Stock Analysis

- Sweden

- /

- Healthtech

- /

- OM:RAY B

Three Swedish Exchange Stocks Estimated To Be Undervalued By Between 11.7% And 49.7%

Reviewed by Simply Wall St

Amidst a landscape of fluctuating global markets, Sweden's stock market presents intriguing opportunities for investors looking for value. As broader indices show mixed performances with geopolitical tensions and economic policies influencing market dynamics, identifying undervalued stocks becomes a strategic approach to potentially capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK34.52 | SEK68.64 | 49.7% |

| Björn Borg (OM:BORG) | SEK55.20 | SEK102.31 | 46% |

| Arcoma (OM:ARCOMA) | SEK17.90 | SEK35.75 | 49.9% |

| Alleima (OM:ALLEI) | SEK68.50 | SEK127.57 | 46.3% |

| RaySearch Laboratories (OM:RAY B) | SEK142.00 | SEK280.65 | 49.4% |

| Biotage (OM:BIOT) | SEK160.30 | SEK297.88 | 46.2% |

| Nolato (OM:NOLA B) | SEK57.80 | SEK111.82 | 48.3% |

| MilDef Group (OM:MILDEF) | SEK66.50 | SEK131.72 | 49.5% |

| Humble Group (OM:HUMBLE) | SEK9.975 | SEK19.46 | 48.7% |

| Hexatronic Group (OM:HTRO) | SEK50.94 | SEK99.34 | 48.7% |

Below we spotlight a couple of our favorites from our exclusive screener

Addnode Group (OM:ANOD B)

Overview: Addnode Group AB provides software and services for design, construction, product data information, project collaboration, and facility management across Sweden, Nordic countries, the US, the UK, Germany, and other international markets with a market capitalization of SEK 16.33 billion.

Operations: The company's revenue is primarily generated from three segments: Design Management at SEK 4.70 billion, Product Lifecycle Management at SEK 1.91 billion, and Process Management (including Content Management) at SEK 1.29 billion.

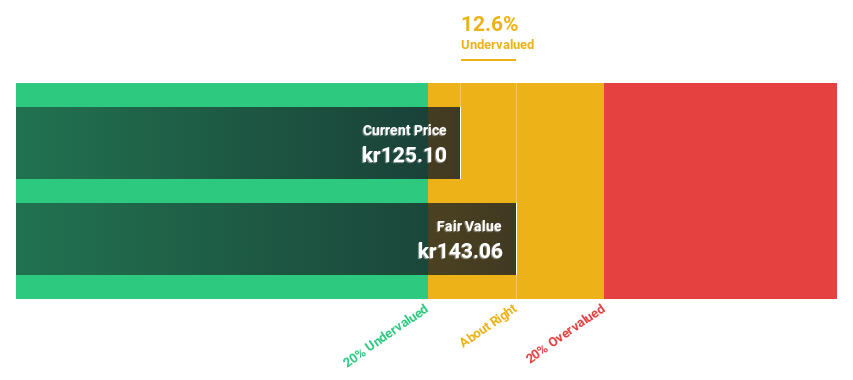

Estimated Discount To Fair Value: 11.7%

Addnode Group, trading at SEK 122.5, is below our fair value estimate of SEK 138.7, suggesting undervaluation based on cash flows. Despite a modest undervaluation and lower profit margins year-over-year (3.8% from 5.5%), the company shows promise with expected earnings growth of 21.4% annually over the next three years—outpacing the Swedish market's forecast of 13.9%. Revenue growth projections also exceed market averages at an annual rate of 8.8%. Recent auditor changes and executive shifts signal internal restructuring which could impact future performance dynamics.

- Our growth report here indicates Addnode Group may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Addnode Group.

RaySearch Laboratories (OM:RAY B)

Overview: RaySearch Laboratories AB, a medical technology company, specializes in software solutions for cancer care across various global regions and has a market capitalization of approximately SEK 4.87 billion.

Operations: The company generates SEK 1.05 billion from its healthcare software segment.

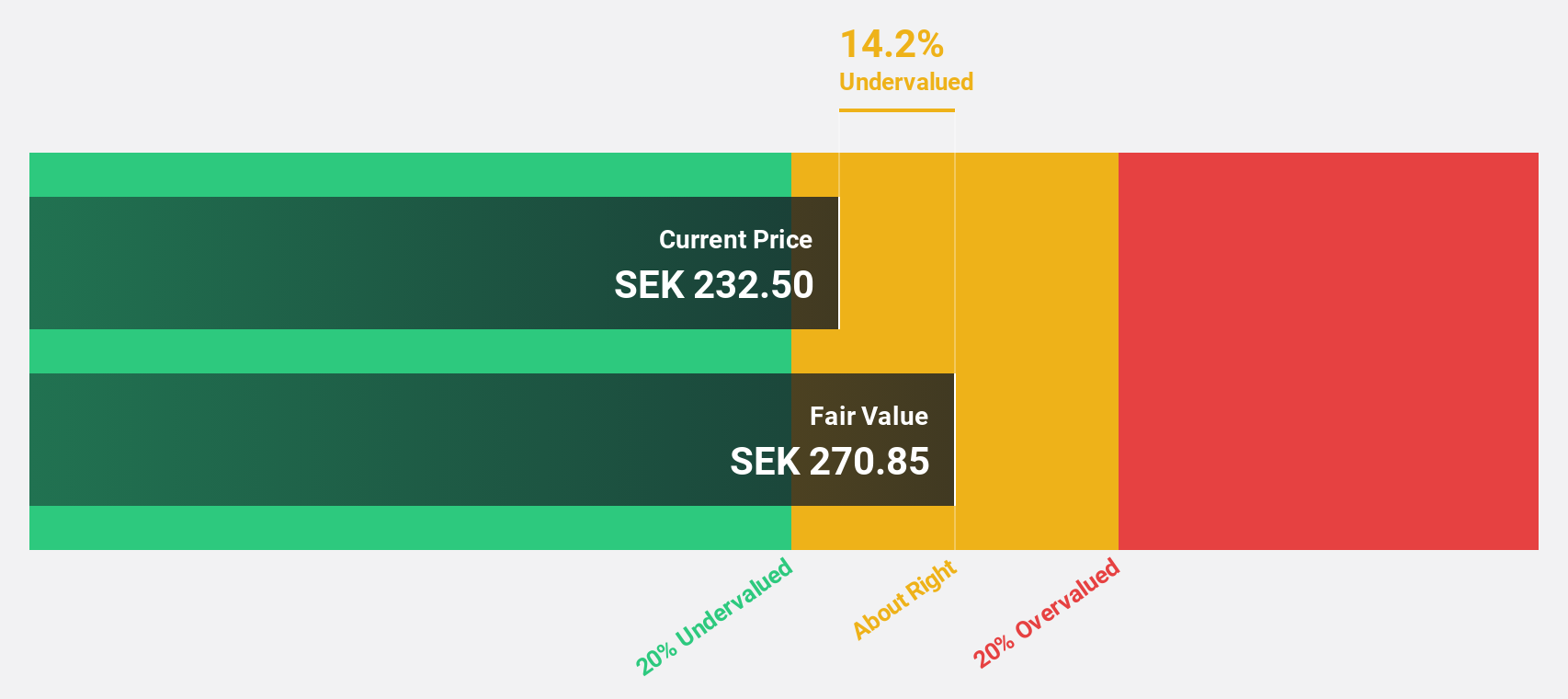

Estimated Discount To Fair Value: 49.4%

RaySearch Laboratories, priced at SEK 142, appears undervalued with a fair value estimate of SEK 280.65, reflecting a significant discount of 49.4%. The company's earnings have surged by 356.9% over the past year and are projected to grow by 33.62% annually, outperforming the Swedish market's growth rate of 13.9%. Recent product enhancements and strategic alliances further support operational efficiencies and expansion in treatment capabilities, potentially bolstering future cash flows despite slower revenue growth projections of 10.6% per year compared to the market forecast of 1.7%.

- In light of our recent growth report, it seems possible that RaySearch Laboratories' financial performance will exceed current levels.

- Get an in-depth perspective on RaySearch Laboratories' balance sheet by reading our health report here.

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) is a company that develops and publishes mobile caller ID applications for individuals and businesses globally, with a market capitalization of approximately SEK 11.94 billion.

Operations: The company generates revenue primarily from its communications software segment, totaling SEK 1.78 billion.

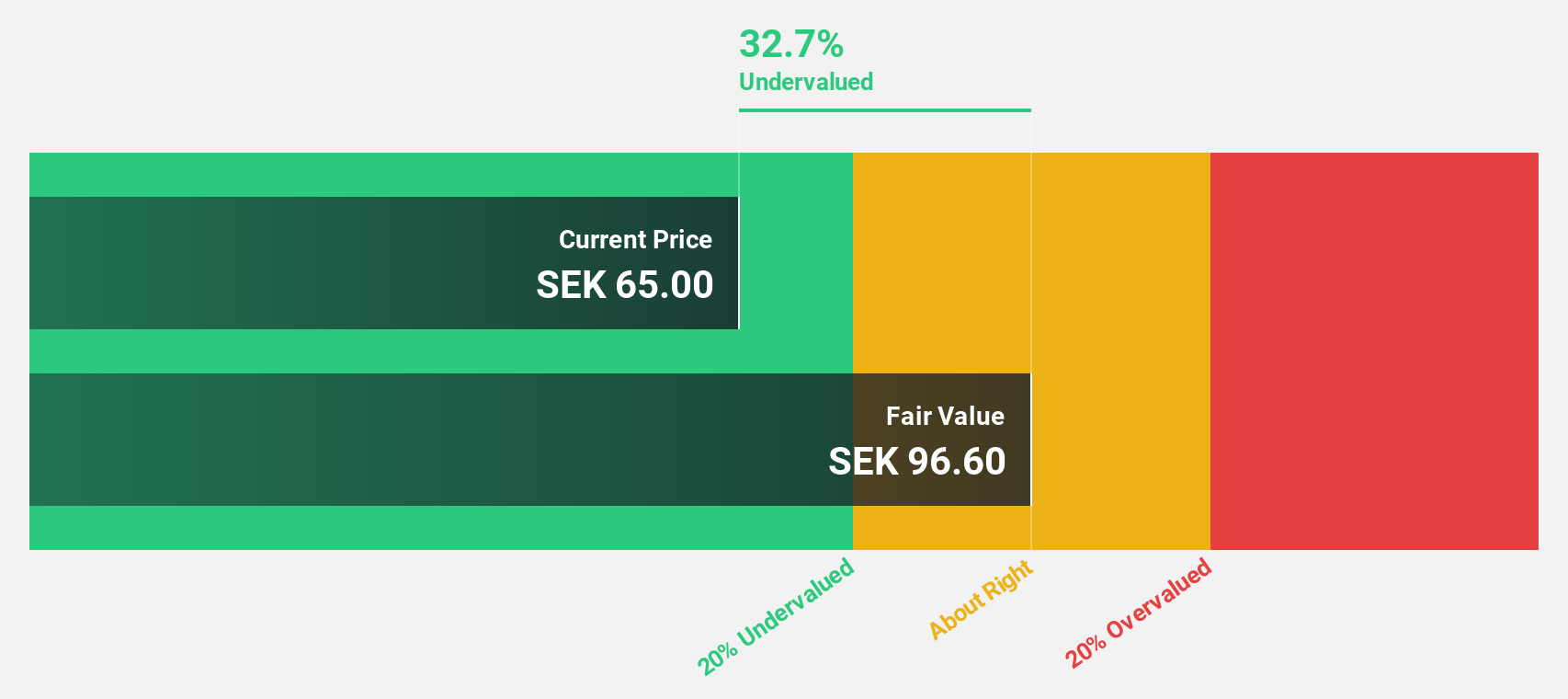

Estimated Discount To Fair Value: 49.7%

Truecaller, trading at SEK 34.52, is significantly undervalued with a fair value estimate of SEK 68.64, marking it as trading below its intrinsic value by over 20%. The company's earnings have expanded by an annual rate of 52.4% over the past five years and are expected to grow at 17.6% annually. Analysts predict a potential price increase of 57.9%. Recent innovations like the AI Call Scanner enhance its competitive edge, potentially driving future revenue and profit growth amidst active share repurchase initiatives.

- Our earnings growth report unveils the potential for significant increases in Truecaller's future results.

- Click here to discover the nuances of Truecaller with our detailed financial health report.

Seize The Opportunity

- Dive into all 52 of the Undervalued Swedish Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether RaySearch Laboratories is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer care in the Americas, Europe, Africa, the Asia-Pacific, and the Middle East.

Flawless balance sheet with reasonable growth potential.