- Sweden

- /

- Household Products

- /

- OM:ESSITY B

Are Essity Shares Attractively Priced After Recent Surge and Sustainability Initiatives?

Reviewed by Bailey Pemberton

- Thinking about whether Essity is a bargain or overpriced? Let's investigate what its current share price means for potential investors like you.

- Essity's stock has seen a slight dip of 0.3% over the past week, yet it surged 5.4% in the last month, even as the longer-term performance remains mixed.

- Recent headlines spotlight Essity's strategic moves in sustainability and product innovation, fueling conversations about its growth prospects and how these efforts might offset broader market headwinds. The company's expanding presence in health and hygiene continues to catch analyst attention as it adapts to evolving consumer needs.

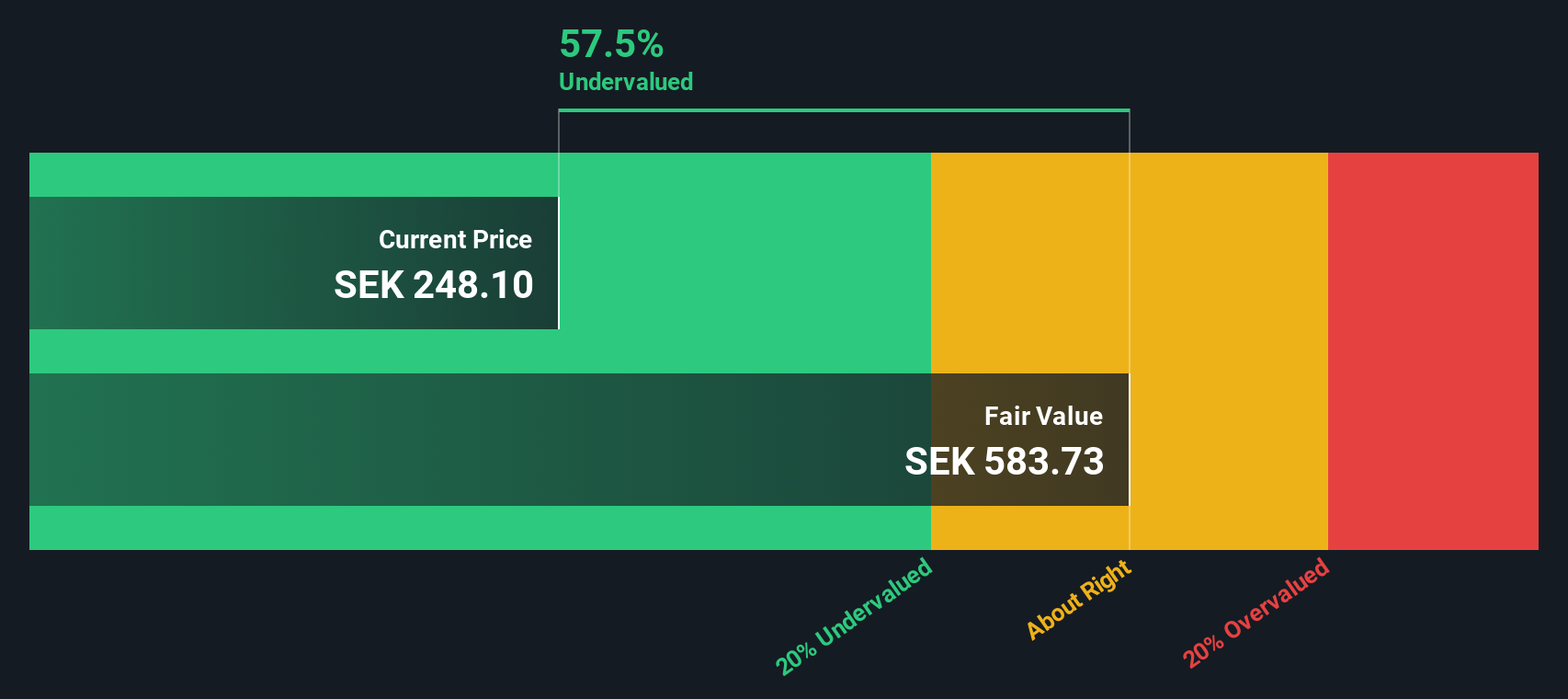

- On our most recent valuation checks, Essity scores a 5 out of 6 for being undervalued. There is plenty for value-focused investors to consider here, so let's explore the approaches used to value the stock and discuss why there may be an even smarter way to judge its long-term potential by the article's end.

Find out why Essity's -11.3% return over the last year is lagging behind its peers.

Approach 1: Essity Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's underlying value by projecting its future cash flows and discounting them back to present-day value. This approach helps investors determine what Essity's shares might truly be worth based on its expected ability to generate cash over time.

Essity's latest reported Free Cash Flow stands at SEK 6.99 billion. Analysts anticipate this figure will more than double, with projections reaching SEK 13.58 billion by 2028. In addition to analyst estimates, further cash flow projections out to 2035 are extrapolated, supporting the scenario of continuous, gradual growth for the business within its sector. All cash flow values are measured in Swedish Krona (SEK).

Based on these projections and using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Essity shares comes to SEK 567.53. This valuation indicates the company's current share price is 53.9% below its intrinsic value, highlighting significant upside potential for investors who prioritize long-term cash generation over short-term fluctuations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Essity is undervalued by 53.9%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Essity Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Essity, as it directly relates a company’s share price to its net earnings. This makes it especially suitable for businesses with steady profits, giving investors a quick sense of how much they are paying for each unit of earnings.

Growth expectations and risk can significantly influence what investors consider a “normal” or “fair” PE ratio. In general, higher growth prospects and lower risks will drive a higher fair PE, while slower growth or increased risk will lower it. A company with strong prospects and a stable track record may be seen as deserving a premium compared to industry peers.

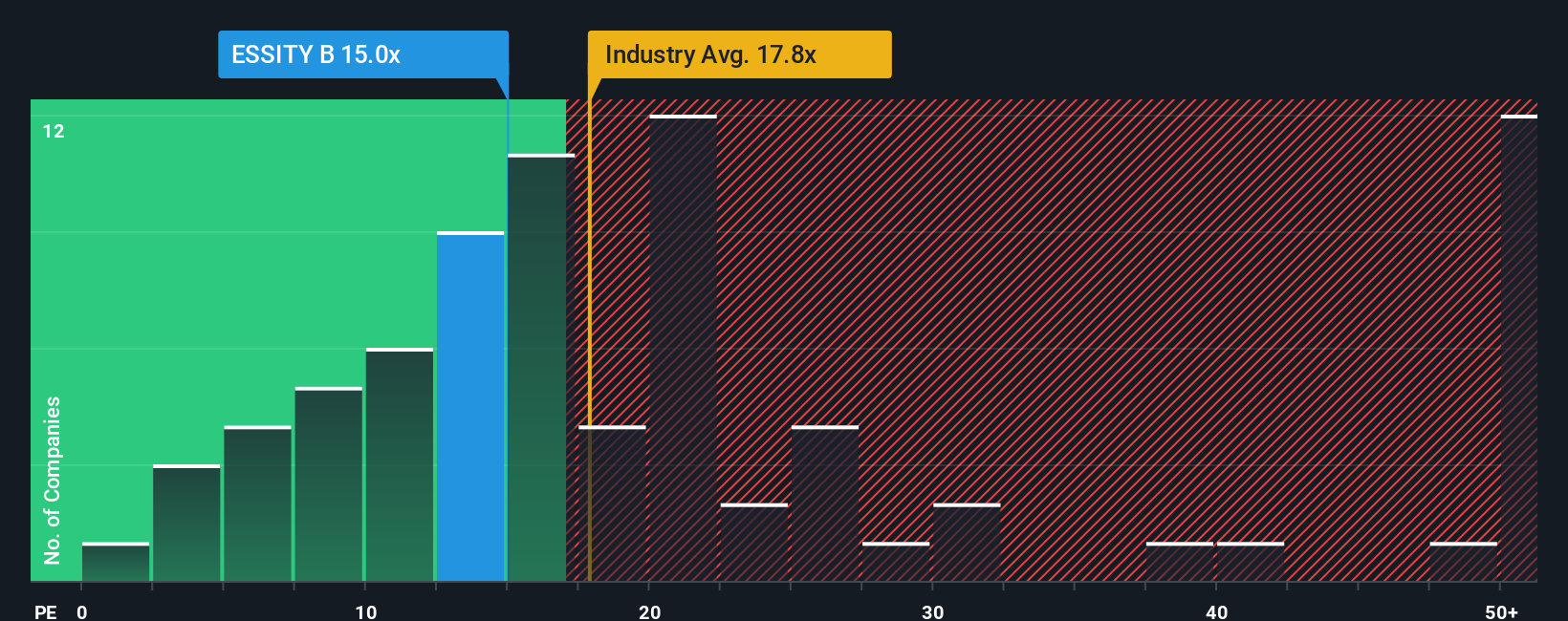

Essity currently trades at a PE ratio of 14.6x. This is not only lower than the Household Products industry average of 17.5x but also below the peer group average of 19.3x. While these comparisons suggest Essity might be undervalued, they do not account for all the factors that could affect a fair valuation.

