden have P/E ratios under 21x and even P/E's lower than 13x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Biotage could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Biotage

Does Growth Match The High P/E?

Biotage's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 19% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is not materially different.

In light of this, it's curious that Biotage's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Shares in Biotage have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Biotage currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Biotage that you should be aware of.

If you're unsure about the strength of Biotage's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Biotage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BIOT

Biotage

Provides solutions and products in the areas of drug discovery and development, analytical testing, and water and environmental testing.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives