- China

- /

- Electronic Equipment and Components

- /

- SHSE:688539

High Growth Tech Stocks to Watch in October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of a U.S. government shutdown and shifting economic indicators, small-cap stocks, particularly in the tech sector, have shown resilience with the Russell 2000 Index outperforming larger indices like the S&P 500. In this environment where rate cuts seem more likely and growth stocks are gaining traction, identifying high growth tech stocks involves looking for companies that can leverage favorable conditions such as lower borrowing costs and increased investor appetite for innovation-driven performance.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Hacksaw (OM:HACK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hacksaw AB (publ) is a B2B technology platform and game development company with a market capitalization of SEK20.31 billion.

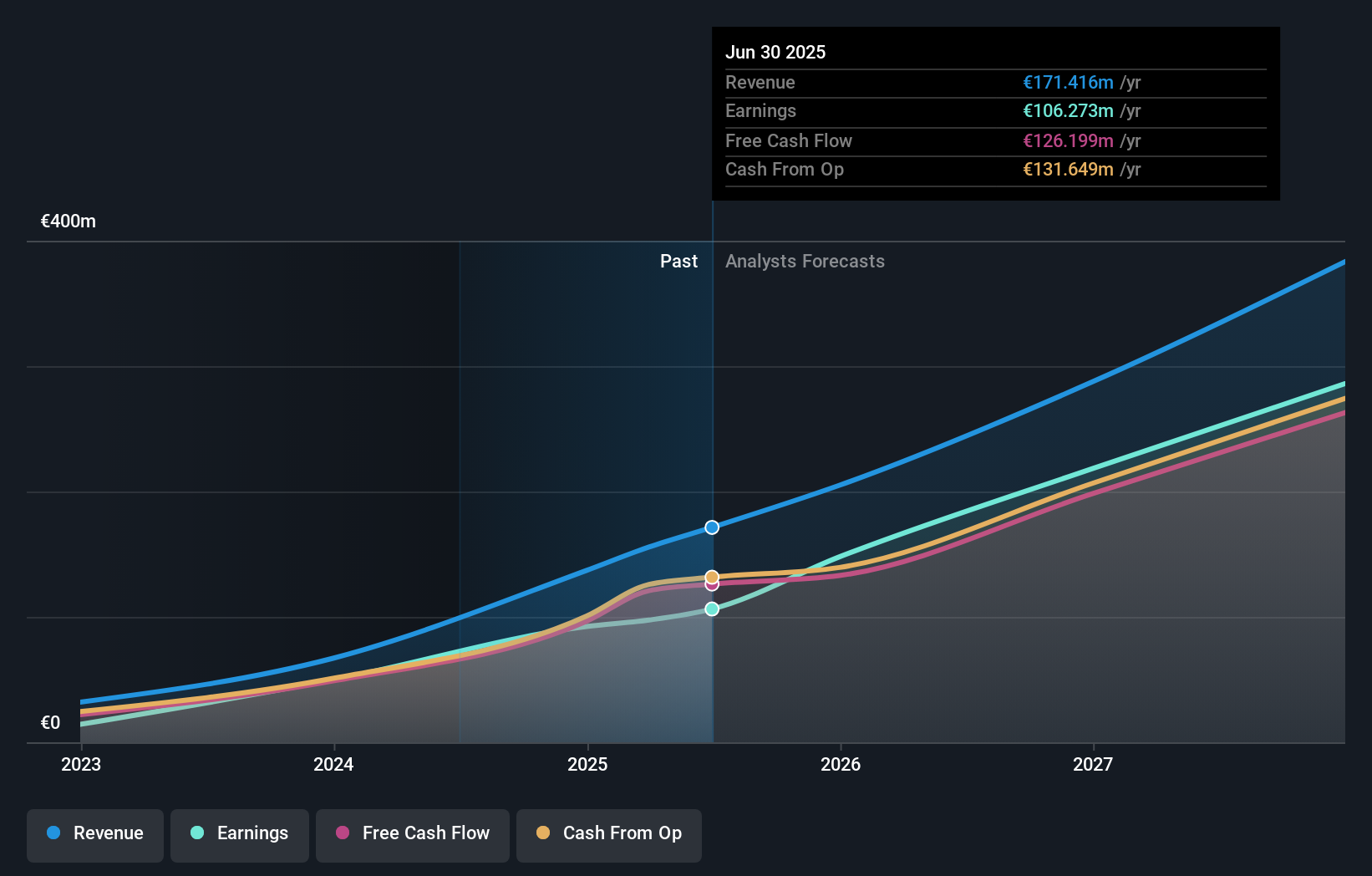

Operations: The company generates revenue primarily from providing online casino solutions and related services to gaming operators, amounting to €171.42 million.