This is where Simply Wall St’s Fair Ratio becomes relevant. The Fair Ratio, at 26.6x for Essity, incorporates company-specific traits such as earnings growth, profit margins, industry dynamics, market capitalization, and unique risk factors. By adjusting for these variables, the Fair Ratio provides a more individualized view of what is justified for a stock, rather than relying entirely on broad industry or peer averages.

Comparing Essity’s current PE of 14.6x to its Fair Ratio of 26.6x highlights a notable difference. This suggests there may be significant upside potential if market sentiment improves and the company continues its positive earnings trajectory.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essity Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story—the reasoning and perspective you have about a company—combined with the numbers that underpin your view, such as your assumptions for future revenue, profit margins, and ultimately, the fair value you believe is justified for the stock.

Narratives bridge the gap between a company’s story and its projected financials by connecting your outlook to concrete forecasts and then calculating what the share price should be worth. On Simply Wall St’s Community page, Narratives make it easy for investors of all levels to contribute, compare, and refine their own perspectives. All of this happens in one place, automatically updated as new news or earnings are released.

This means you can clearly see how your assumptions stack up versus other investors, identify when the Fair Value you believe in dips below today’s price (which may be a signal to sell) or rises above it (which may suggest an opportunity to buy), and always stay in sync when market events change the story.

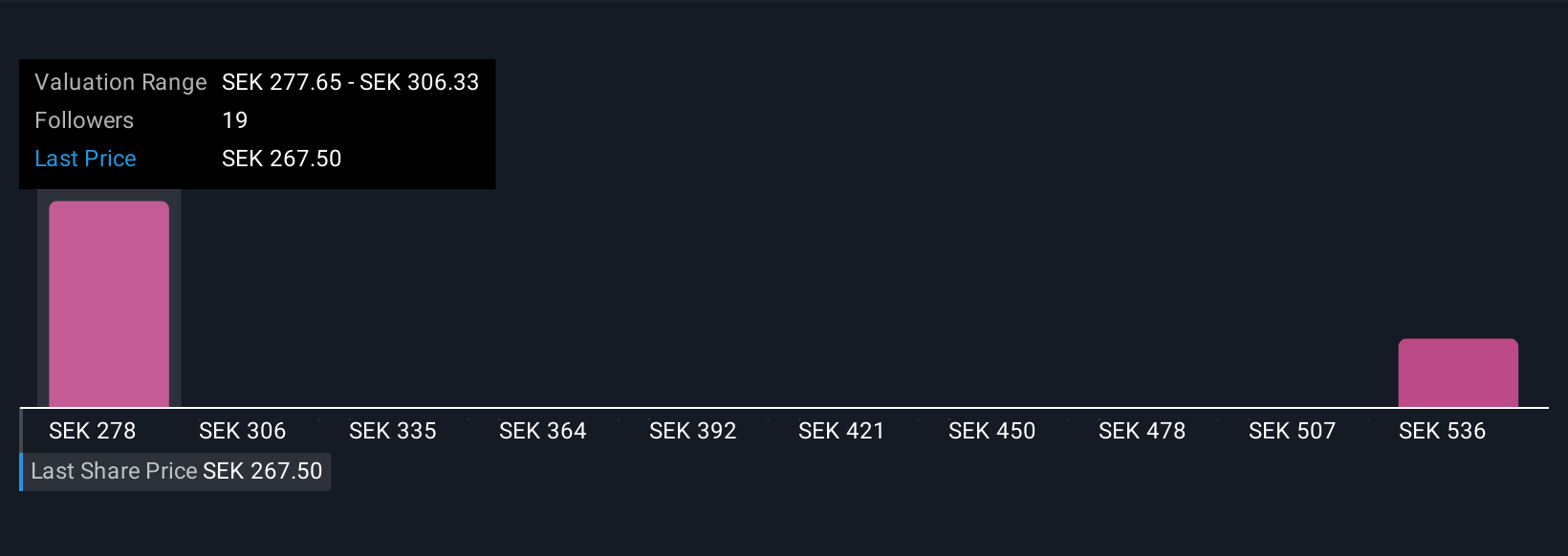

For example, some investors have a bullish Narrative for Essity, forecasting strong demand and efficiency gains to drive a fair value of SEK330 per share, while more cautious investors see structural challenges and suggest a fair value closer to SEK230. By choosing or creating your Narrative, you gain both confidence and context for any investment decision.

Do you think there's more to the story for Essity? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ESSITY B

Essity

Develops, produces, and sells hygiene and health products and services in Europe, North and Latin America, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives