Stock Analysis

- China

- /

- Communications

- /

- SZSE:000810

Exploring Three High Growth Tech Stocks With Strong Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major stock indexes, growth stocks have continued to capture investor interest, with the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks faced declines. As global markets navigate these dynamic conditions, identifying high-growth tech stocks with robust potential becomes crucial for investors looking to capitalize on the evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across multiple continents including Europe, the Americas, Asia, Oceania, and Africa with a market capitalization of €16.84 billion.

Operations: The company generates significant revenue from its communications segment, amounting to €14.86 billion, followed by Bolloré Energy at €2.75 billion. The industry segment contributes €353 million to the overall revenue stream.

Bolloré SE has demonstrated a robust financial trajectory, with third-quarter revenues soaring to €5.56 billion from €3.20 billion the previous year, and nine-month figures equally impressive at €16.15 billion compared to last year's €9.43 billion. This surge aligns with an earnings forecast growth of 32.7% annually, significantly outpacing the French market's 12.5%. Despite slower revenue growth projections of 8.1% annually against a more dynamic market expectation of 20%, Bolloré’s recent shift into profitability highlights its potential in adapting and thriving in competitive environments. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining long-term growth in the high-stakes tech sector. Looking ahead, while Bolloré’s return on equity might appear modest at 4.9% over three years, the company’s strategic movements—including significant shareholder meetings discussing tender offers—suggest proactive governance aiming to bolster market position and shareholder value further. As it continues to navigate through technological advancements and market demands, Bolloré's focus on developing proprietary technologies and expanding its operational scope could well shape its trajectory in the evolving global tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Bolloré.

Review our historical performance report to gain insights into Bolloré's's past performance.

Embracer Group (OM:EMBRAC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Embracer Group AB (publ) is a global developer and publisher of PC, console, mobile, VR, and board games with a market capitalization of approximately SEK44.20 billion.

Operations: The company generates revenue primarily from tabletop games (SEK14.41 billion), followed by PC/console games (SEK11.31 billion), mobile games (SEK5.77 billion), and entertainment & services (SEK5.99 billion).

Embracer Group, amidst a challenging tech landscape, has shown resilience with an expected earnings growth of 105.4% annually, signaling potential recovery and adaptation in its business model. Despite recent revenue dips to SEK 8.66 billion from SEK 10.96 billion year-over-year in Q2 and a net loss improvement to SEK 391 million from SEK 562 million, the company's strategic amendments such as the proposed reverse share split aim to stabilize its market position. This move aligns with Embracer's R&D commitment which remains vital for fostering innovation and maintaining competitive edge in the evolving entertainment industry where technological advancements are pivotal.

- Click to explore a detailed breakdown of our findings in Embracer Group's health report.

Gain insights into Embracer Group's historical performance by reviewing our past performance report.

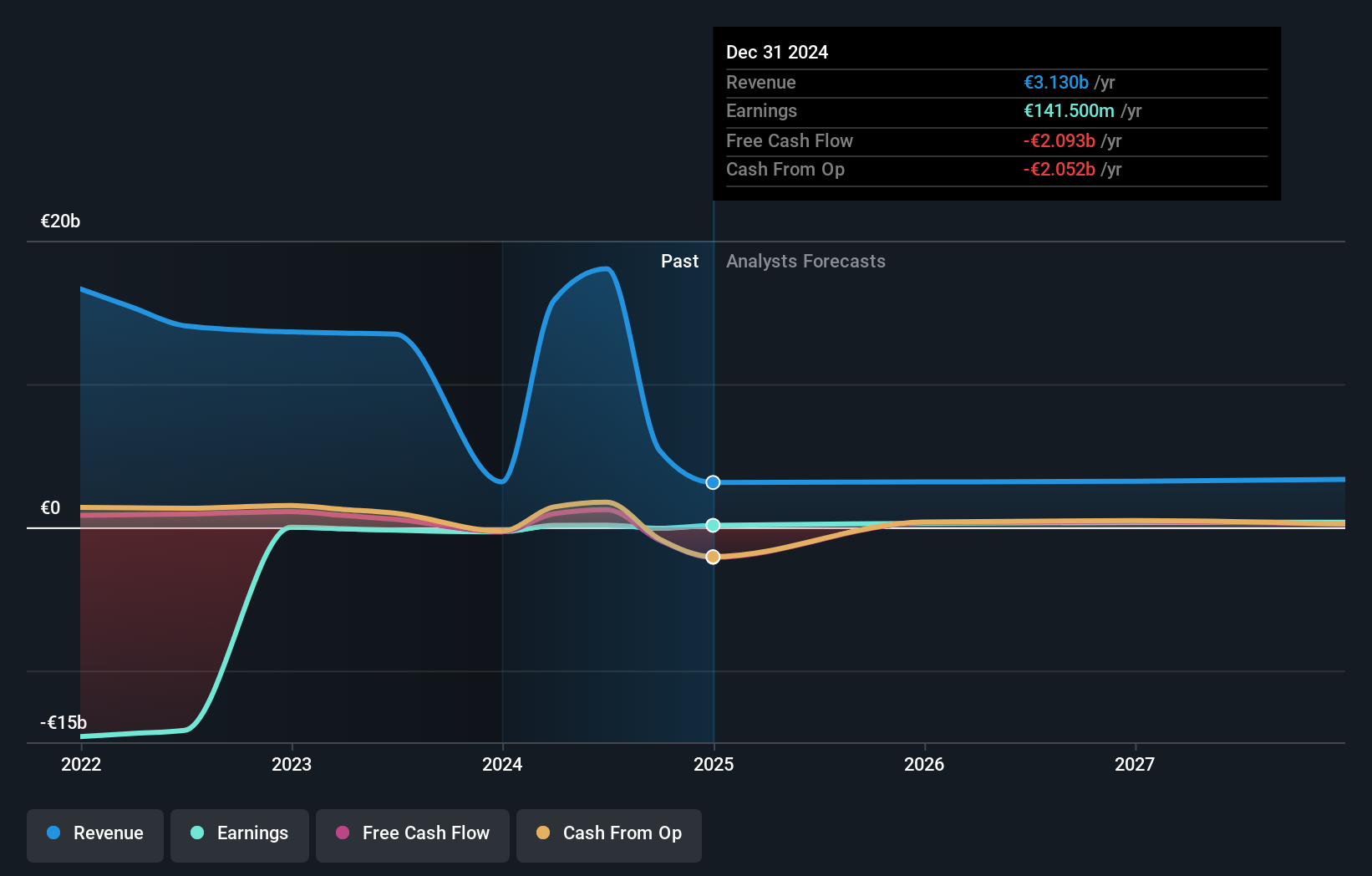

Skyworth Digital (SZSE:000810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Skyworth Digital Co., Ltd. is engaged in the global production and sale of home video entertainment and intelligent connectivity solutions, with a market capitalization of CN¥15.96 billion.

Operations: Skyworth Digital focuses on the manufacturing and sale of home video entertainment products and intelligent connectivity solutions globally. The company operates with a market capitalization of CN¥15.96 billion, reflecting its significant presence in the industry.

Skyworth Digital, navigating a challenging tech environment, has demonstrated resilience with its revenue forecast to grow by 15.9% annually, outpacing the Chinese market's average of 13.8%. Despite a significant reduction in net income from CNY 447.81 million to CNY 236.48 million over the past nine months, the company maintains a robust commitment to innovation through R&D investments. This strategic focus is crucial as it aims to rebound and capitalize on emerging market opportunities, particularly in digital technologies where adaptability and forward-thinking are key. The firm recently affirmed its shareholder commitment by announcing a dividend despite facing earnings pressures, underscoring its stable financial management amidst downturns. Looking ahead, Skyworth Digital's projected annual profit growth of 30.4% suggests potential for substantial recovery and growth within the competitive tech landscape. This outlook is supported by their ongoing enhancements in product offerings and operational efficiencies which are essential for sustaining long-term competitiveness in an increasingly digitalized global market.

- Get an in-depth perspective on Skyworth Digital's performance by reading our health report here.

Explore historical data to track Skyworth Digital's performance over time in our Past section.

Make It Happen

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1286 more companies for you to explore.Click here to unveil our expertly curated list of 1289 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000810

Skyworth Digital

Manufactures and sells home video entertainment and intelligent connectivity solutions worldwide.