BioInvent (OM:BINV) Revenue Growth Forecast Tops Market Expectations, Reinforcing Bullish Outlook

Reviewed by Simply Wall St

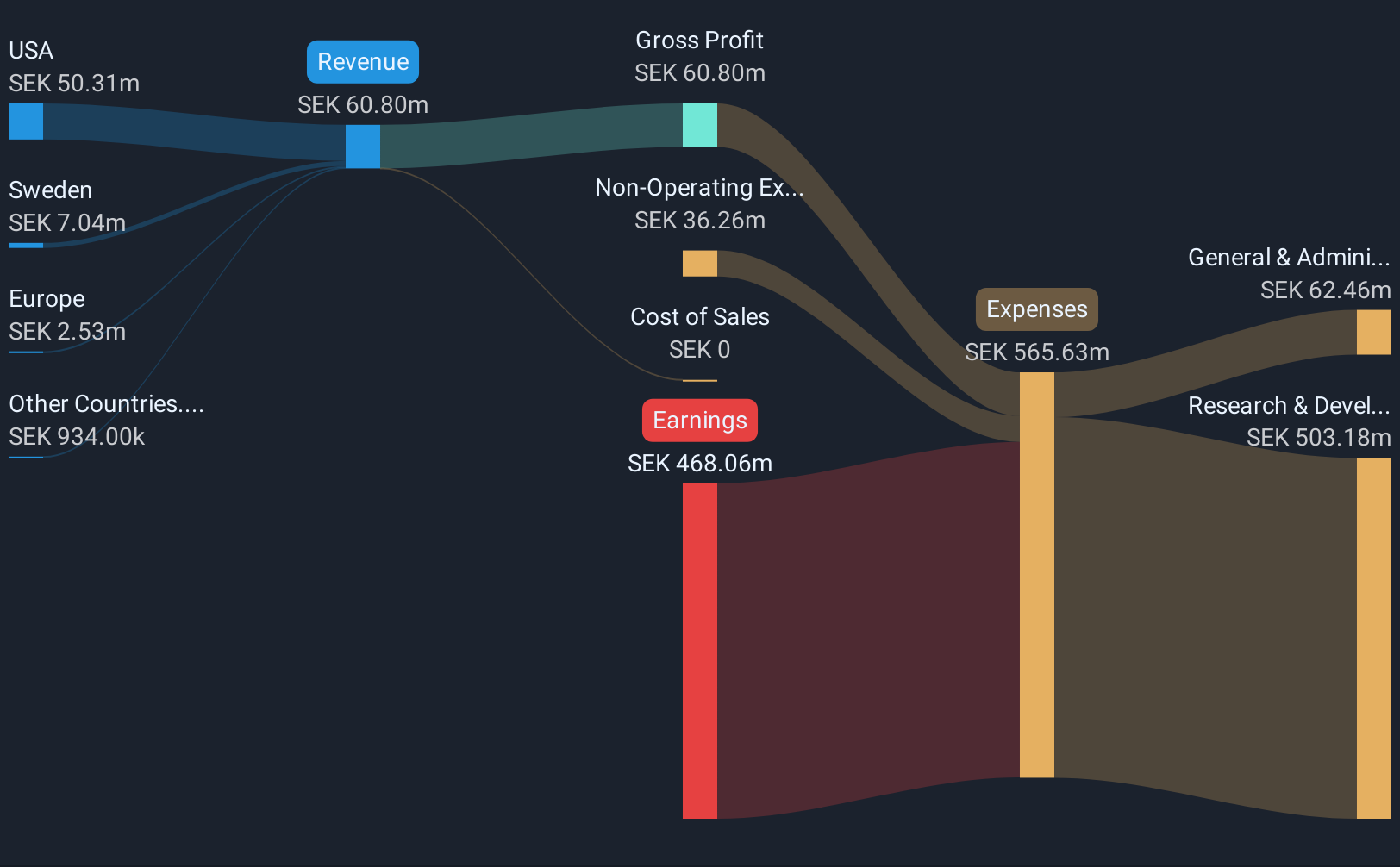

BioInvent International (OM:BINV) reported another year of unprofitability, with net losses growing at an annual rate of 27.2% over the past five years. Notably, the company is forecast to turn things around, as earnings are expected to jump 57.17% annually and BioInvent is projected to become profitable within the next three years. Investors are eyeing the strong revenue growth outlook as a potential catalyst, with the pace set to outstrip the broader market and support a constructive valuation argument.

See our full analysis for BioInvent International.Now, we will see how these numbers compare to the dominant narratives in the market. Some expectations may be validated by the results, while others could face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Losses Rising Despite Outlook for Profitability

- BioInvent’s net losses have increased at a 27.2% annual rate over the past five years, with no improvement in net profit margins noted year over year.

- Optimists focus on management’s guidance that profitability may arrive within three years. They stress that a projected 57.17% annual earnings growth sets BioInvent apart from typical unprofitable biotechs.

- The forecasted turnaround is considered above average relative to the Swedish market, highlighting a potential inflection point absent from past performance.

- The lack of progress on net profit margins up to now, however, makes some investors question whether the inflection will materialize on the projected timeline.

Sales Growth Outpaces Industry Peers

- With revenues projected to rise 22.6% per year, BioInvent’s top-line growth is set to surpass both the Swedish market average of 3.7% and the broader biotech industry.

- The prevailing market view sees strong revenue acceleration as a potential reward for taking the risk of holding an unprofitable biotech. Rapid sales expansion provides more flexibility to absorb development costs and pursue commercialization.

- Analysts see forecasted growth as a potential catalyst for a positive rerating of the stock, especially since revenue momentum could boost the company’s longer-term sustainability.

- Nonetheless, some investors note that future operating leverage is highly dependent on BioInvent’s ability to turn sales growth into improved margins, which remains unproven according to the latest filings.

Valuation Metrics Signal Constructive Sentiment

- BioInvent trades at a Price-To-Sales Ratio of 8.9x, which is below the peer average of 29x and underneath the Swedish biotech sector’s 9.5x mark.

- The prevailing market view is that current multiples reflect a constructive stance from investors, as the company is favorably priced for its sector and maintains promising growth prospects.

- Valuation positioning supports the idea of further upside if the transition to profitability happens as forecasted, a scenario not yet reflected in higher-multiple peers.

- On the other hand, skeptics remain alert to cross-sector volatility and warn that even discounted valuations can pressure stocks if profitability timelines shift again or sector momentum slows.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BioInvent International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

BioInvent’s persistent net losses and uncertain path to sustained profitability highlight the risks of relying on as-yet-unproven earnings improvements.

If you want a more consistent track record, consider stable growth stocks screener (2112 results) for companies that deliver steady growth in both revenue and earnings cycle after cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioInvent International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BINV

BioInvent International

A clinical-stage company, discovers and develops immuno-modulatory antibodies for the treatment of cancer in Sweden, Europe, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives