- Sweden

- /

- Paper and Forestry Products

- /

- OM:BRG B

Does Bergs Timber's (STO:BRG B) CEO Salary Compare Well With Industry Peers?

Peter Nilsson became the CEO of Bergs Timber AB (publ) (STO:BRG B) in 2013, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Bergs Timber

How Does Total Compensation For Peter Nilsson Compare With Other Companies In The Industry?

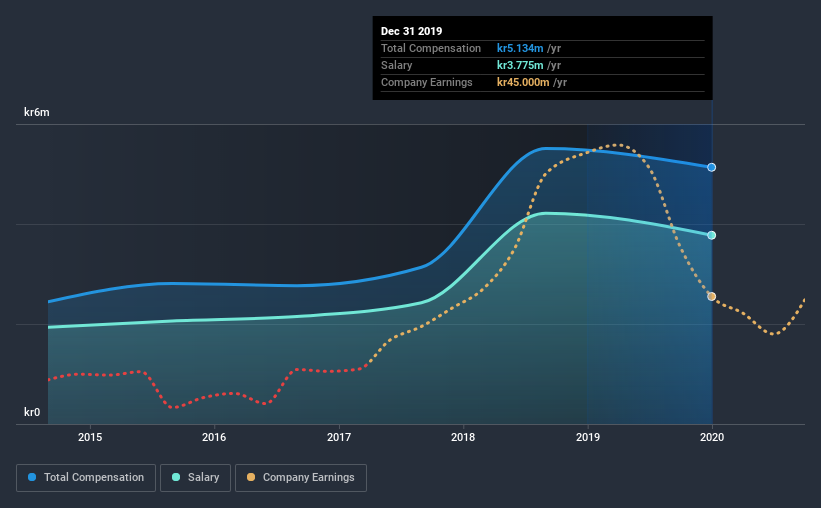

According to our data, Bergs Timber AB (publ) has a market capitalization of kr1.1b, and paid its CEO total annual compensation worth kr5.1m over the year to December 2019. We note that's a small decrease of 6.8% on last year. We note that the salary portion, which stands at kr3.78m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below kr1.7b, reported a median total CEO compensation of kr2.0m. Accordingly, our analysis reveals that Bergs Timber AB (publ) pays Peter Nilsson north of the industry median. What's more, Peter Nilsson holds kr2.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | kr3.8m | kr4.2m | 74% |

| Other | kr1.4m | kr1.3m | 26% |

| Total Compensation | kr5.1m | kr5.5m | 100% |

Speaking on an industry level, nearly 52% of total compensation represents salary, while the remainder of 48% is other remuneration. Bergs Timber pays out 74% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Bergs Timber AB (publ)'s Growth Numbers

Bergs Timber AB (publ) has reduced its earnings per share by 6.2% a year over the last three years. Its revenue is up 53% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bergs Timber AB (publ) Been A Good Investment?

Bergs Timber AB (publ) has generated a total shareholder return of 23% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Bergs Timber AB (publ) is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Be that as it may, revenue figures are showing some positive trends recently. Shareholder returns have also grown during this time, but haven't been as impressive. Importantly, EPS growth is negative, a worrying trend. All things considered, we don't think CEO compensation is unfair, though shareholders will likely want to see an overall improvement in performance before any potential raise.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Bergs Timber that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Bergs Timber, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bergs Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:BRG B

Bergs Timber

Bergs Timber AB (publ) engages in development, production, and marketing of processed wood products in Sweden, Latvia, the United Kingdom, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives