- Sweden

- /

- Paper and Forestry Products

- /

- OM:BRG B

Should You Use Bergs Timber's (STO:BRG B) Statutory Earnings To Analyse It?

Broadly speaking, profitable businesses are less risky than unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Bergs Timber (STO:BRG B).

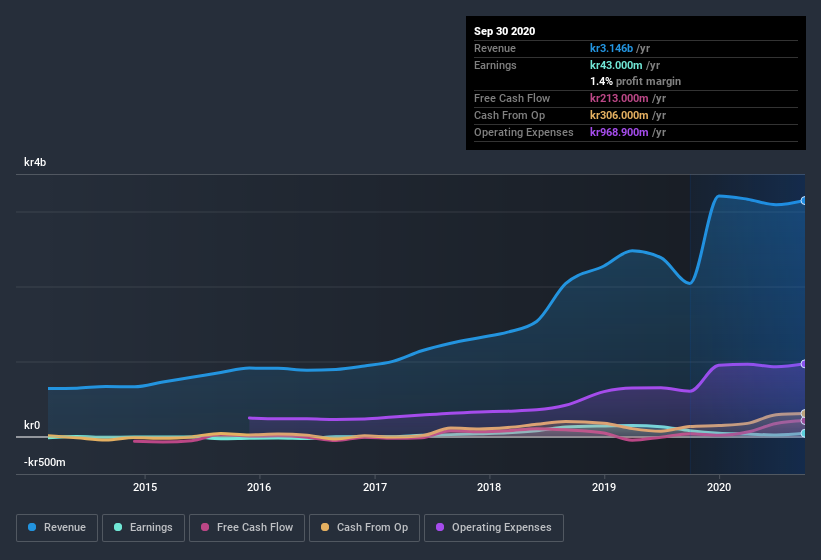

While Bergs Timber was able to generate revenue of kr3.15b in the last twelve months, we think its profit result of kr43.0m was more important. Happily, it has grown both its profit and revenue over the last three years (though we note its profit is down over the last year).

View our latest analysis for Bergs Timber

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, we think it's worth taking a closer look at Bergs Timber's cashflow, as well as examining the impact that unusual items have had on its reported profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Zooming In On Bergs Timber's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Bergs Timber has an accrual ratio of -0.11 for the year to September 2020. That indicates that its free cash flow was a fair bit more than its statutory profit. In fact, it had free cash flow of kr213m in the last year, which was a lot more than its statutory profit of kr43.0m. Bergs Timber shareholders are no doubt pleased that free cash flow improved over the last twelve months. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

How Do Unusual Items Influence Profit?

Surprisingly, given Bergs Timber's accrual ratio implied strong cash conversion, its paper profit was actually boosted by kr28m in unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Bergs Timber had a rather significant contribution from unusual items relative to its profit to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Bergs Timber's Profit Performance

Bergs Timber's profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Having considered these factors, we don't think Bergs Timber's statutory profits give an overly harsh view of the business. So while earnings quality is important, it's equally important to consider the risks facing Bergs Timber at this point in time. For example - Bergs Timber has 2 warning signs we think you should be aware of.

Our examination of Bergs Timber has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Bergs Timber or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bergs Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BRG B

Bergs Timber

Bergs Timber AB (publ) engages in development, production, and marketing of processed wood products in Sweden, Latvia, the United Kingdom, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026