Most Shareholders Will Probably Agree With Duroc AB (publ)'s (STO:DURC B) CEO Compensation

Despite positive share price growth of 26% for Duroc AB (publ) (STO:DURC B) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 09 November 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Duroc

How Does Total Compensation For John Hager Compare With Other Companies In The Industry?

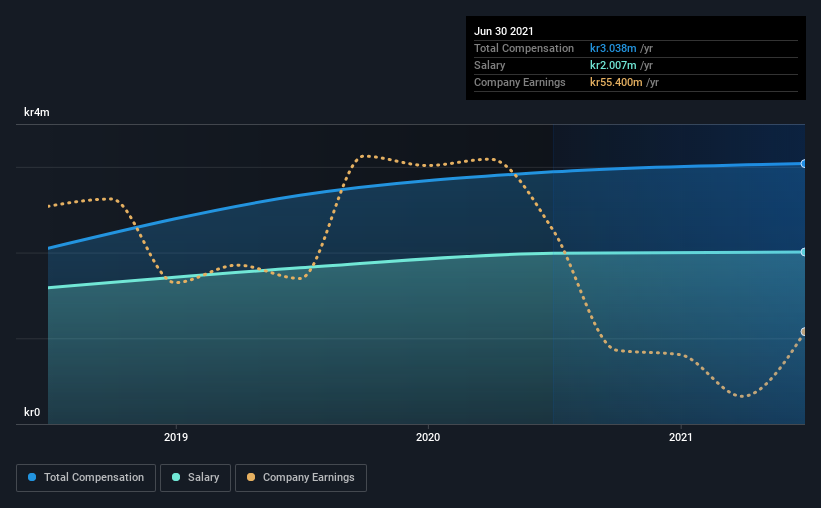

Our data indicates that Duroc AB (publ) has a market capitalization of kr1.5b, and total annual CEO compensation was reported as kr3.0m for the year to June 2021. That's a modest increase of 3.3% on the prior year. We note that the salary portion, which stands at kr2.01m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between kr853m and kr3.4b, we discovered that the median CEO total compensation of that group was kr3.8m. So it looks like Duroc compensates John Hager in line with the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | kr2.0m | kr2.0m | 66% |

| Other | kr1.0m | kr950k | 34% |

| Total Compensation | kr3.0m | kr2.9m | 100% |

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. Although there is a difference in how total compensation is set, Duroc more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Duroc AB (publ)'s Growth Numbers

Over the last three years, Duroc AB (publ) has shrunk its earnings per share by 25% per year. It achieved revenue growth of 3.0% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Duroc AB (publ) Been A Good Investment?

Duroc AB (publ) has served shareholders reasonably well, with a total return of 26% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Duroc that you should be aware of before investing.

Switching gears from Duroc, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:DURC B

Duroc

Through its subsidiaries, engages in the fiber, industrial trade, and other businesses in Sweden, Europe, and the United States.

Excellent balance sheet with low risk.

Market Insights

Community Narratives