Hacksaw's strategic expansion into new markets, including a significant partnership with William Hill and entry into Pennsylvania's iGaming sector, underscores its innovative approach in the tech-driven gaming industry. With revenue surging by 68.3% over the past year and earnings projected to grow at 37.6% annually, Hacksaw is outpacing average market growth rates significantly. This growth is bolstered by recent launches on platforms like BetMGM, enhancing its footprint in North America and showcasing a robust portfolio that meets escalating demand for diverse gaming content.

- Delve into the full analysis health report here for a deeper understanding of Hacksaw.

Gain insights into Hacksaw's past trends and performance with our Past report.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NanJing GOVA Technology Co., Ltd. is a Chinese company focused on the research, design, development, production, and sale of sensors and sensor network systems, with a market cap of CN¥6.42 billion.

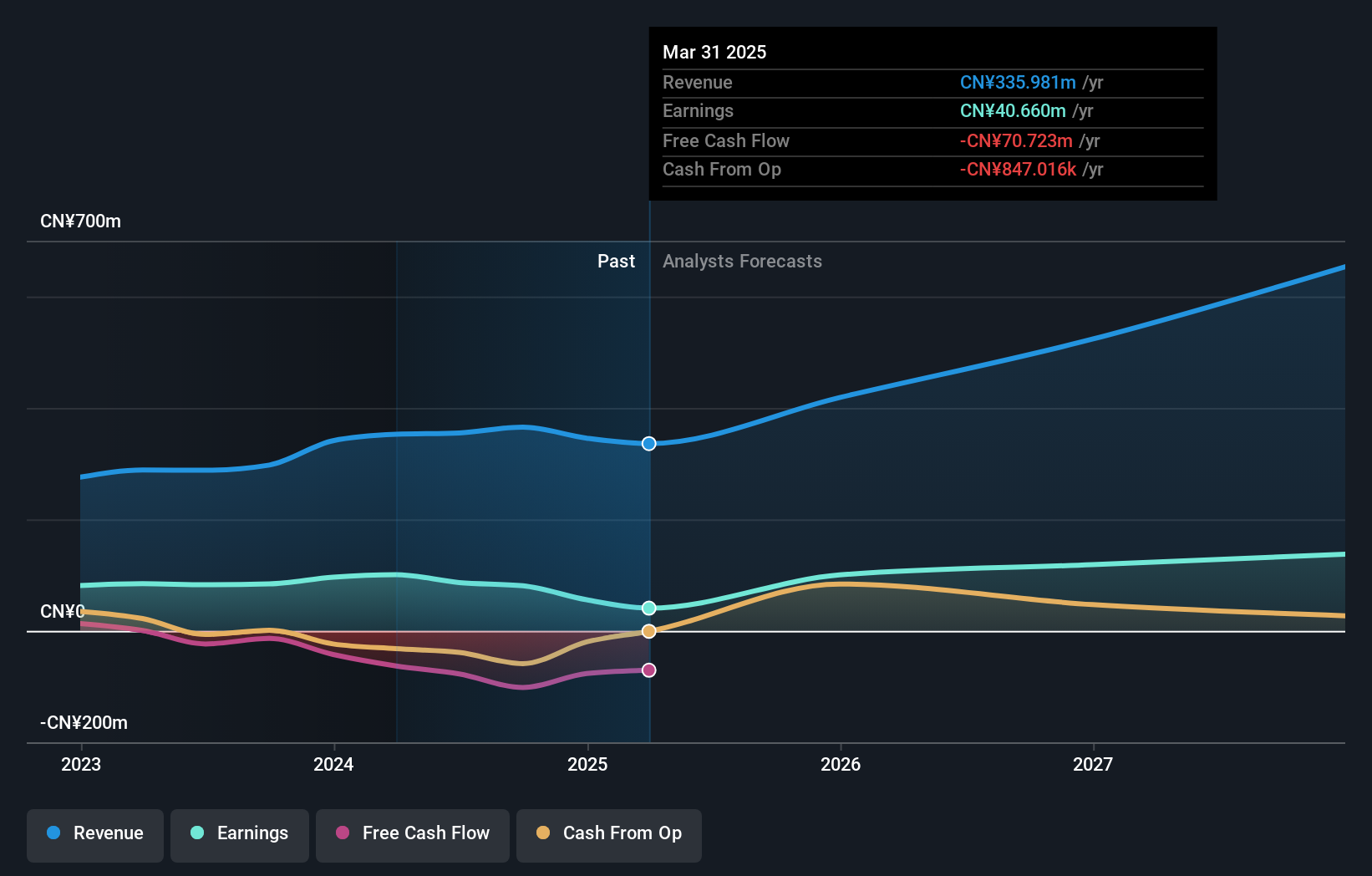

Operations: The company generates revenue primarily from its electronic test and measurement instruments segment, amounting to CN¥372.01 million.

NanJing GOVA Technology's recent performance demonstrates its resilience and potential in the tech sector, with a notable increase in half-year sales from CNY 155.46 million to CNY 183.89 million and a slight uptick in net income to CNY 30.94 million. This growth is underscored by an impressive annual revenue increase of 22.8% and an expected earnings surge of 28.4% per year, signaling robust future prospects despite current profit margins at 15%, down from last year’s 24.4%. The company's commitment to innovation is evident as it navigates through competitive markets, positioning itself for sustained expansion amidst challenging economic conditions.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

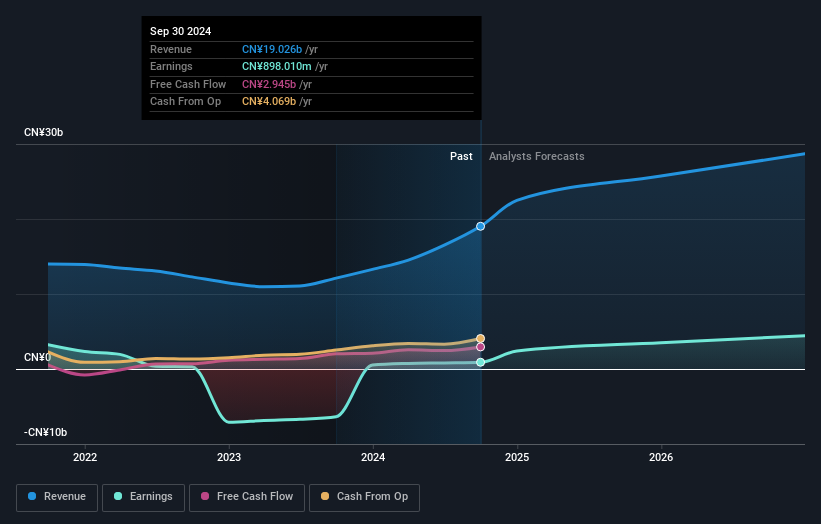

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both within China and globally, with a market capitalization of approximately CN¥152.30 billion.

Operations: Zhejiang Century Huatong Group Co., Ltd generates revenue through its diverse operations in the auto parts, Internet games, and cloud data sectors across domestic and international markets. The company has a market capitalization of around CN¥152.30 billion.

Zhejiang Century Huatong Group has shown remarkable financial performance with its half-year sales more than doubling to CNY 17.1 billion from CNY 9.2 billion, alongside a surge in net income to CNY 2.66 billion from CNY 1.16 billion previously, reflecting an earnings growth of 233% over the past year. This growth trajectory is supported by robust forecasts indicating a potential annual earnings increase of 36.5%. The company's strategic amendments to its articles of association hint at structural adjustments poised to bolster future operations, aligning with industry trends towards enhanced corporate governance and operational efficiency.

- Dive into the specifics of Zhejiang Century Huatong GroupLtd here with our thorough health report.

Learn about Zhejiang Century Huatong GroupLtd's historical performance.

Key Takeaways

- Gain an insight into the universe of 243 Global High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJing GOVA Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688539

NanJing GOVA Technology

Engages in the research, design, development, production, and sale of sensors and sensor network systems in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success