Billerud And 2 Other Stocks On The Swedish Exchange That May Be Undervalued

Reviewed by Simply Wall St

The Swedish stock market has been navigating a complex economic landscape, influenced by recent interest rate cuts and mixed signals from global markets. As investors seek opportunities amid these fluctuations, identifying undervalued stocks becomes crucial for capitalizing on potential growth. In this context, a good stock is one that demonstrates strong fundamentals and resilience in the face of economic uncertainty. With this in mind, let's explore Billerud and two other stocks on the Swedish exchange that may currently be undervalued.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CTT Systems (OM:CTT) | SEK270.00 | SEK491.56 | 45.1% |

| Concentric (OM:COIC) | SEK218.50 | SEK406.65 | 46.3% |

| Husqvarna (OM:HUSQ B) | SEK69.28 | SEK125.64 | 44.9% |

| Biotage (OM:BIOT) | SEK184.50 | SEK364.26 | 49.3% |

| Lindab International (OM:LIAB) | SEK280.60 | SEK529.24 | 47% |

| Nolato (OM:NOLA B) | SEK52.35 | SEK98.72 | 47% |

| Mentice (OM:MNTC) | SEK27.30 | SEK50.92 | 46.4% |

| Nexam Chemical Holding (OM:NEXAM) | SEK4.29 | SEK7.93 | 45.9% |

| MilDef Group (OM:MILDEF) | SEK83.30 | SEK160.15 | 48% |

| Lyko Group (OM:LYKO A) | SEK115.80 | SEK215.47 | 46.3% |

We'll examine a selection from our screener results.

Billerud (OM:BILL)

Overview: Billerud AB (publ) is a global provider of paper and packaging materials with a market cap of SEK28.38 billion.

Operations: Billerud generates revenue from three primary segments: SEK27.08 billion from Region Europe, SEK11.35 billion from Region North America, and SEK2.77 billion from Solutions & Other (excluding currency hedging).

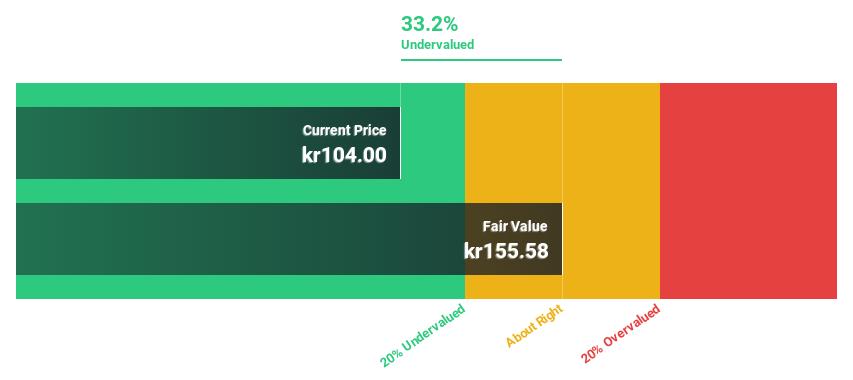

Estimated Discount To Fair Value: 34.4%

Billerud is trading at SEK 114.1, significantly below its estimated fair value of SEK 173.91, indicating it may be undervalued based on cash flows. Despite a low forecasted Return on Equity of 8.6% in three years, the company's earnings are projected to grow significantly at 31.4% per year, outpacing the Swedish market's growth rate of 15.1%. Recent leadership changes and improved net income from SEK -481 million to SEK 63 million bolster its potential for future performance.

- The growth report we've compiled suggests that Billerud's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Billerud's balance sheet health report.

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions and special electronics primarily for the security and defense sectors, with a market cap of SEK3.32 billion.

Operations: MilDef Group AB (publ) generates revenue of SEK1.11 billion from its Computer Hardware segment.

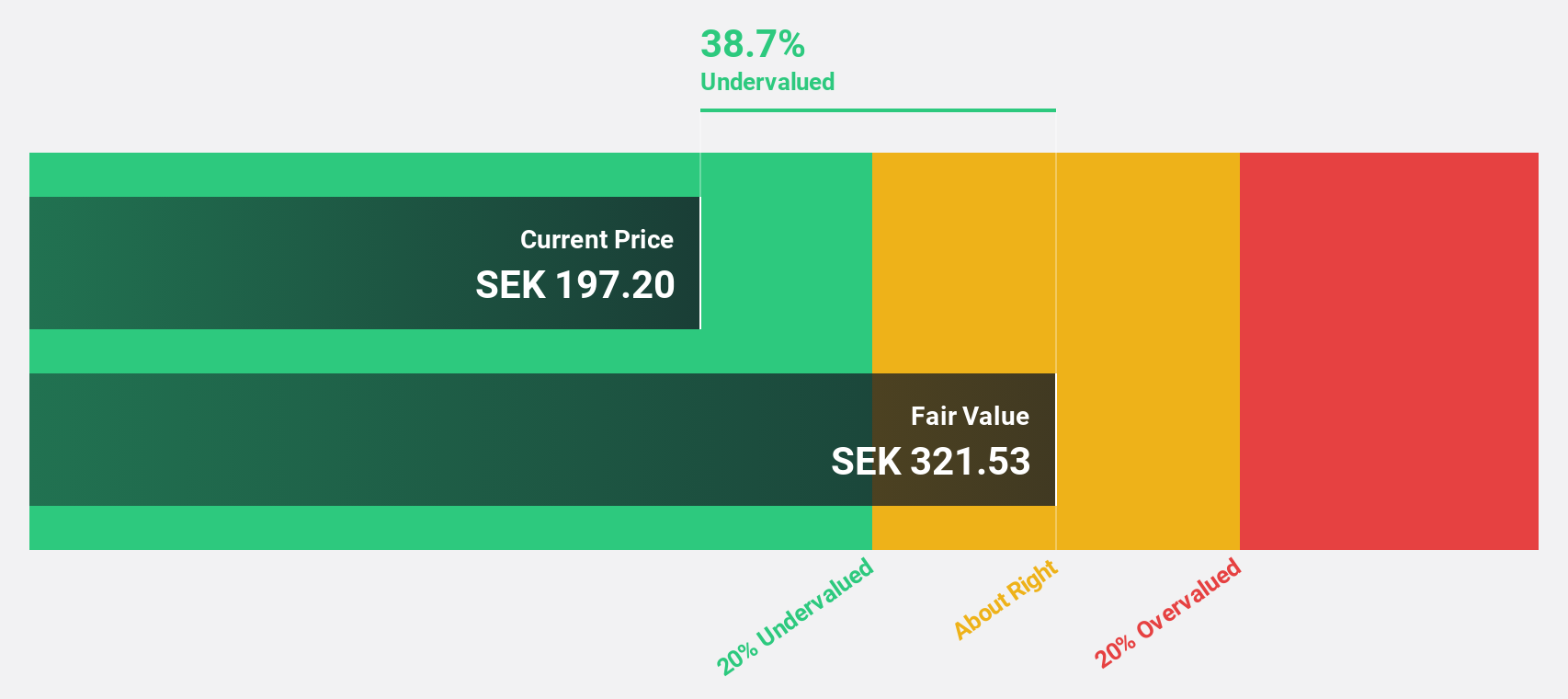

Estimated Discount To Fair Value: 48%

MilDef Group, trading at SEK 83.3, is valued significantly below its estimated fair value of SEK 160.15. The company's earnings are forecast to grow substantially at 47.41% per year, outpacing the Swedish market's growth rate of 15.1%. Despite a lower profit margin this year (3.9% vs last year's 6.2%), recent contracts with Danish and Norwegian defense agencies totaling SEK 99.5 million underscore its strong cash flow potential and strategic positioning in the defense sector.

- Our earnings growth report unveils the potential for significant increases in MilDef Group's future results.

- Delve into the full analysis health report here for a deeper understanding of MilDef Group.

Nyab (OM:NYAB)

Overview: Nyab AB (publ) offers engineering, construction, and maintenance services for energy, infrastructure, and industrial projects in Finland and Sweden, with a market cap of SEK 4.14 billion.

Operations: Nyab's revenue from heavy construction amounts to €308.95 million.

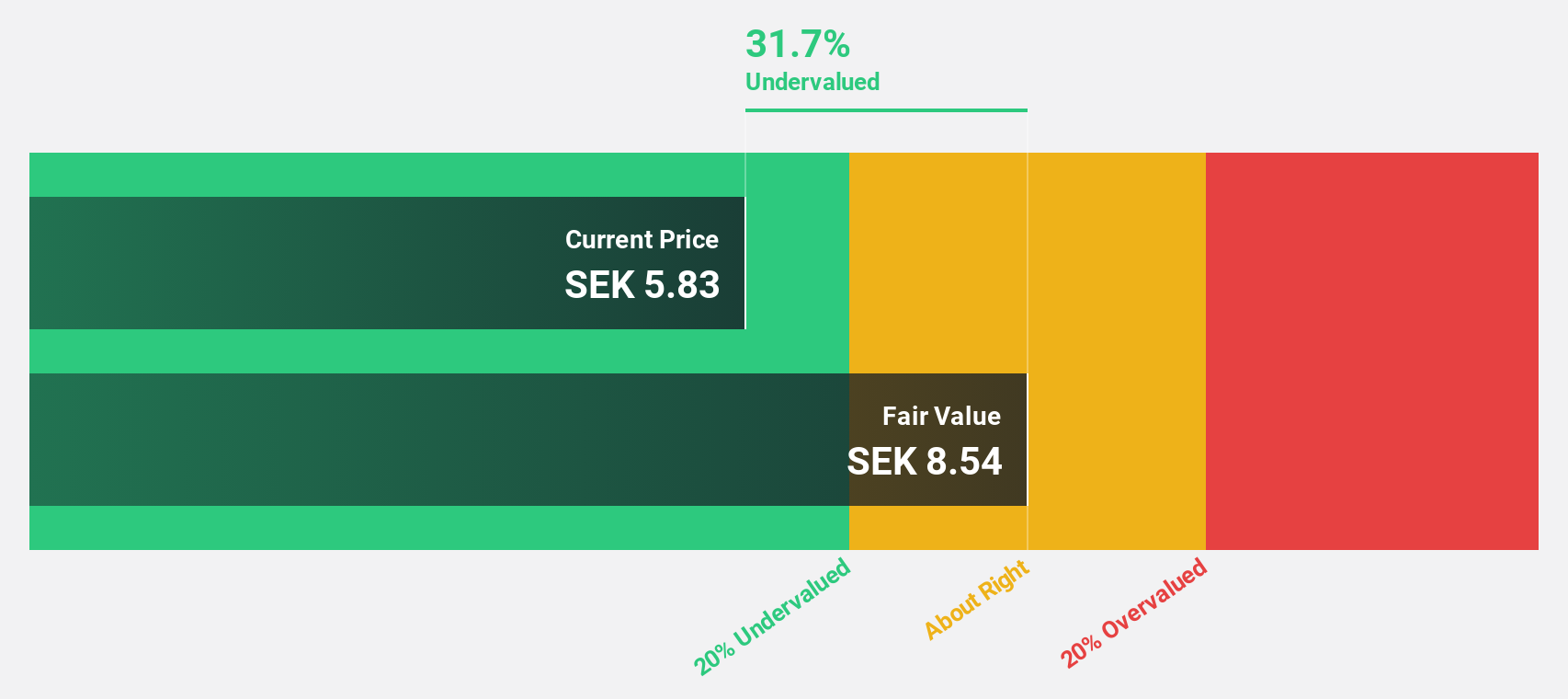

Estimated Discount To Fair Value: 43%

Nyab AB, trading at SEK 5.83, is significantly undervalued with an estimated fair value of SEK 10.22. Despite a decline in profit margins this year (2.9% vs last year's 7.4%), the company’s earnings are forecast to grow substantially at 28.1% per year, outpacing the Swedish market's growth rate of 15.1%. Recent contracts, including a SEK 931 million power line project and a SEK 230 million infrastructure extension, bolster its cash flow potential and strategic positioning in Sweden’s infrastructure sector.

- Our comprehensive growth report raises the possibility that Nyab is poised for substantial financial growth.

- Take a closer look at Nyab's balance sheet health here in our report.

Seize The Opportunity

- Access the full spectrum of 44 Undervalued Swedish Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billerud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILL

Flawless balance sheet with reasonable growth potential.