European Undervalued Small Caps With Insider Action In November 2025

Reviewed by Simply Wall St

As the European market navigates a period of mixed performance, with the STOXX Europe 600 Index recently pulling back after reaching new highs, investors are closely monitoring interest rate policies and economic growth indicators. In this environment, identifying promising small-cap stocks requires careful consideration of factors such as insider activity and valuation metrics, which can provide insights into potential opportunities amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.9x | 1.5x | 30.92% | ★★★★★★ |

| Bytes Technology Group | 16.0x | 3.9x | 24.66% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.71% | ★★★★★☆ |

| Nyab | 17.1x | 0.7x | 39.86% | ★★★★☆☆ |

| Boozt | 17.6x | 0.8x | 48.56% | ★★★★☆☆ |

| J D Wetherspoon | 10.1x | 0.3x | 5.35% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.32% | ★★★★☆☆ |

| Pexip Holding | 36.5x | 5.4x | 25.00% | ★★★☆☆☆ |

| Fiskars Oyj Abp | 39.7x | 0.9x | 24.61% | ★★★☆☆☆ |

| Fastighets AB Trianon | 14.2x | 4.6x | -222.12% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

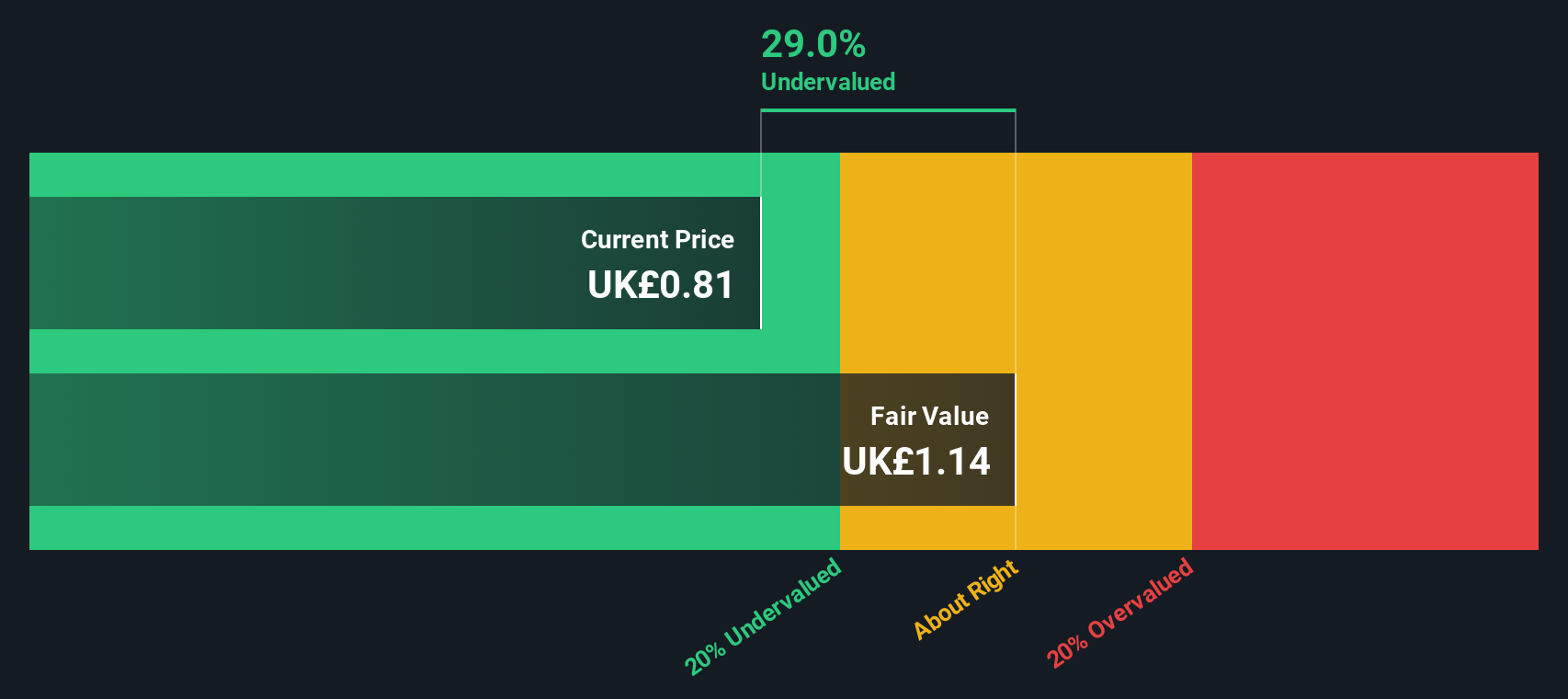

Coats Group (LSE:COA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Coats Group operates as a leading industrial thread manufacturer, serving the apparel, footwear, and performance materials sectors with a market capitalization of approximately £1.5 billion.

Operations: The company generates revenue primarily from apparel, footwear, and performance materials. Over time, the gross profit margin has shown variation, reaching 37.13% in June 2024. Operating expenses are a significant portion of costs, with sales and marketing and general & administrative expenses being notable components.

PE: 23.7x

Coats Group, a European small-cap, is navigating a complex financial landscape. While earnings are projected to grow 26.84% annually, the company relies entirely on external borrowing for funding, which carries higher risk. Recent insider confidence was evident with share purchases over the past year. Despite shareholder dilution and large one-off items impacting results, Coats aims to enhance its position through strategic acquisitions like OrthoLite Holdings LLC. Today's Q3 sales report could shed light on their trajectory.

- Dive into the specifics of Coats Group here with our thorough valuation report.

Understand Coats Group's track record by examining our Past report.

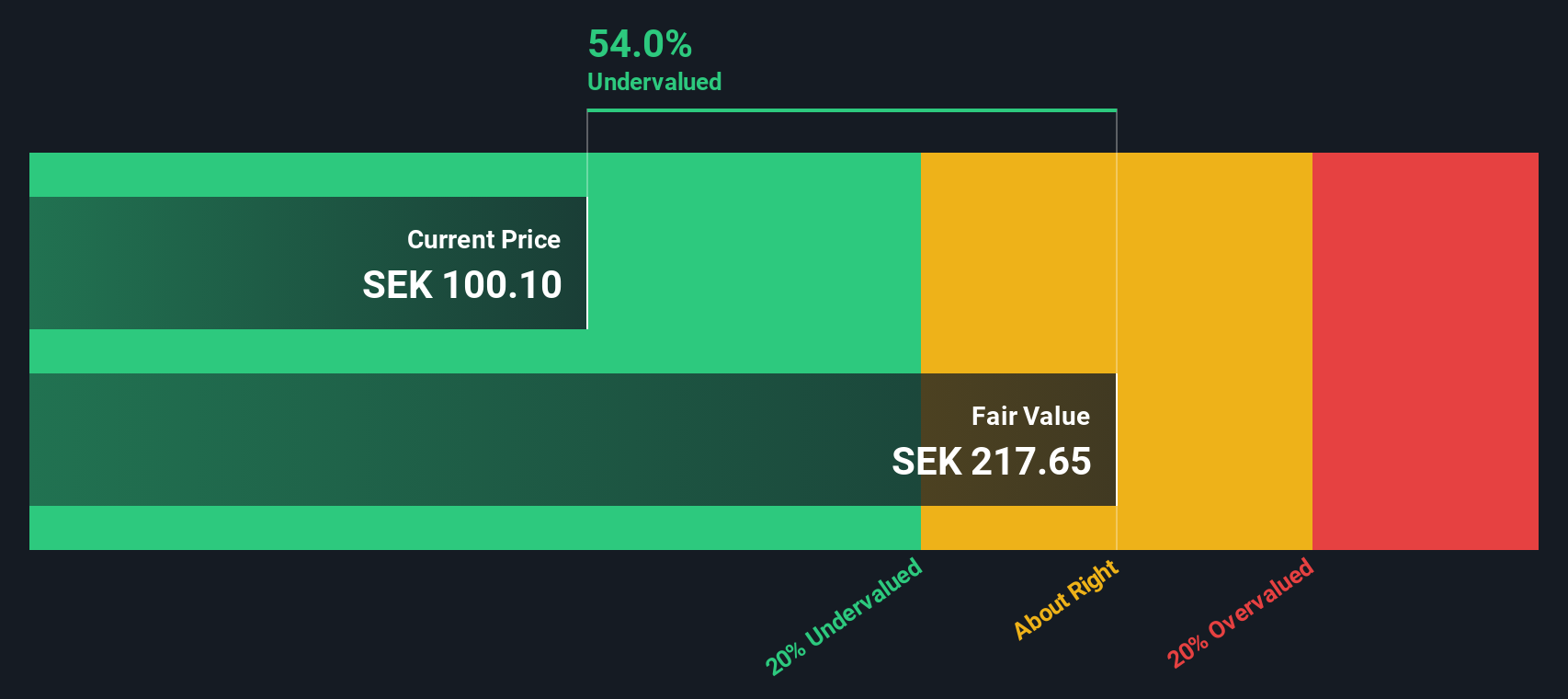

Boozt (OM:BOOZT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Boozt is a Nordic technology company that operates an online fashion and lifestyle retail platform, with a market capitalization of approximately SEK 6.5 billion.

Operations: Boozt generates revenue primarily through its sales, with recent figures showing a significant increase to SEK 8.26 billion by September 2025. The company's gross profit margin has shown variability, reaching 28.88% in the same period. Operating expenses have been substantial, driven largely by sales and marketing costs alongside general and administrative expenses. Over time, net income margins have improved to reach 4.51%.

PE: 17.6x

Boozt, a European company with a smaller market presence, has shown signs of being undervalued. Recent financials reveal steady growth, with third-quarter sales reaching SEK 1.67 billion and net income rising to SEK 26 million from SEK 15 million the previous year. The company repurchased over 2.6 million shares for SEK 235 million between April and September 2025, signaling insider confidence in its potential. Revenue is projected to grow annually by around 5%, despite relying on higher-risk external funding sources.

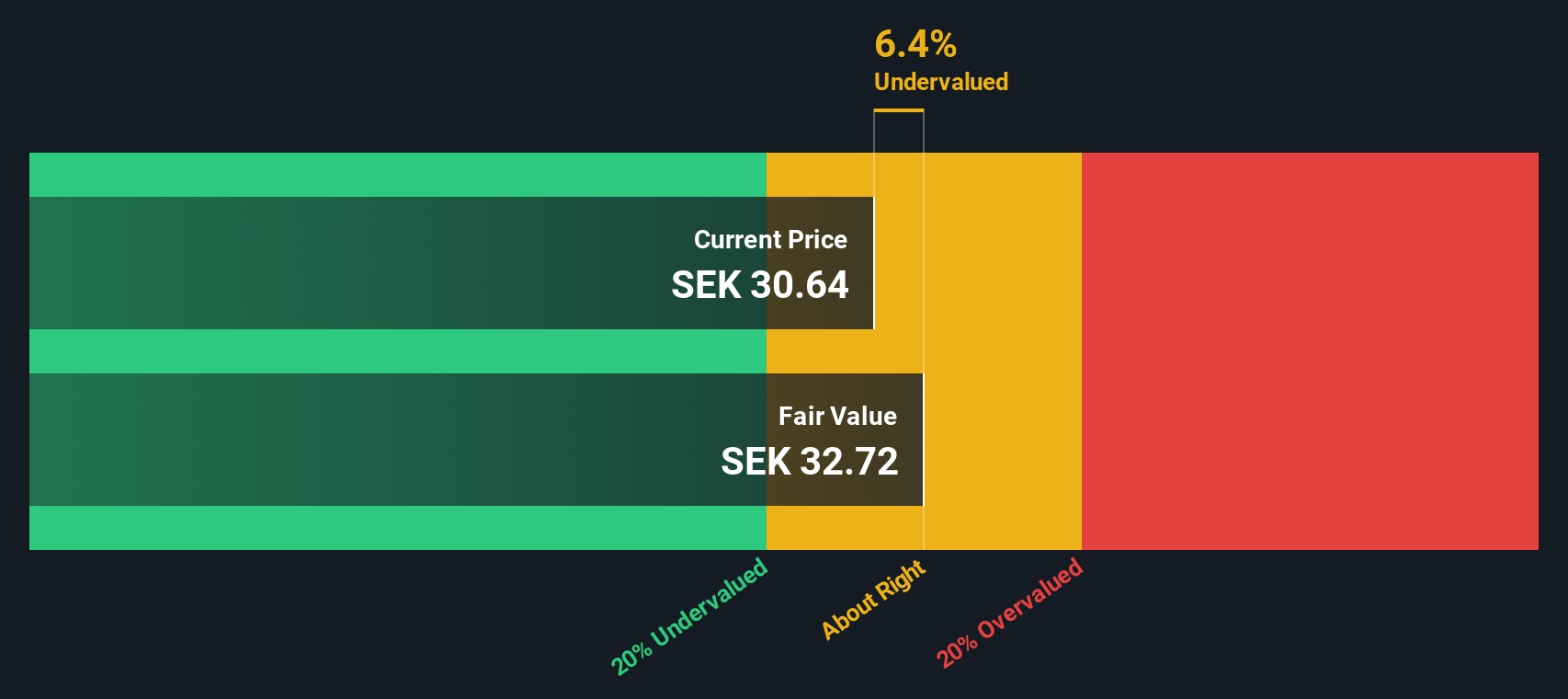

Vimian Group (OM:VIMIAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vimian Group operates in the animal health sector, focusing on medtech, diagnostics, specialty pharma, and veterinary services with a market capitalization of €1.71 billion.

Operations: The company's revenue streams are primarily derived from Specialty Pharma (€181.60 million) and Medtech (€153.80 million), with Veterinary Services contributing €63.10 million and Diagnostics €22.70 million. The gross profit margin has shown variability, reaching 70% in Q3 2024 before adjusting to 68.62% by Q3 2025, reflecting changes in cost of goods sold relative to revenue growth over time.

PE: 44.4x

Vimian Group, a player in the animal health sector, is eyeing acquisitions to bolster its position. With sales hitting €104.3 million in Q3 2025, up from €87.6 million last year, and net income swinging to €6.5 million from a loss of €2.1 million, their financials show promise despite reliance on external borrowing for funding. The company aims for €300 million by 2030 without exceeding 3x leverage, underscoring strategic ambitions amidst insider confidence reflected through stock purchases earlier this year.

- Click here to discover the nuances of Vimian Group with our detailed analytical valuation report.

Gain insights into Vimian Group's past trends and performance with our Past report.

Make It Happen

- Dive into all 60 of the Undervalued European Small Caps With Insider Buying we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boozt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOOZT

Boozt

Sells fashion, apparel, shoes, accessories, kids, home, sports, and beauty products online.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives