Discover European Penny Stocks: Turbomecanica And 2 Other Promising Picks

Reviewed by Simply Wall St

As European markets experience a boost from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, investors are increasingly exploring diverse opportunities across the continent. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area despite being considered a niche market today. In this article, we explore three penny stocks that stand out for their financial resilience and potential for long-term growth amidst current economic conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.40 | €45.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €247.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.12 | €65.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.81 | €17.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN5.00 | PLN13.47M | ✅ 2 ⚠️ 4 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.725 | €417.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.942 | €31.77M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 344 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Turbomecanica (BVB:TBM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Turbomecanica SA manufactures and sells engines, mechanical assemblies, and equipment for aircraft and helicopters in Europe and Asia, with a market cap of RON172.53 million.

Operations: The company does not report specific revenue segments.

Market Cap: RON172.53M

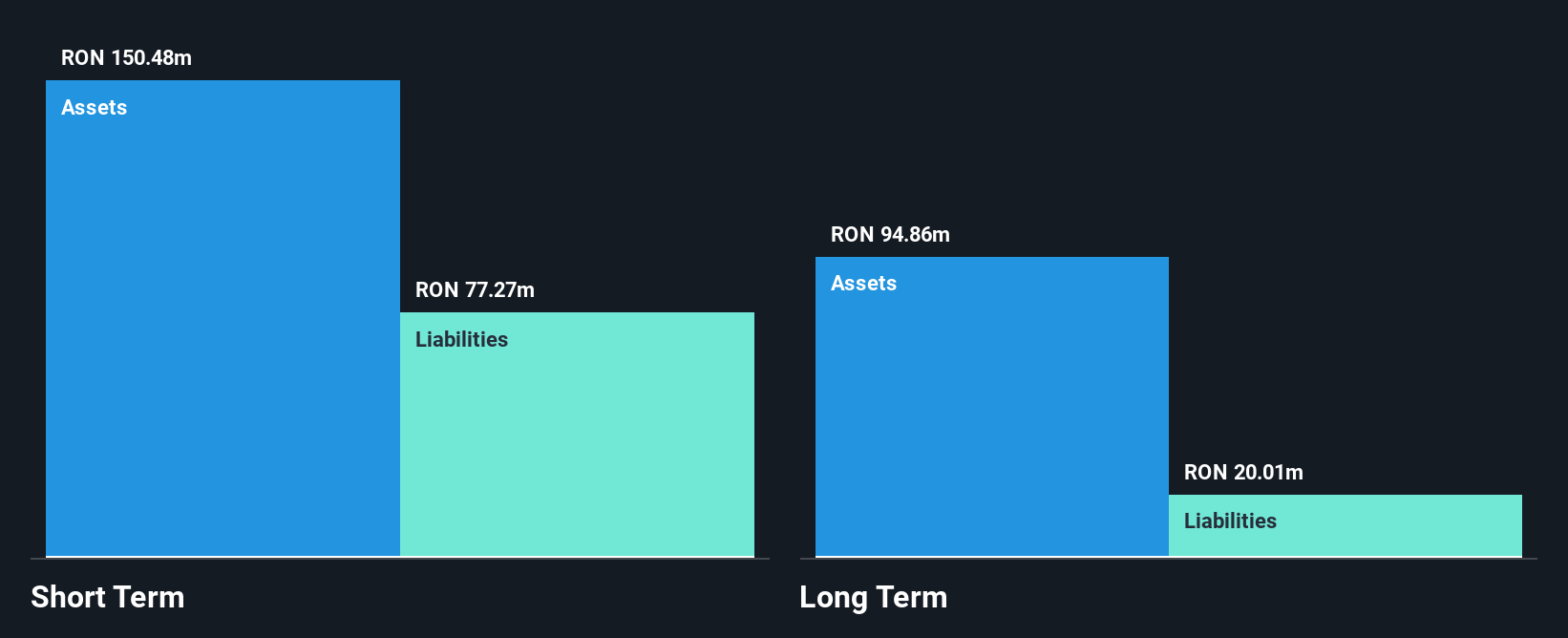

Turbomecanica SA, with a market cap of RON172.53 million, shows promising financial health for a penny stock. The company boasts more cash than total debt and has short-term assets exceeding both short- and long-term liabilities, indicating strong liquidity. Its earnings growth of 53% over the past year outpaces its five-year average and surpasses industry growth rates. Despite a low return on equity at 12.2%, Turbomecanica's price-to-earnings ratio is attractively below the regional market average, suggesting potential value for investors mindful of its dividend sustainability concerns due to insufficient free cash flow coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Turbomecanica.

- Explore historical data to track Turbomecanica's performance over time in our past results report.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AFYREN SAS offers sustainable alternatives to petroleum-based ingredients using non-food biomass in France, with a market cap of €67.49 million.

Operations: The company generates revenue from its Chemicals segment, amounting to €2.86 million.

Market Cap: €67.49M

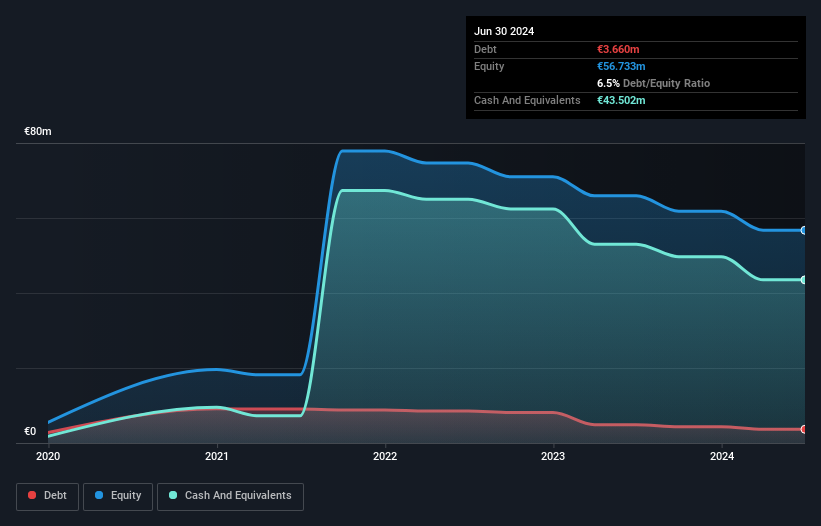

AFYREN SAS, with a market cap of €67.49 million, is navigating its industrial ramp-up phase at AFYREN NEOXY, backed by a recent €4 million grant from the “France Relance” initiative. The company has achieved continuous production and is accelerating commercialization of bio-based acids under multi-year contracts worth €165 million. Despite being unprofitable and having volatile share prices, AFYREN's revenue is projected to grow significantly at 51.72% annually. With more cash than debt and short-term assets covering liabilities, it maintains financial stability while planning strategic investments to enhance production capacity and profitability targets.

- Jump into the full analysis health report here for a deeper understanding of AFYREN SAS.

- Explore AFYREN SAS' analyst forecasts in our growth report.

Bambuser (OM:BUSER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bambuser AB (publ) operates a cloud-based video commerce platform and has a market cap of SEK139.20 million.

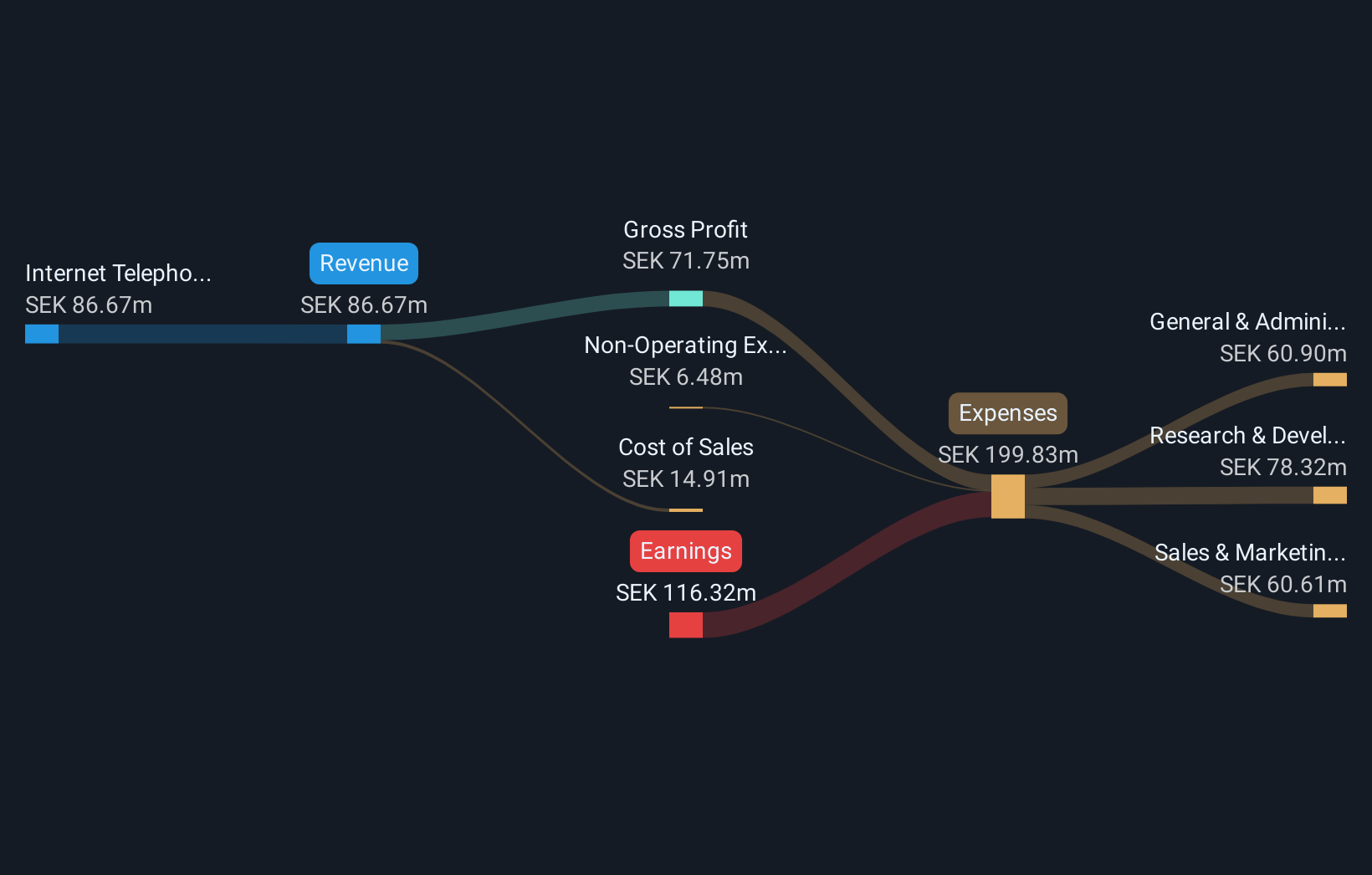

Operations: Bambuser generates revenue from its Internet Telephone segment, which amounts to SEK92.75 million.

Market Cap: SEK139.2M

Bambuser AB, with a market cap of SEK139.20 million, is leveraging strategic partnerships to enhance its video commerce platform. Recent collaborations with Alibaba Cloud and Decathlon aim to expand Bambuser's reach in the Chinese and French markets, respectively. Despite a volatile share price and ongoing unprofitability, the company reported SEK43.32 million in sales for the first half of 2025 but faced increased net losses compared to last year. Bambuser remains debt-free with short-term assets exceeding liabilities, supported by an experienced management team and board as it navigates growth opportunities in live video shopping globally.

- Unlock comprehensive insights into our analysis of Bambuser stock in this financial health report.

- Review our historical performance report to gain insights into Bambuser's track record.

Where To Now?

- Discover the full array of 344 European Penny Stocks right here.

- Curious About Other Options? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALAFY

AFYREN SAS

Provides biobased products to replace petroleum-based molecules in France.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives