3 Stocks With Estimated Discounts Up To 49.1% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, major indices have shown volatility with growth stocks lagging behind value shares. Amidst these fluctuations, investors may find opportunities in stocks trading below their intrinsic value, which can offer potential for long-term gains when market conditions stabilize. Identifying undervalued stocks involves assessing factors such as strong fundamentals and resilience in uncertain times, making them attractive options for those looking to capitalize on current market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | US$22.50 | US$44.83 | 49.8% |

| Harmony Gold Mining (JSE:HAR) | ZAR180.36 | ZAR359.54 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.80 | SEK450.91 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.49 | US$46.79 | 49.8% |

| Ligand Pharmaceuticals (NasdaqGM:LGND) | US$129.90 | US$258.67 | 49.8% |

| Redcentric (AIM:RCN) | £1.1775 | £2.35 | 50% |

| DoubleVerify Holdings (NYSE:DV) | US$19.72 | US$39.40 | 49.9% |

| Laboratorio Reig Jofre (BME:RJF) | €2.89 | €5.74 | 49.6% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$272.22 | US$544.40 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.24 | €16.38 | 49.7% |

Let's uncover some gems from our specialized screener.

Billerud (OM:BILL)

Overview: Billerud AB (publ) is a global provider of paper and packaging materials, with a market cap of SEK24.10 billion.

Operations: The company generates revenue from various segments, with Region Europe contributing SEK27.30 billion, Region North America bringing in SEK11.65 billion, and Solution & Other (excluding currency hedging) adding SEK2.73 billion.

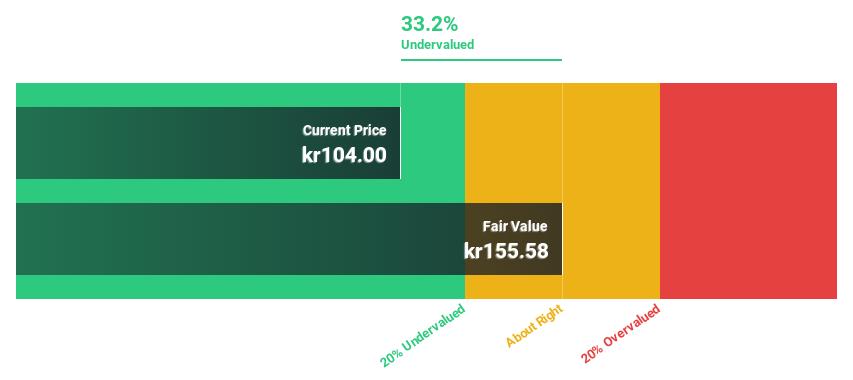

Estimated Discount To Fair Value: 23.1%

Billerud is trading at SEK 96.9, below its estimated fair value of SEK 126.06, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 34.66% annually, surpassing the Swedish market's growth rate of 15.5%. However, profit margins have decreased from last year and dividends remain unstable. Recent Q3 earnings showed increased sales but lower net income compared to the previous year, indicating mixed financial performance.

- The analysis detailed in our Billerud growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Billerud's balance sheet health report.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector, focusing on the production of dietary fibers and other health-related products, with a market cap of CN¥6.15 billion.

Operations: I'm sorry, but it seems that the specific revenue segment details for Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. are missing from the provided text. Please provide the relevant information so I can assist you further.

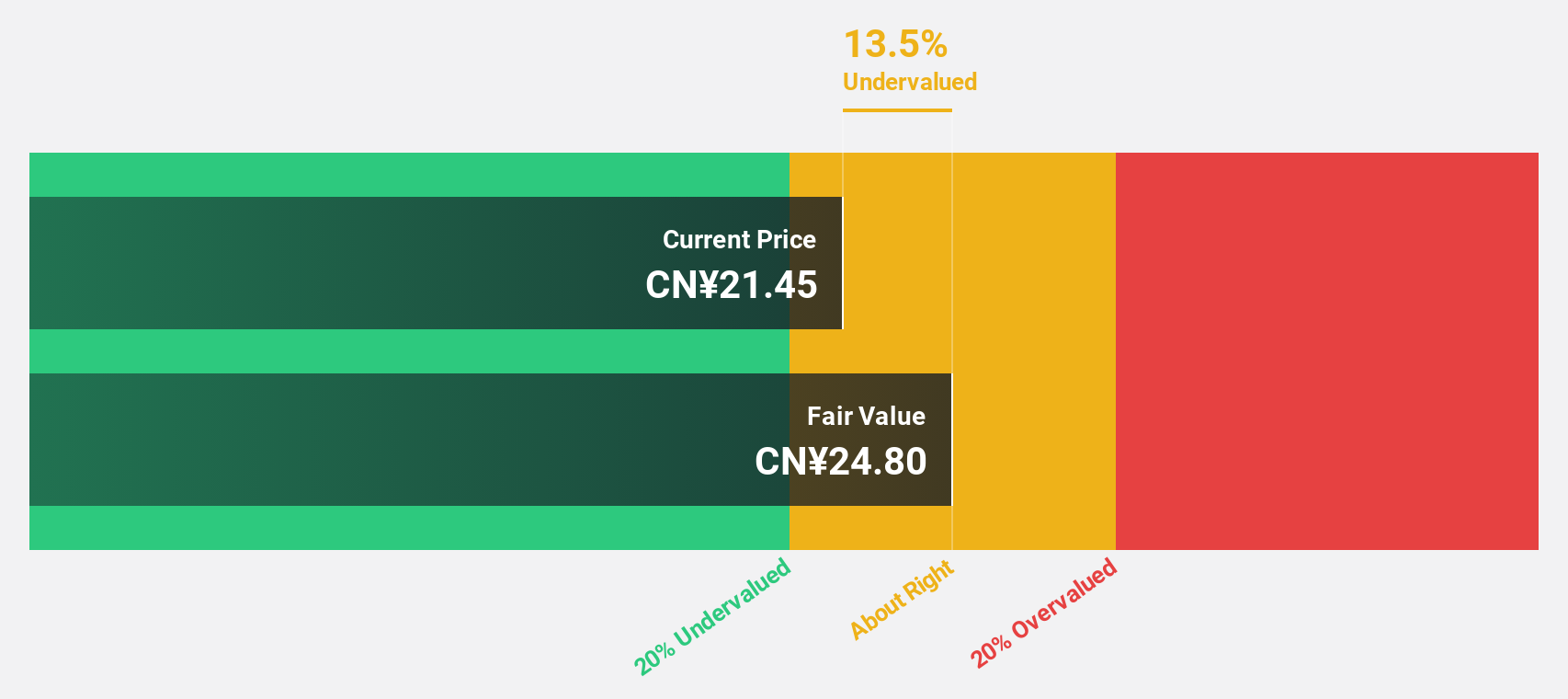

Estimated Discount To Fair Value: 42.6%

Shandong Bailong Chuangyuan Bio-Tech is trading at CN¥19.05, significantly below its estimated fair value of CN¥33.16, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow 30.6% annually, outpacing the broader Chinese market growth rate of 26.3%. Recent earnings for the nine months ended September 2024 showed sales increasing to CN¥820.39 million from CN¥653.79 million last year, with net income rising to CN¥182.59 million from CN¥141.34 million, indicating strong financial performance amidst high non-cash earnings levels and good relative industry value despite low future return on equity forecasts at 18.7%.

- The growth report we've compiled suggests that Shandong Bailong Chuangyuan Bio-Tech's future prospects could be on the up.

- Dive into the specifics of Shandong Bailong Chuangyuan Bio-Tech here with our thorough financial health report.

Anhui Huaheng Biotechnology (SHSE:688639)

Overview: Anhui Huaheng Biotechnology Co., Ltd. develops, produces, and sells amino acids and other organic acids both in China and internationally, with a market cap of CN¥8.34 billion.

Operations: The company generates revenue primarily from its Bio Manufacturing Industry segment, amounting to CN¥2.11 billion.

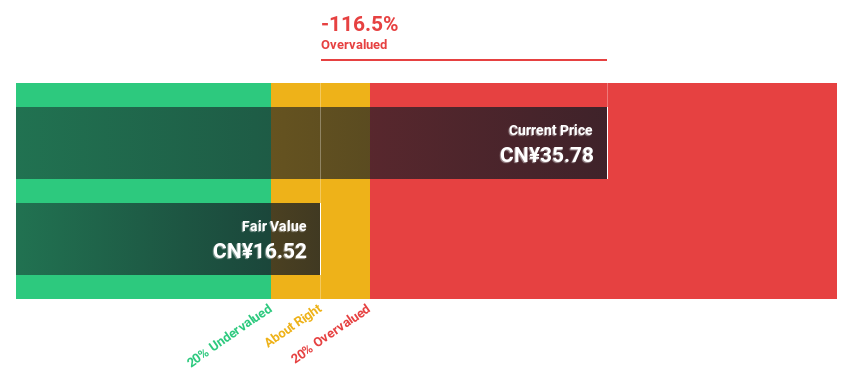

Estimated Discount To Fair Value: 49.1%

Anhui Huaheng Biotechnology is trading at CN¥36.61, well below its estimated fair value of CN¥71.91, suggesting significant undervaluation based on cash flows. Despite a volatile share price and lower profit margins this year (14.1% compared to 23.5%), earnings are projected to grow rapidly at 53.4% annually, surpassing market expectations. Recent earnings showed sales rising to CN¥1,539 million from CN¥1,364 million last year, though net income decreased to CN¥169.89 million from CN¥319.95 million due to high non-cash earnings levels and debt coverage concerns by operating cash flow.

- Our comprehensive growth report raises the possibility that Anhui Huaheng Biotechnology is poised for substantial financial growth.

- Take a closer look at Anhui Huaheng Biotechnology's balance sheet health here in our report.

Next Steps

- Access the full spectrum of 922 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605016

Shandong Bailong Chuangyuan Bio-Tech

Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

Flawless balance sheet and undervalued.