Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that ProfilGruppen AB (publ) (STO:PROF B) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for ProfilGruppen

How Much Debt Does ProfilGruppen Carry?

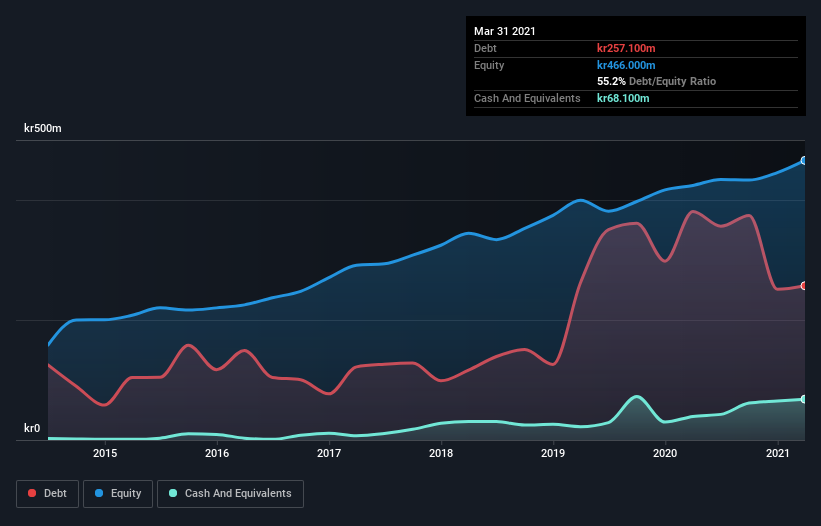

As you can see below, ProfilGruppen had kr238.9m of debt at March 2021, down from kr380.8m a year prior. On the flip side, it has kr68.1m in cash leading to net debt of about kr170.8m.

A Look At ProfilGruppen's Liabilities

Zooming in on the latest balance sheet data, we can see that ProfilGruppen had liabilities of kr554.4m due within 12 months and liabilities of kr226.8m due beyond that. On the other hand, it had cash of kr68.1m and kr294.0m worth of receivables due within a year. So it has liabilities totalling kr419.1m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of kr668.8m, so it does suggest shareholders should keep an eye on ProfilGruppen's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

ProfilGruppen has net debt worth 1.9 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 6.3 times the interest expense. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. Shareholders should be aware that ProfilGruppen's EBIT was down 67% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But it is ProfilGruppen's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, ProfilGruppen basically broke even on a free cash flow basis. Some might say that's a concern, when it comes considering how easily it would be for it to down debt.

Our View

Mulling over ProfilGruppen's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. We're quite clear that we consider ProfilGruppen to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for ProfilGruppen you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade ProfilGruppen, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:PROF B

ProfilGruppen

Manufactures and sells customized aluminum extrusions in Sweden and Germany.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives